Photo by Dan Cristian Pădureț / Unsplash

Price Taker

Definition

A market participant who has no influence or impact on the market price of a product is called a price taker. A price-taker is a person or firm that accepts the prevailing market price.

In perfect competition, where there are many sellers selling identical products with no entry and exit barriers, firms are considered price takers because they have no power to influence the market price.

Characteristics of Price Taker

The following are the main conditions for being a price-taker:

Lack of Market Power

Price takers have no ability to influence or control the market price of a product or service.

Large Number of Buyers and Sellers

A price-taker operates in a market with a large number of sellers, making it difficult for any single participant to have a significant impact on price.

Homogeneous Products

Price takers typically deal with products that are identical or very similar to those offered by other sellers, leaving little room for differentiation.

Perfect Information

Price takers have access to complete information about the market, including prices and available products.

Ease of Entry and Exit

Price-takers can easily enter or exit the market without facing significant barriers or restrictions.

Wage Taker

A person who has no control over the wage received is called a wage taker. Wage takers have to accept the wage rate prevailing in the market without having the ability to negotiate or influence it. Employees are considered wage takers in a perfect labour market.

Advantages of Price Taker

The advantages of price-taking are explained below:

Market Efficiency

Price takers benefit from the efficiency of competitive markets, where prices are determined by supply and demand.

No Need for Pricing Strategy

Price takers do not have to spend resources on developing complex pricing strategies since they accept the prevailing market price.

No Pressure to Innovate

Price-takers can focus on production and operations without the pressure to constantly innovate or differentiate their products.

Ease of Entry and Exit

Price takers can easily enter or exit the market without facing significant barriers, allowing for flexibility and adaptability.

Fair Competition

Price takers operate in a fair and level playing field where no single firm has the power to manipulate prices, promoting healthy competition.

Disadvantages of Price Taker

The disadvantages of price-taking are explained below:

Limited Pricing Power

Price takers have little control over the market price, which can limit their ability to maximise profits.

Vulnerability to Price Fluctuations

Price-takers are more susceptible to price fluctuations in the market, which can impact their revenue and profitability.

Lack of Product Differentiation

Price-takers often sell homogeneous products, making it challenging to differentiate themselves from competitors.

Difficulty in Building Brand Loyalty

Without the ability to set prices or offer unique products, price-takers may find it harder to build customer loyalty.

Potential for Lower Profit Margins

Price takers may face intense competition, leading to lower profit margins due to their inability to command higher prices.

Different Types of Markets

There are the following types of markets in the context of price takers:

Perfect Competition

Perfect competition refers to a market where there are many buyers and sellers with perfect knowledge and no entry or exit barriers. Sellers are small, with an insignificant market share, and sell homogenous products. Sellers are price takers, as they have no ability to affect the market price of products.

