An image of a hand containing coins.

Binding Price Floor

What is a Price Floor?

A price floor refers to the minimum legal price that can be paid for a product. It is a price control law used by governments to make sure that the prices of certain goods and services do not fall below a certain level. It is also called the minimum price.

When the law of the price floor is in place, it becomes illegal to pay any price lower than the price floor. Hence, the market price of the product must not fall below the price floor.

Why is Price Floor Used?

In a free market, the price of a product is determined through the interaction of its demand and supply without government intervention. This price, at times, may be very low due to market imperfections like monopolies or oligopolies exploiting suppliers or due to lower demand and higher supply during the time of good harvest of the product. This lower price may not be profitable for some sellers. Sellers might also feel exploited if the product is a perishable good. Hence, governments want to support those sellers by ensuring that the price does not fall below a certain level.

Examples of Price Floor

Governments can use price floors for many products, including:

Demerit Good

A price floor is used by governments for some demerit goods, such as tobacco products and alcohol. The objective is to reduce the quantity of these products that consumers buy and consume.

Wages

Governments often use the price floor through the minimum wage law in order to increase wages in certain occupations, especially for low-skilled workers. This will avoid the exploitation of workers by powerful employers. The details of the minimum wage law and its workings will be explained in the later part of this article.

Imported Goods

Governments also use price floors for certain types of imported goods where domestically produced substitutes are available. The objective here is to increase the prices of imported goods so that they can become less competitive in the domestic market as compared to local products.

Supporting Farmers

Price floors are also called price supports because they support producers, especially farmers by protecting them from the harmful effects of a sudden fall in the prices of agricultural goods like wheat and rice. Farm prices fluctuate rapidly due their inelastic demand and inelastic supply. The manufacturers of agricultural commodities suffer a lot when price of these products suddenly fall. Governments use price floors to support these farmers from rapid and sudden price falls.

Types of Price Floor

There are two types of price floors, which are explained below.

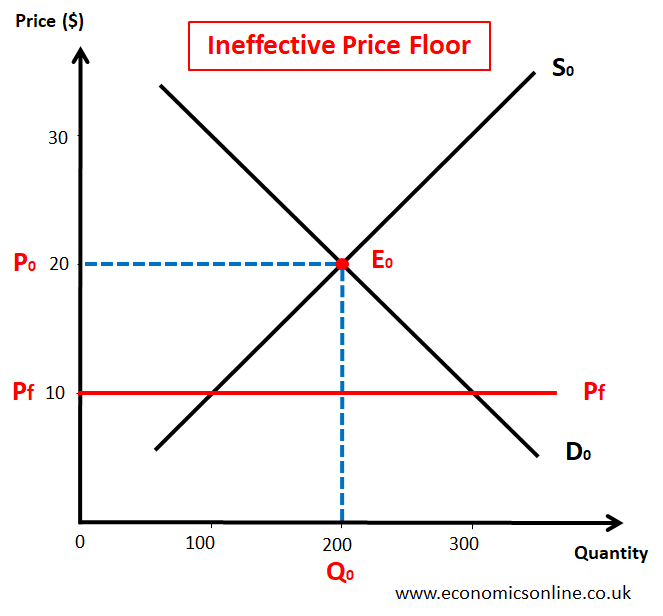

Ineffective or Non-binding Price Floor

A price floor is considered ineffective or non-binding if it is set below the market equilibrium price. This price floor is called ineffective or non-binding because it will not increase the price of a product from its existing market equilibrium price. This is illustrated by the following diagram:

In the above graph, the existing market equilibrium price is P0, which is $20. The government has set the price floor (Pf) at $10. This price floor of $10 is less than the equilibrium price of $20. Hence, it is ineffective, and buyers will continue paying the same $20 price for the product.

Effect on the Market

An ineffective price floor has no effect on the market, and the market will keep operating at its original equilibrium position.

Buyers are paying a price equal to $20. When a price floor is imposed by the government, the market price must not fall below the price floor. In this case, the market price of $20 is already above the price floor of $10. So buyers will keep paying the prevailing price, making this price floor ineffective as it has no effect on the market.

