Photo by Alexander Grey / Unsplash

Disinflation Definition

What is Disinflation?

Disinflation refers to the decrease in the inflation rate, which means that there is still inflation and prices are rising, but at a slower rate as compared to previous years.

Disinflation is a type of inflation in which the rate of inflation decreases over time. During the period of disinflation, the general price level increases at a decreasing rate.

Suppose that the inflation rate was 10% in the previous year, and then it decreased to 3%. This 7% decrease in the inflation rate is known as disinflation.

Basic Terms

Let us define some basic terms.

Inflation

A sustained increase in the general price level of goods and services in an economy over a period of time is called inflation.

Reflation

Reflation is a type of inflation in which the rate of inflation increases over a period of time. During reflation, the general price level increases at an increasing rate.

Deflation

A decrease in the general price level of goods and services in an economy is called deflation.

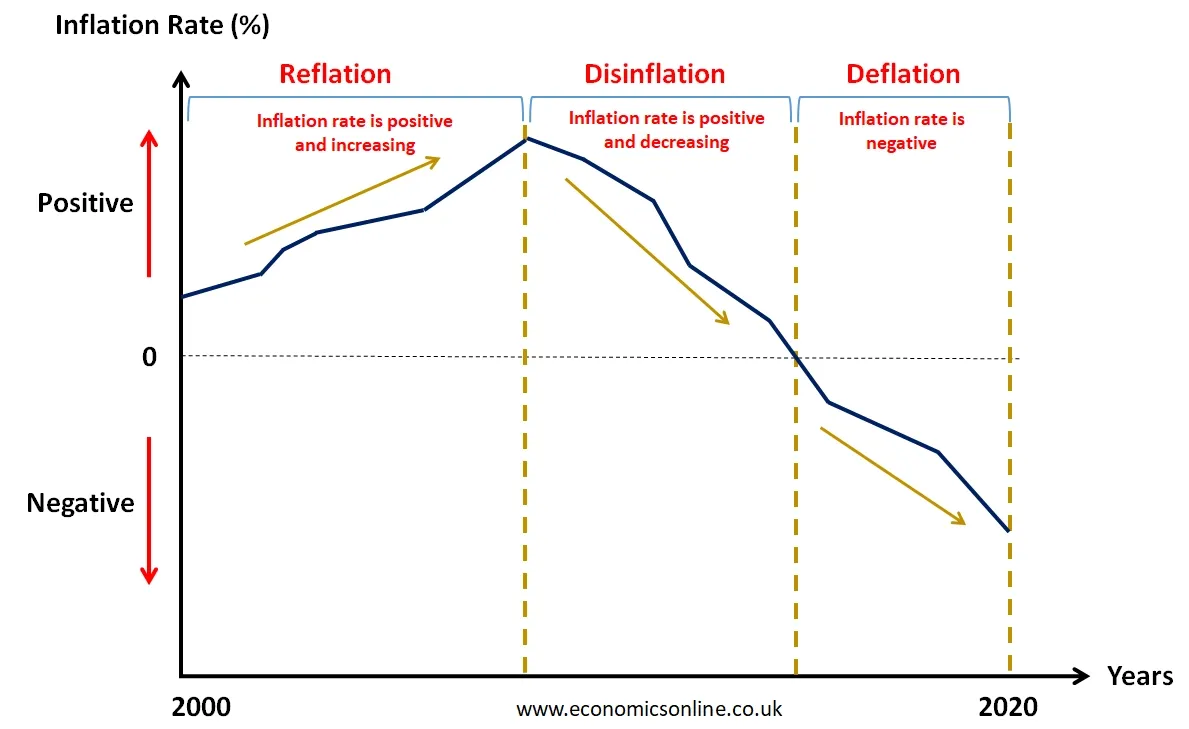

Diagram

The following diagram illustrates reflation, disinflation, and deflation.

In the above graph, we have years on the horizontal axis (x-axis) and the inflation rate on the vertical axis (y-axis). This graph shows reflation, disinflation, and deflation by showing ups and downs in the inflation rate from 2000 to 2020. The rising rate of change of inflation initially indicates reflation. The middle part of the graph shows a gradual disinflation, where the rate of inflation is positive but decreasing. Finally, the last section of the graph illustrates deflation when the rate of inflation becomes negative and falls below zero.

Causes of Disinflation

The following are some causes of disinflation:

Government Policies

Disinflation is caused by the macroeconomic policies of the government. For example, governments may use contractionary fiscal policy or tighter monetary policy to control rising inflation. These policies may slow down inflation and economic activity in a country and create disinflation by decreasing inflation rate.