Price-taking by Firms in Perfect Competition

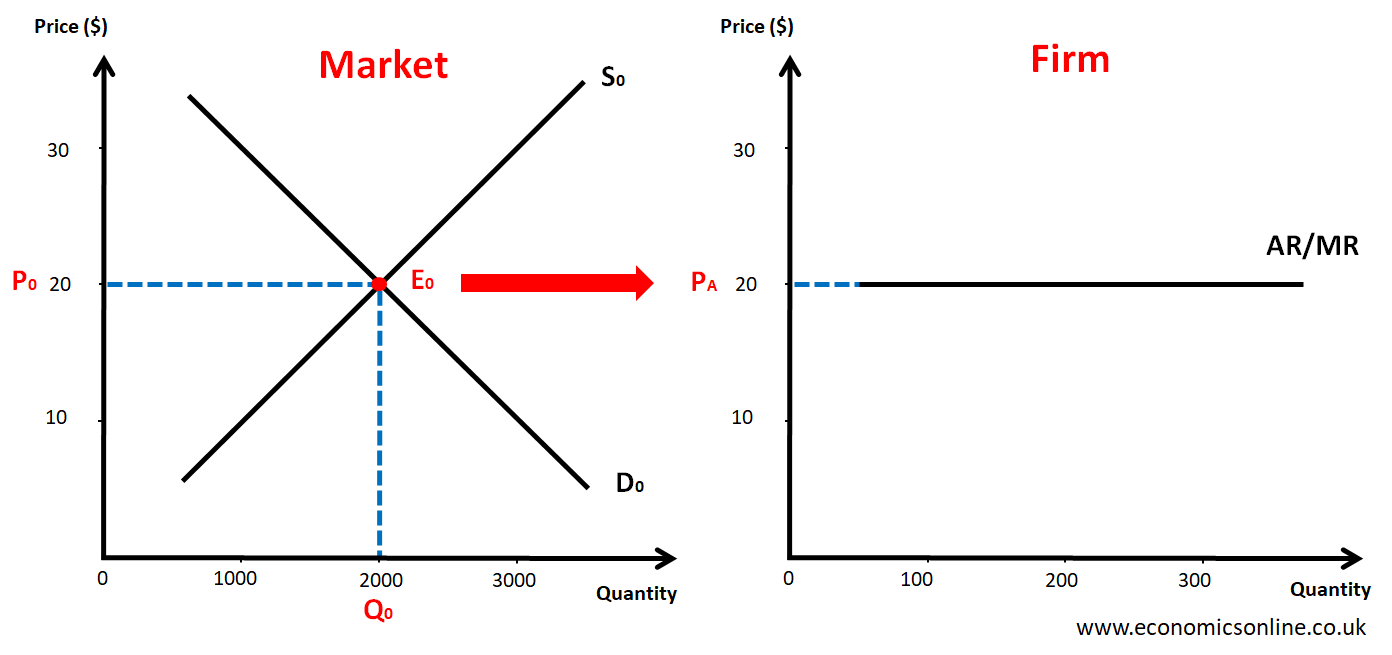

In a perfectly competitive market, firms are price-takers. The process of price-taking is explained below with the help of the following diagram:

The above graph on the left shows the workings of the market, where the market price is determined based on the interaction of demand and supply forces. In this graph, we have taken the quantity of product on the horizontal axis (x-axis) and the price in dollars on the vertical axis (y-axis). The equilibrium price is P0, which belongs to the equilibrium point E0, which is the point of intersection of demand and supply curves.

The graph on the right illustrates that a firm is taking the price from the market, which is shown by the horizontal average revenue (AR) / marginal revenue (MR) curve. For a firm operating in a perfectly competitive market, the AR/MR curve is horizontal because of price-taking.

If the price is increased in the market due to a rise in demand or a fall in supply, the firm will take the new price, and the AR/MR curve will shift upward.

If the price decreases in the market due to a fall in demand or a rise in supply, the firm will take the new price, and the AR/MR curve will shift downward.

