An image showing effect of inflation on money.

GDP Deflator - Formula, Calculation and Importance

What is the GDP Deflator?

Defintion

The GDP deflator is a price index that is used to measure the change in the price level of all the goods produced in a country over a period of time.

In simple words, the GDP deflator is used to convert nominal GDP, which is the GDP measured at current prices, to real GDP, which is the GDP measured at base year prices or constant prices. By doing so, the GDP deflator helps to eliminate the impact of inflation or deflation on the economy's growth rate.

Explanation

The Gross Domestic Product (GDP) is a measure of the total value of all final goods and services produced (total output) within the geographic boundaries of a country in one year. GDP is a key measure of economic activity, but it can be affected by changes in prices over time. The GDP deflator is an important tool that economists use to adjust for these price changes and accurately measure the growth of an economy.

In simple words, the GDP deflator is used to convert nominal GDP, which is the GDP measured at current prices, to real GDP, which is the GDP measured at base year prices. By doing so, the GDP deflator helps to eliminate the impact of inflation or deflation on the economy's growth rate.

The GDP deflator measures the prices of finished goods produced, rather than consumed, in a country. So it includes the prices of capital goods as well as consumer products and includes the price of exports but excludes the price of imports.

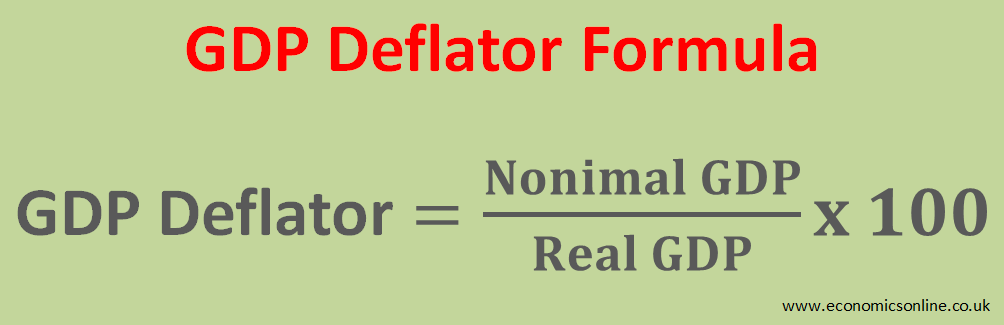

Formula for calculating the GDP Deflator

The formula for calculating the GDP deflator is as follows in the form of the GDP deflator equation:

GDP Deflator = (Nominal GDP / Real GDP) x 100

The GDP deflator is expressed as a percentage. It is calculated by dividing the nominal GDP by the real GDP and multiplying it by 100.

GDP Deflator Calculation

Suppose that the nominal GDP of a country in 2022 is $10 trillion, and the real GDP for the same year is $8 trillion. To calculate the GDP deflator for the country, we can use the formula mentioned above:

GDP Deflator = (Nominal GDP / Real GDP) x 100

GDP Deflator = ($10 trillion / $8 trillion) x 100

GDP Deflator = 125

Therefore, the GDP deflator for the country is 125.

Some statistics of GDP deflator of different countries can be checked here.

Importance of the GDP Deflator

The GDP deflator is an essential tool in economics because it helps to measure the real growth of an economy by eliminating the effects of inflation. For instance, if the nominal GDP of a country increases by 5% in a year, it does not necessarily mean that the country's economy has grown by 5%. If the inflation rate for the same year is 3%, then the real GDP growth of the country is only 2%. The GDP deflator provides a more accurate picture of the economy's growth and helps policymakers make informed decisions.

Limitations of the GDP Deflator

Like any economic indicator, the GDP deflator has its limitations. For example, it may not accurately capture changes in the quality of goods and services over time. If the quality of goods and services increases, the price may remain the same, resulting in a deflated measure of economic growth. Additionally, the GDP deflator is a broad measure that does not differentiate between different sectors of the economy, which may be growing at different rates.

GDP Deflator vs. Consumer Price Index (CPI)

The GDP price deflator and the Consumer Price Index (CPI) are both price indices that are used to measure inflation, but they differ in a few ways.

The GDP deflator measures the change in prices of all goods and services produced within a country, including those used for investment purposes. It is used to calculate real GDP, which is GDP adjusted for inflation.

On the other hand, the CPI measures the change in prices of goods and services bought by consumers. It is used to calculate the inflation rate that affects consumers directly, such as the cost of living.

While both are useful indicators of inflation, the GDP deflator provides a more comprehensive picture of price inflation throughout the entire economy, while the CPI is more focused on the prices of goods and services consumed by households.

The GDP deflator isn't based on a fixed basket of goods and services. For example, changes in consumption patterns, investment patterns, or the introduction of new goods and services are automatically incorporated in the GDP deflator but not in the CPI. Hence, the GDP deflator is a more comprehensive measure of inflation.

The following table shows a quick look at the comparison between the GDP deflator and the CPI.

|

Criteria |

GDP Deflator |

Consumer Price

Index (CPI) |

|

Definition |

Measures the average change in prices of all goods and services

produced in an economy over time |

Measures the average change in prices of a basket of goods and

services consumed by households over time |

|

Purpose |

To adjust nominal GDP to real GDP by eliminating the effects of

inflation or deflation |

To measure the inflation rate and the purchasing power of consumers'

income |

|

Coverage |

Includes all goods and services produced within a country's borders,

whether consumed domestically or abroad |

Includes goods and services purchased by households |

|

Methodology |

Based on the ratio of nominal GDP to real GDP |

Based on the weighted average of prices of a basket of goods and

services |

|

Formula |

GDP Deflator = (Nominal GDP / Real GDP) x 100 |

CPI = (Cost of Basket in Current Year / Cost of Basket in Base Year) x

100 |

|

Calculation |

Uses the prices of all goods and services produced within a country's

borders |

Uses the prices of a fixed basket of goods and services consumed by

households |

|

Time period |

Quarterly and annually |

Monthly and annually |

|

Base year |

Changes with every calculation |

Fixed for a number of years |

|

Usefulness |

Helps to measure the real growth of an economy and is used by

policymakers and economists to make informed decisions |

Helps to measure the inflation rate and is used by policymakers and

consumers to adjust their spending and investment decisions |

Conclusion

The GDP deflator is an important price index that helps to measure the real growth of an economy by adjusting for changes in prices over time. The formula for calculating the GDP deflator is simple, and the example provided above illustrates how it can be computed. Despite its limitations, the GDP deflator remains an essential tool for policymakers and economists to measure and understand economic growth.