Supply-side Shocks

Disinflation may also be caused by fluctuations in aggregate supply. These positive supply-side shocks can be due to various reasons, such as increased productivity or a surge in the supply of essential commodities. These changes in aggregate supply can decrease the rate of inflation and cause disinflation.

Global Economic Factors

International factors like lower oil prices, reduced global demand, or a strong domestic currency can lead to disinflation by influencing the cost of imports.

Wage Rates

When labour unions or workers accept lower wage increases or when there is a high level of unemployment, it can reduce cost-push inflation pressures, leading to disinflation.

Technological Advancements

Technological innovations can lead to increased productivity and cost reductions, which can contribute to disinflation in industries that adopt these innovations.

Characteristics of Disinflation

The following are the characteristics of disinflation:

Decreasing Inflation Rate

Disinflation is characterised by a gradual decrease in the rate of inflation over time. It does not mean that the general price level will also decrease. It means that the prices of goods and services will increase, but at a decreasing rate.

Positive Inflation Rate

Disinflation is a type of inflation, which means that the rate of inflation will be positive. In other words, during disinflation, the positive rate of inflation decreases and the general price level increases at a slower rate.

Rising General Price Level

Since disinflation is a type of inflation and the inflation rate is positive, hence the general price level increases during the period of disinflation.

Central Bank Policy

Disinflation is often a deliberate policy choice made by central banks to maintain price stability and control inflation. Central banks may use monetary policy tools like interest rate adjustments to achieve disinflation.

Economic Growth

Disinflation is generally associated with a growing economy as the gross domestic product increases. It is often seen as a sign of a healthy economy, as long as it does not lead to deflation.

Effects of Disinflation

The following are some effects of disinflation:

Improved Purchasing Power

Disinflation can increase the purchasing power of consumers compared to the past as the cost of living rises at a slower rate. This means that consumers can buy more with their income.

Price Stability

Disinflation helps maintain price stability by reducing the rate of inflation. It means that prices are rising at a slower rate. The slow and gradual rise in the general price level gives businesses hope for a rising profit in the future. Hence, disinflation leads to a more predictable and stable economic environment, which can benefit both consumers and businesses.

Improved Business Confidence

Disinflation can boost business confidence as the prices increase, which gives business owners optimism about their future profits. It provides a more stable economic environment, making it easier for businesses to plan and invest.

Low Nominal Interest Rates

Disinflation may create an opportunity for lower nominal interest rates, which can stimulate borrowing and investment in the economy.

Economic Stability

Disinflation can contribute to overall economic stability by reducing the volatility and uncertainty associated with rapid price increases.

Exchange Rate Effects

Disinflation can influence exchange rates, as lower inflation may make a country's currency more attractive to foreign investors, potentially strengthening the currency.

CPI as a Measure of Disinflation

CPI stands for Consumer Price Index. The Consumer Price Index is used as a measure of disinflation. The Consumer Price Index measures the overall changes in prices of goods or services over time. The decreasing value of CPI above 100 indicates a period of disinflation.

Is Disinflation Bad?

Disinflation is normally considered a good indicator in economics and is a sign of a healthy economy and effective government policies. It indicates that the rising inflation rate is under control. Governments aim to achieve a low inflation rate of 2% to 5% through disinflation. However, there is a risk that the disinflation may prolong and the inflation rate continues to fall even below zero. This will lead to deflation, which is very harmful for the economy. Deflation can lead to reduced consumer spending as people delay purchases in anticipation of lower prices. This, in turn, can negatively impact businesses and lead to a vicious cycle of economic stagnation.

Moreover, for individuals and entities with fixed debt obligations, disinflation can increase the real burden of their debt. This is because the value of money increases, making it more challenging to repay loans.

Lastly, prolonged disinflation can hinder economic growth by reducing consumer and business spending, leading to lower production and employment.

Disinflation Returns

A situation in which the inflation rate starts to decrease just after a period of increase is called a disinflation return. A disinflation return is beneficial for the economy as the inflation rate decreases. Disinflation returns are used to stabilise prices and enhance purchasing power.