Price Taking and Normal Profit in Perfect Competition

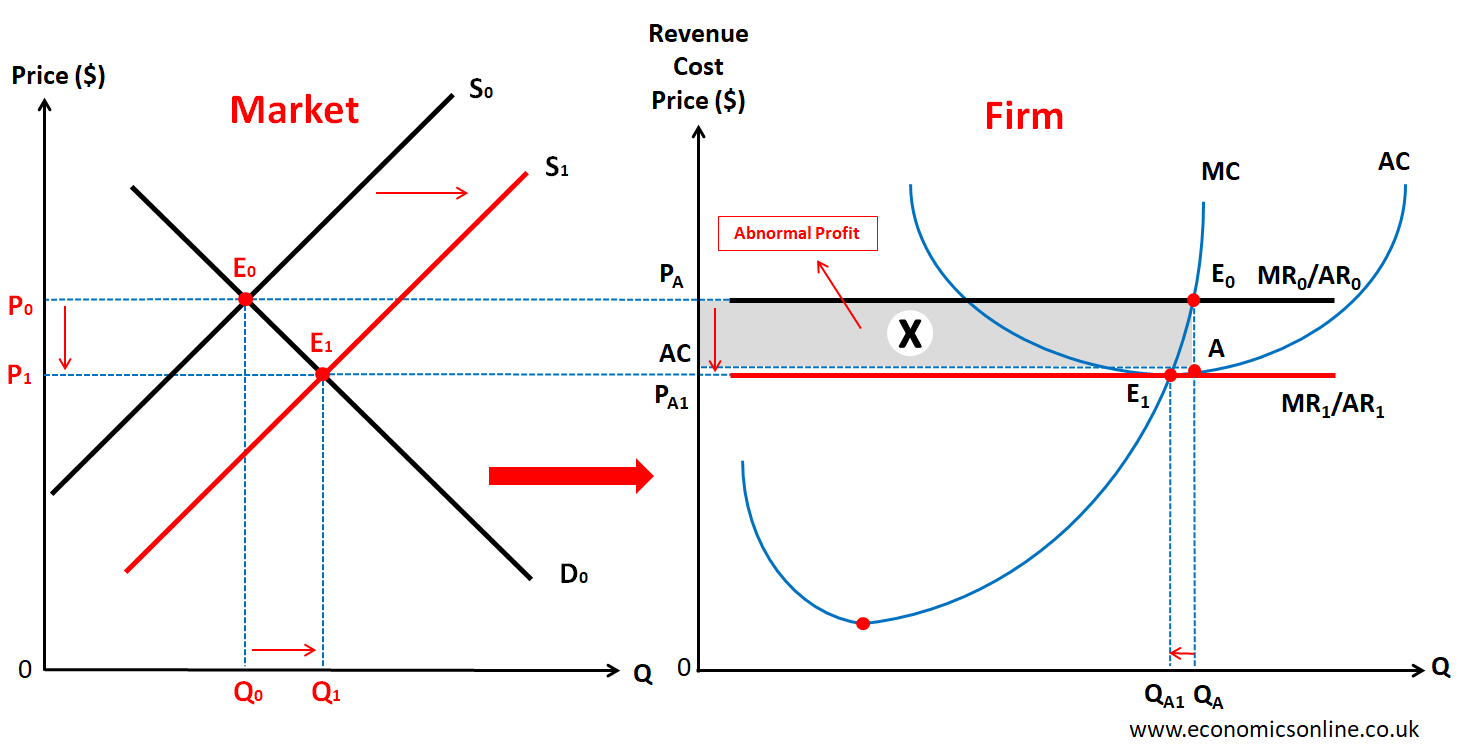

In a perfectly competitive industry, firms can earn an abnormal profit in the short run; however, in the long run, they earn a normal profit. This is also related to price-taking, as illustrated by the following graph.

In the above graphs, initially, the firm is earning an abnormal profit in the short run. The initial market equilibrium is at E0, P0 and Q0. The market equilibrium price is P0. Firm A will take the same price from the market, so PA = P0. At price PA firm A is generating abnormal or supernormal profit equal to area X. The firm's equilibrium is at E0 on the right-side graph, where the marginal cost (MC) curve intersects with the marginal revenue (MR) curve.

Due to perfect knowledge, firms will know about the existence of abnormal profits. This abnormal profit will become an incentive for new firms to enter the market. Due to easy entry, many firms will enter the market, and as a result, market supply will rise from S0 to S1.

Due to the rise in supply, the market will have a new equilibrium at E1, P1, and Q1. The market equilibrium price decreased from P0 to P1 and the quantity traded increased from Q0 to Q1.

Firm A will take the new price P1 from the market, so PA1 = P1. At this new price, firm A is earning a normal profit and the long-run equilibrium is at the normal economic profits.

