An image showing increasing costs.

Cost-Push Inflation

What is Cost-Push Inflation?

Cost-push inflation refers to inflation caused by an increase in the cost of production in an economy.

In simple words, when the costs of production are increased for firms in an economy, the general price level of goods and services increases, which is called cost-push inflation.

There may be many reasons of an increase in the costs of production including an increase in cost of raw materials, expensive fuel, higher rents, higher electricity bills and higher wages.

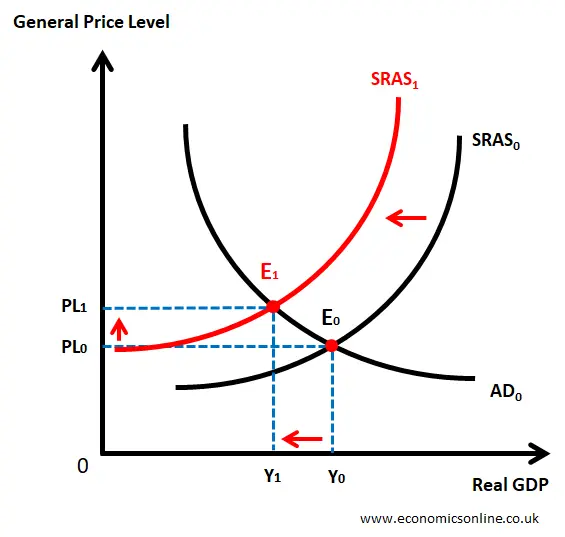

Cost-Push Inflation: Diagram

Cost-push inflation can be illustrated by the following graph.

In the above graph, real GDP is taken on the horizontal axis (X-axis), and the general price level is taken on the vertical axis (Y-axis). The initial equilibrium is at E0, which is the point of intersection of the short-run aggregate supply curve (SRAS0) and the aggregate demand curve (AD0). The initial price level is PL0, and the initial level of national income, or real GDP, is Y0.

Due to an increase in the cost of production in an economy, the short-run aggregate supply curve is shifted towards the left from SRAS0 to SRAS1. The new equilibrium point is E1.

The general price level has increased from PL0 to PL1. This is called cost-push inflation.

The real GDP is decreased from Y0 to Y1, which is negative economic growth. This will also increase unemployment in the economy.

Cost-Push Inflation: Examples

OPEC

A classic example of cost-push inflation occurred during the 1970s. The Organization of Petroleum Exporting Countries (OPEC) reduced production by 25% due to political instability in the Middle East. This caused an increase in oil prices, leading to higher production and transportation costs. This caused wide-spread cost-push inflation in many countries.

COVID-19

Another recent example of cost-push inflation occurred in 2021 due to the global outbreak of the coronavirus (COVID-19). During that time, firms were facing higher production costs due to disruptions in the global supply chain. With travel restrictions and lockdown measures in place, many businesses experienced difficulties in sourcing raw materials and components from heavily affected regions. As a result, the scarcity of inputs and logistical challenges led to higher production costs. This resulted in cost-push inflation in many countries.

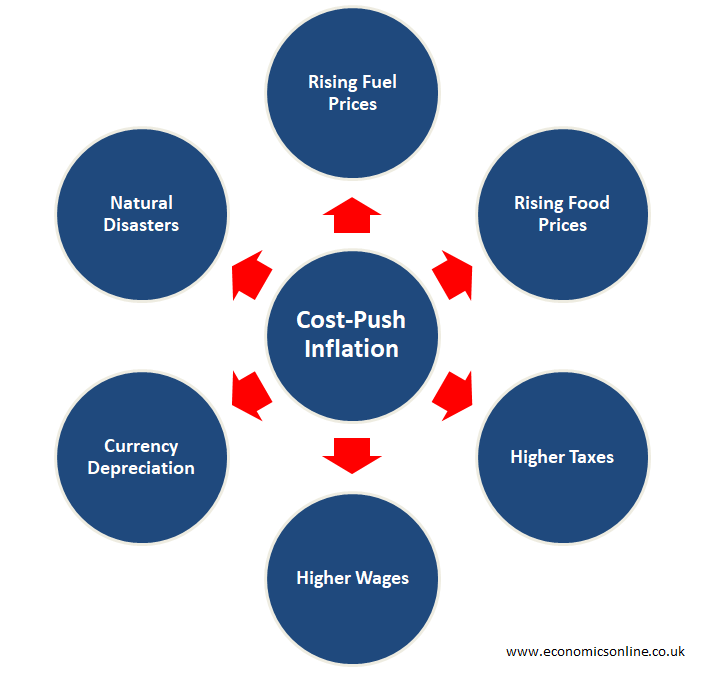

What Causes Cost-Push Inflation?