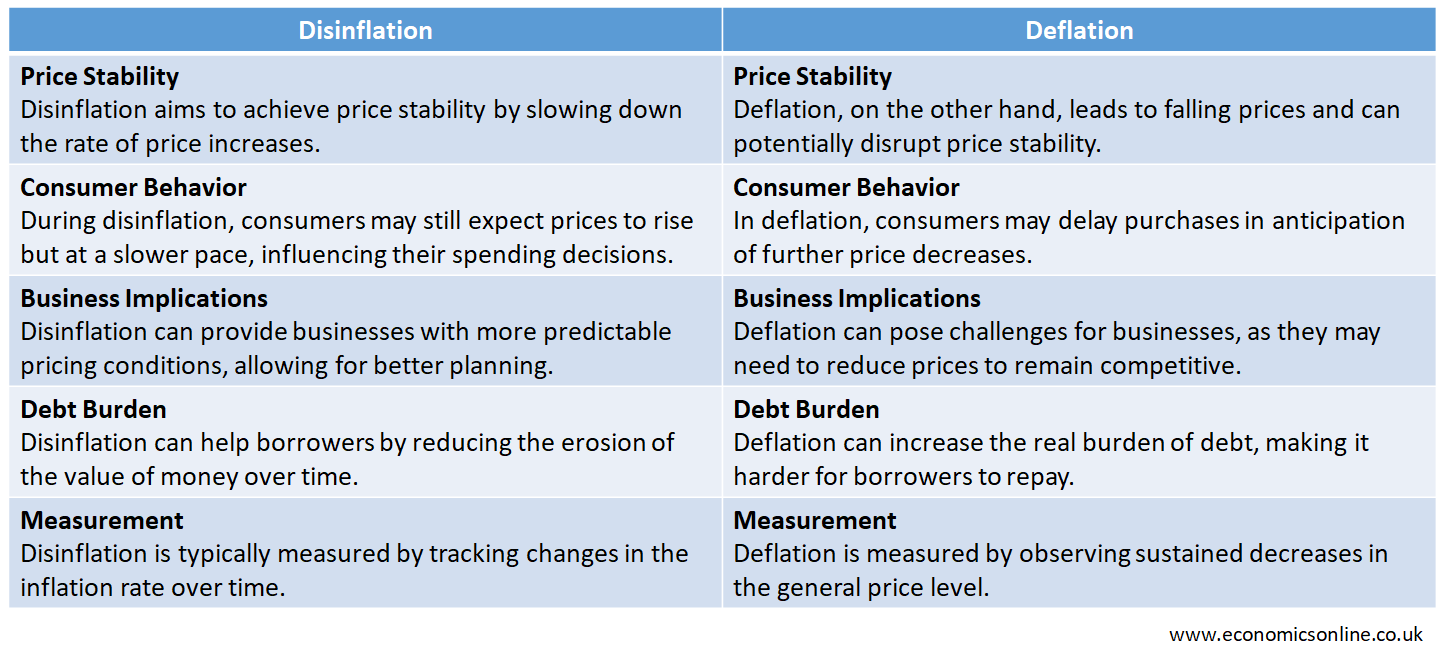

Deflation vs. Disinflation

The following table contains the main points of difference between deflation and disinflation.

Deflation

A decrease in the general price level of goods or services in an economy is called deflation. In deflation, prices fall instead of rising due to the negative inflation rate. Deflation is the opposite of inflation.

Causes of Deflation

The following are causes of deflation:

Decreased Aggregate Demand

Deflation is caused by a fall in the aggregate demand of goods and services leading to a fall in the general price level in the economy.

Increased Aggregate Supply

A rise in aggregate supply of goods and services which is not accompanied by sufficient demand can cause the general price level to decrease leading to deflation.

Technological Advancements

Technological advancements can cause reductions in production costs and increase productivity; this can decrease prices for goods or services leading to deflation.

Tight Monetary Policies

Governments use tight monetary policies to control rising inflation but there is risk that deflation might occur. When central banks implement restrictive monetary policies, such as raising interest rates, it can reduce borrowing and spending, contributing to deflationary pressures.

Economic Downturn or Recession

During periods of economic downturn or economic recession, reduced economic activity can lead to deflationary pressures as businesses struggle to maintain prices.

Effects of Deflation

The deflation has negative effects on the economy:

Reduced Spending

Deflation has negative effects on consumer spending as the unemployment rate is high. Individuals prefer not to buy goods or services as the prices are high. This can lead to a reduced demand of goods and services and businesses suffer in the form of decreasing sales.

Debt Burden

Deflation also has a negative effect on the borrowers, as the value of money increases during deflation. Borrowers have to pay back their debts with a high value money leading to higher debt burden.