Firm A is also able to sell less quantity now (QA1 instead of QA) because new firms will take some customers away from firm A, even though the quantity traded in the market has increased from Q0 to Q1 because of the entry of new firms. Hence, in the long run, firms earn a normal profit in perfect competition.

Imperfect Competition

A market structure in which buyers and sellers have some control over market prices is called imperfect competition. In imperfectly competitive markets, firms are called price makers or price setters. Different types of markets in imperfect competition are given below.

Monopoly

Monopoly refers to a market with a single seller having 100% market share. A single firm is satisfying the demand of the whole market and has complete control over the market price as there is no competition in the market. This seller is a price-maker and dominates the whole market.

Oligopoly

Oligopoly refers to a market with a few sellers who dominate the market. These players have large control over the market prices and have authority to change the market prices accordingly. These sellers are called price makers because of their significant power to influence the market price.

Monopolistic Competition

A market in which many buyers and sellers compete but provide differentiated products or services is called monopolistic competition. In monopolistic competition, firms have some control over the market price due to product differentiation, and they are called price makers.

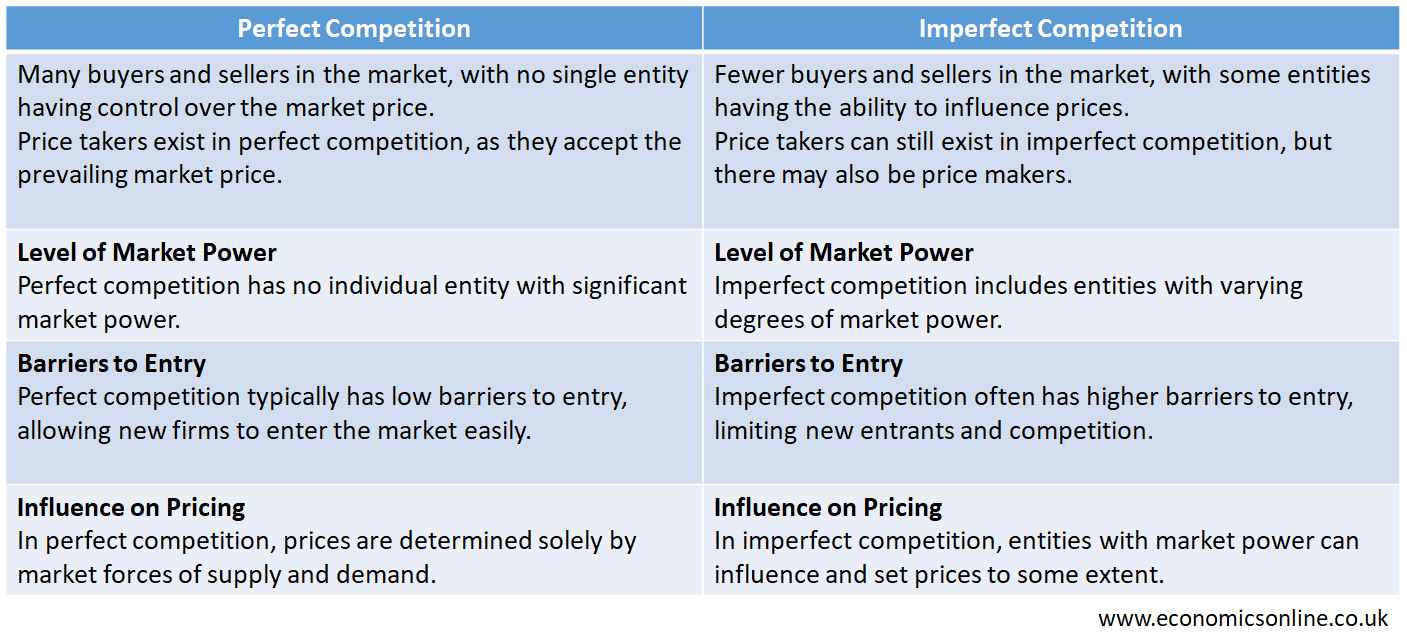

Perfect Competition vs. Imperfect Competition

The following table summarises the main differences between perfect competition and imperfect competition.