There are many causes of cost-push inflation. Some of them are explained below.

Rising Fuel Prices

One of the major causes of cost-push inflation is rising fuel prices. When the price of fuel, such as oil and gas, increases, it directly impacts transportation and production costs. Due to higher price of oil, firms increase the prices of their products to cover higher expenses, which can lead to cost-push inflation.

Rising Food Prices

If the cost of food items, such as grains, fruits, and vegetables, rises significantly, it can impact food production costs. This happened in 2021 due to supply chain disturbances during the Coronavirus outbreak. Food manufacturers and retailers may pass on these increased costs to consumers through higher prices, leading to cost-push inflation.

Higher Taxes

When taxes imposed on firms increase, it affects their profit margins negatively. Firms may respond by increasing prices to maintain their profitability, thereby contributing to cost-push inflation.

Higher Wages

If wages rise across various industries, may be due to an increase in the national minimum wage or powerful trade unions, it increases labor costs for firms. As a result, businesses may raise prices to offset the increased expenses, leading to cost-push inflation.

Currency Depreciation

The depreciation of a country's currency makes imported goods, such as raw materials and components, expensive. The importing firms face higher costs, which can lead to higher prices for their goods, hence cost-push inflation.

Natural Disasters

Natural disasters, such as hurricanes, floods, earthquakes, or droughts, can disrupt production, damage infrastructure, and lead to a scarcity of resources. The shortage of goods and services can result in higher production costs, which may be passed on to consumers in the form of higher prices, contributing to cost-push inflation.

Effects of Cost-Push Inflation

Cost-push inflation can have several effects on the economy, including:

Fall in the Value of Money

Cost-push inflation erodes the purchasing power of money. As the general price level rises due to increased production costs, the same amount of money can buy fewer goods. This leads to a decrease in the value of money, reducing the standard of living for consumers.

Negative Economic Growth

Cost-push inflation can be accompanied by negative economic growth. When businesses face higher production costs, they may reduce their output, leading to a fall in short-run aggregate supply. This will result in a fall in the real GDP of the country, leading to negative economic growth. During this period of slow economic activity, firms struggle to maintain profitability, and consumers face higher prices for goods and services.

Unemployment

Cost-push inflation is normally accompanied by higher levels of unemployment. As firms face increased costs, they may use cost-cutting measures, including reducing their workforce. This can lead to a rise in unemployment rates and economic hardship for individuals and households.

Redistribution of Income

Cost-push inflation can result in a redistribution of income within the economy. As the price level increases, individuals with fixed incomes may experience a decline in their purchasing power. On the other hand, business owners can keep pace with inflation and maintain or even increase their purchasing power. This can lead to income inequality and social disparities.

Impact on Balance of Payments

Cost-push inflation can affect a country's balance of payments negatively. When production costs increase, it can make exported goods expensive in foreign markets. This can result in a fall in the value of exports, leading to a negative effect on the balance of payments.

Wage-Price Spiral

Cost-push inflation can trigger a vicious cycle known as the wage-price spiral. During cost-push inflation, workers demand higher wages to maintain their real income. This wage increase will add to the production costs of firms, leading to higher prices. Now, more money is needed to buy expensive goods and services. This will lead to further wage claims and an increase in prices. This is called the wage-price spiral and is very bad for an economy.

Cost-Push Inflation vs. Demand-Pull Inflation

These are two major types of inflation or causes of inflation. Cost-push inflation occurs when the costs of production, such as wages, raw materials, or energy, increase, leading to higher prices for goods and services. It is driven by a fall in the short-run aggregate supply. On the other hand, demand-pull inflation arises when aggregate demand exceeds the available supply of goods and services in an economy. It is driven by a rise in aggregate demand due to increased consumer spending, investment, or government spending.