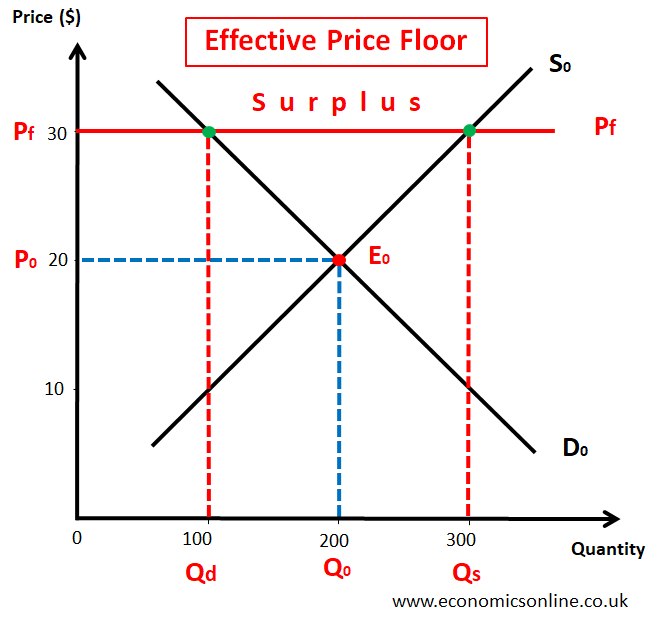

Effective or Binding Price Floor

A price floor is considered effective or binding if it is set above the market equilibrium price. This Price floor is called an effective or binding price floor because it will increase the price of a product from the existing market equilibrium price. This is illustrated by the following diagram:

In the above diagram, the initial equilibrium level is E0 and the existing market equilibrium price is P0, which is $20. The government has set the price floor (Pf) at $30. This price floor of $30 is higher than the equilibrium price of $20. Hence, it is effective, and buyers cannot pay the existing $20 price for the product. In fact, it is now illegal to pay any price less than the price floor of $30.

Effect on the Market

An effective price floor will immediately increase the price of the product, and the market cannot operate at its normal equilibrium position.

Buyers were paying a price equal to $20. When a price floor is imposed by the government, the market price must not fall below the price floor. In this case, the market price of $20 is less than the price floor of $30, as shown by the horizontal line. As any price below $30 will become illegal, buyers will have to pay at least the minimum price of $30.

In the above figure, at the price floor (Pc) of $30, the production or quantity supplied (Qs) of 300 units, is more than the quantity demanded (Qd) of the product that consumers wish to buy, i.e., the new quantity demanded (Qd) of 100 units. This is a market surplus, or excess supply. Consequently, as the price cannot fall below $30 to restore market equilibrium, some of the units out of the quantity supplied of 300 units, will remain unsold.

This unsold stock can lead to the emergence of an informal, black, or underground market for the product, with sellers selling the unsold stock at a lower price, well below the floor price. Such black markets inevitably arise when there are dissatisfied sellers who have not been able to sell their goods because of a lack of demand.

Advantages of an Effective Price Floor

An effective price floor can generate many benefits, including:

Immediate Price Increase

One of the primary benefits of price floors is the immediate increase in price. This can support the producers, especially farmers of wheat, rice and other agricultural commodities, by ensuring some reasonable revenue and profits. That is why the price floors are also called agricultural price supports. The sellers who will sell the products at a higher price will be happy because of the increased producer surplus and hence their welfare.

Seller Protection

Through an effective price floor, sellers are protected from being exploited by the buyers who are powerful and paying low prices. Sellers also feel secure because they are protected from any sudden fall in the price of the product.

Disadvantages of an Effective Price Floor

While price floors aim to protect sellers, they can have the following drawbacks.

Market Surplus

An effective price floor will create a market surplus, excess supply or unsold stock as the market cannot operate at normal equilibrium due to price floor. This means that the price mechanism and the market forces are not allocating the resources. Producers may also over-produce some products because of the incentive of a higher price in the form of price floor. This will cause an inefficient resource allocation.

Reduced Quantity Demanded

Buyers of the product may decrease their quantity demanded or choose not to buy at all due to the price floor.

Due to the price floor, buyers may find it expensive to buy products at the minimum price. This will reduce the quantity demanded of the product from the original quantity, which will not be sufficient to clear the available quantity supplied of the product.

Dissatisfied Sellers

Despite the price floor, not all sellers may be able to sell the product due to the limited quantity demanded. Customers may buy products from some sellers, while the remaining sellers will be left with their unsold stock. Moreover, some sellers will be able to sell a smaller quantity of the products. This can result in dissatisfaction among those sellers who are unable to sell the products. These dissatisfied sellers can sell their unsold stock at lower price in the black markets.

Effects on Buyers

While price floors aim to protect producers, they can harm the buyers. Higher prices resulting from the binding price floors can reduce the purchasing power of buyer firms and create barriers to entry for new competitors. This will also increase their production costs. The consumer surplus will also decrease due to an increase in price.