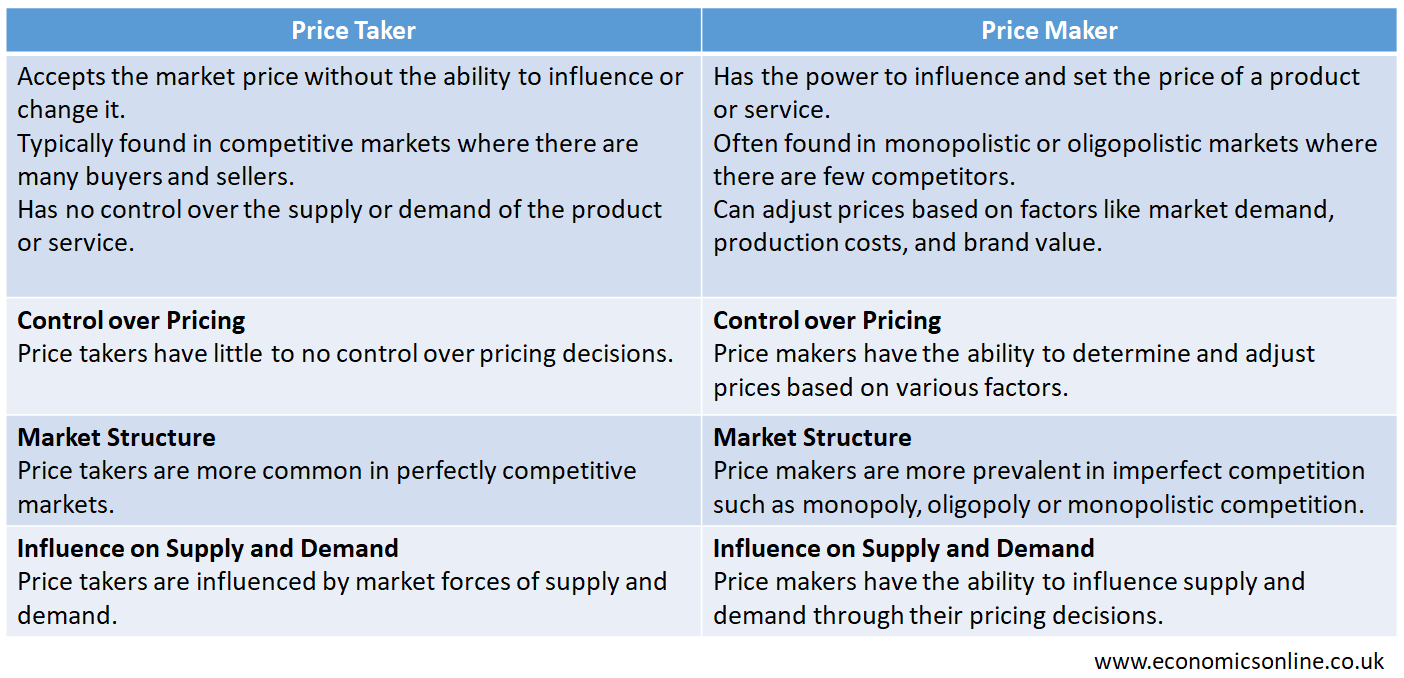

Price Taker vs. Price Maker

The following table summarises the main differences between price takers and price makers.

Conclusion

In conclusion, a price taker is a market participant who has no influence or impact on the price of products or services. He has to accept the prevailing prices in the market. Different types of markets affect price takers in terms of market prices and competition. Price takers have both advantages and disadvantages, such as no barriers to entry or vulnerability to price fluctuations, etc. Price takers have no control over the market, just like wage takers.