Economic Slowdown

Deflation can contribute to an economic slowdown as businesses face lower profits and may cut back on production and investments.

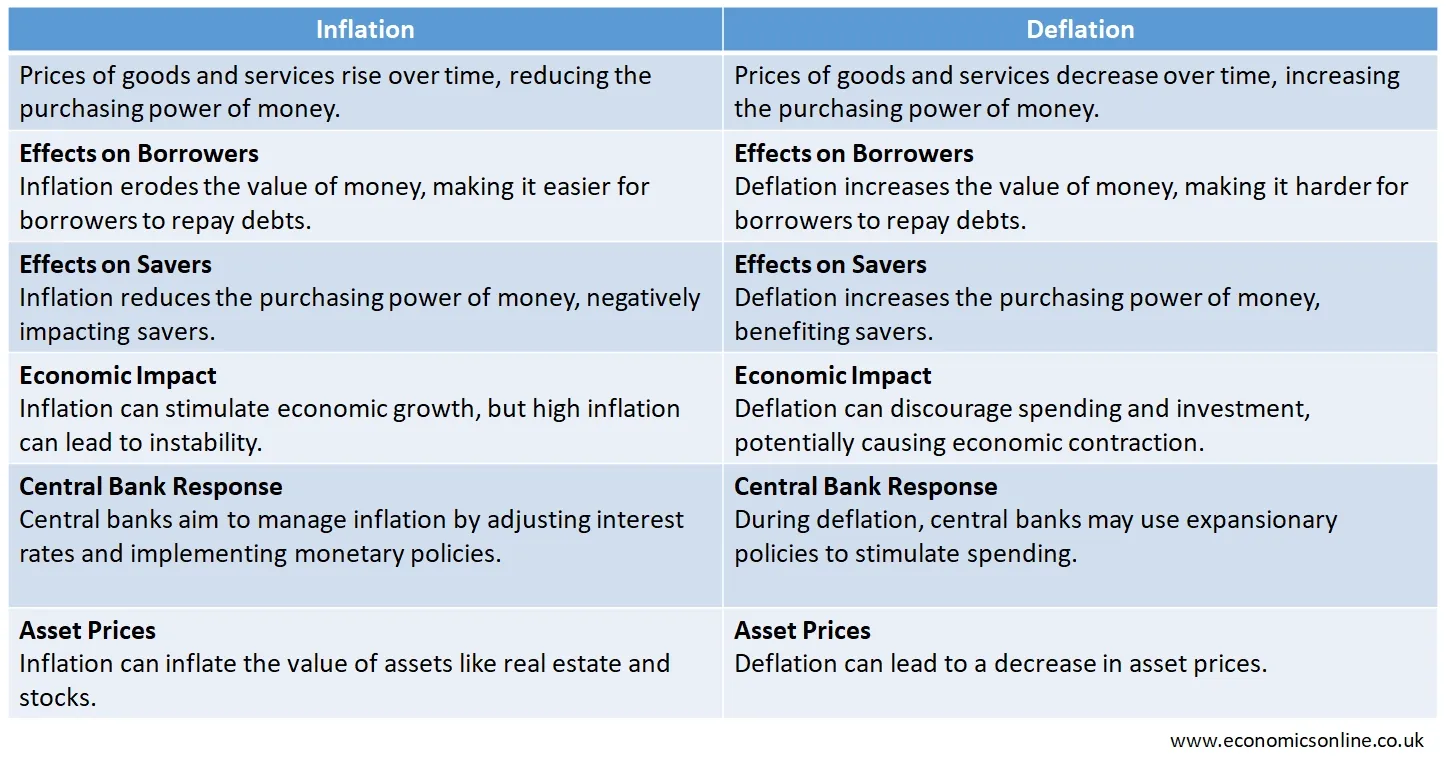

Inflation vs. Deflation

The following table contains the main points of difference between inflation and deflation.

The Role of Federal Reserve

The Federal Reserve System implements different monetary policies to overcome inflation in a country and stimulate economic growth. The Federal Reserve can adjust monetary policies according to the economic conditions in the country, increase or decrease interest rates, and use different strategies to influence the spending and investment of consumers. This will help manage the overall economic conditions in a country.

Conclusion

In conclusion, disinflation is a decrease in the inflation rate over time. This decrease in the inflation rate can be achieved by governments when they try to control rising inflation rate through the use of contractionary demand-side policies. Disinflation has a positive impact on the overall economic conditions because it helps stabilise prices for goods or services, which reduces the rising inflation rate and stimulates economic growth.