Administration Cost

The government has to spend money on enforcing the price floors. This might include the costs of monitoring the prices, conducting inspections, and taking legal action against violators.

How can Governments Overcome Market Surplus?

The government can solve the problem of market surplus by increasing the demand of the product in the market by forcing the sellers to produce less. Tis can be done through the imposition of taxes on sellers. Governments can also buy the unsold stock and store it for future use.

Price Floor vs. Price Ceiling

While price ceiling is the legally fixed maximum price which can be charged for a product, the price floor is the minimum price which can be paid for a good or service. National minimum wage used in labor market is an example of a price floor. Price floor is also used for the farmers of wheat, rice or other agricultural commodities to protect their farm incomes. While price ceiling is legal maximum price used to protect consumers, the price floor is used to support producers by increasing their producer surplus through an increase in the price of the product.

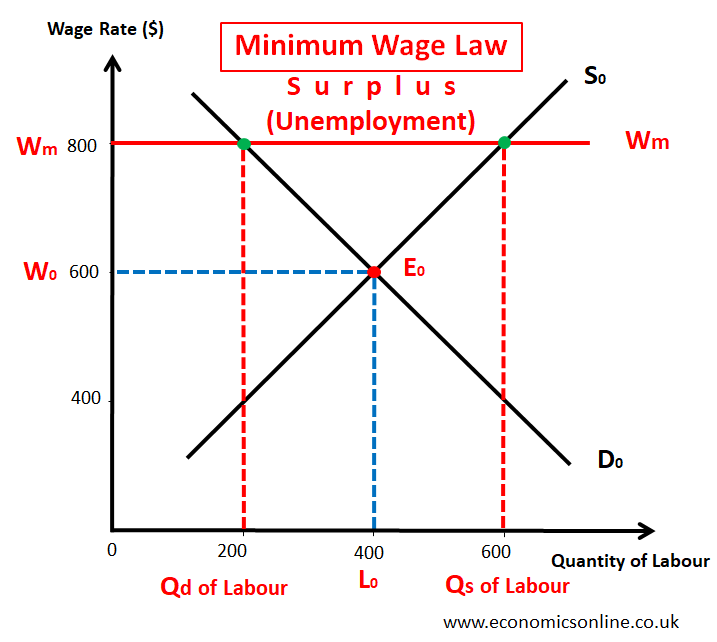

Minimum Wage: An Example of the Price Floor

The national or federal minimum wage legislation is the best-known example of a price floor. Its working is illustrated by the following diagram:

In the above diagram, the quantity of labour is taken on the X-axis while, the wage rate is taken on the Y-axis. The initial equilibrium level is E0, at the point of intersection of the demand curve and the supply curve. The existing equilibrium wage rate is W0, which is $600 per month. The government has set the minimum wage rate (Wm) at $800. This minimum wage rate of $800 is higher than the equilibrium wage rate of $600. Hence, it is effective, and buyers of labour (firms) cannot pay the existing $600 wage rate to the workers. In fact, it is now illegal to pay any wage rate less than the minimum wage rate of $800.

Effect on the Labour Market

The minimum wage law will immediately increase the wage rate, and the labour market cannot operate at its normal equilibrium position.

Firms buying labor were paying a wage rate equal to $600. When a minimum wage law is imposed by the government, the labour market wage rate must not fall below the minimum wage. In this case, the prevailing wage rate of $600 is less than the minimum wage of $800, shown by the horizontal line. As any wage rate below $800 will become illegal, firms will have to pay at least the minimum wage of $800 to employees.

In the above figure, at the minimum wage rate (Wm) of $800, the quantity supplied (Qs) of labour 600 workers, is more than the quantity demanded (Qd) of labour which firms wish to hire, i.e., the new quantity demanded (Qd) of 200 workers. This is a market surplus which will create unemployment. Consequently, as the wage rate cannot fall below $800 to restore the labour market equilibrium, some of the workers of 600, will not find jobs.

Alternatives to the Price Floor

While a price floor may appear to be a straightforward solution to increase the price of some products, it has several drawbacks. The government can explore and use some alternatives to the price floor in order to increase the price of products. These alternatives may include taxes on to producers and assigning them the production quotas.

Conclusion

A price floor is the legal minimum price and is a handy tool used by governments to increase prices and protect producers. While a price floor may initially seem beneficial, its negative effects can be many, including market surplus and the emergence of black markets. Governments must carefully weigh the benefits of price floor against its drawbacks when considering its implementation. One possibility is to use a price floor for a short period of time. The government can also explore alternative measures to increase the price of products.