During cost-push inflation, an economy may face negative economic growth and rising unemployment. On the other hand, during demand-pull inflation, an economy may face economic growth and reduced unemployment.

That is why cost-push inflation is more harmful than demand-pull inflation.

How Bad is Cost-Push Inflation?

The severity of cost-push inflation depends on the following factors:

The Rate of Inflation

The rate of cost-push inflation determines its impact on the economy. If the inflation rate is relatively low and manageable, it may have a limited negative effect on the overall economy. However, if the rate of inflation is high, it can erode purchasing power, reduce consumer confidence, and disrupt economic stability.

Accelerating Inflation

The accelerating rate of cost-push inflation indicates a worsening situation. Rapidly rising prices can lead to uncertainties, hamper investment decisions, and undermine economic growth. On the other hand, a stable rate of cost-push inflation may allow businesses and consumers to adjust gradually, minimising the negative and disruptive effects.

Expected Inflation

If cost-push inflation is expected, it allows individuals and firms to plan and adjust their strategies accordingly. However, if the rate of inflation is unexpected, it can create uncertainty, negatively impacting consumer spending, business investments, and economic performance.

The Rate of Inflation in Other Countries

If the rate of cost-push inflation is significantly higher than that of the trading partner countries, it may lead to a loss of competitiveness in international markets, affecting the balance of trade negatively and potentially reducing economic growth.

How to Control Cost-Push Inflation?

Governments can use the following policy measures to control cost-push inflation.

Contractionary Fiscal and Monetary Policies

The government can use contractionary fiscal policy by increasing tax rates and decreasing government spending. Governments can also use contractionary monetary policy by increasing interest rates and decreasing the money supply in the economy. Both of these policies will control inflation by reducing aggregate demand.

The down side is that these demand-side policies will increase unemployment and decrease real GDP of the country.

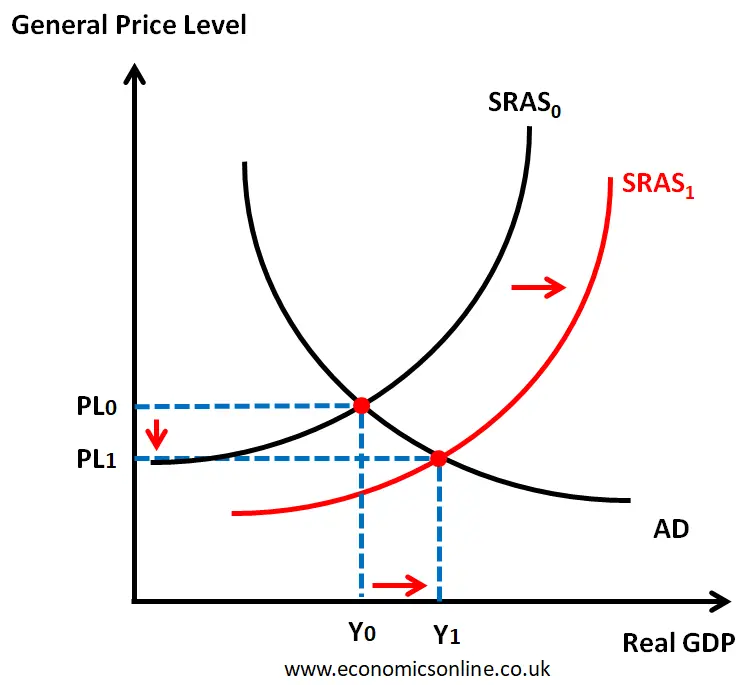

Supply-Side Policies

Governments can use supply-side policies aimed at improving productivity and reducing production costs. These policies will shift the aggregate supply curve towards the right and reduce cost-push inflation. This is illustrated by the following diagram.

The supply side policies will also promote economic growth and unemployment, as shown by the above graph, through an increase in real GDP from Y0 to Y1.

Conclusion

Cost-push inflation occurs when the general price level in an economy increases due to higher costs of production. Cost-push inflation is considered more harmful than demand-pull inflation due to its negative effects on economic growth and employment. Cost-push inflation stems from the leftward shift of the aggregate supply curve. Periods of cost-push inflation can be very challenging for individuals, firms, and governments. Understanding the causes and effects of cost-push inflation and its seriousness can help governments make and use appropriate and effective economic policies.