An image of a market word on a wooden table.

Market Structure

Introduction

The collection of buyers and sellers of a product is called its market. Markets differ significantly in terms of their features. For example, the market for wheat has different features as compared to the market for utilities. The way firms operate in a particular market and take different decisions depends largely on the type of market they operate in. In this article, we will explain different types of markets based on their features.

What is a Market Structure?

Market structure refers to the characteristics of a market that determine the behaviour of firms operating in that market. In other words, market structure is the set of features of a market that determine the way firms compete and make pricing and output decisions. In microeconomics, the concept of market structure is very helpful in understanding the behaviour of firms in terms of pricing decisions, output decisions, and other ways of competing.

The behaviour of firms depends on the market structure they operate in. It means that firms operating in the same market structure behave in the same way, while firms operating in different market structures behave differently.

Characteristics of Market Structure

The following are some important characteristics of a market structure:

- Number of firms

- Market knowledge

- Market power

- Product Differentiation

- Entry barriers

- Exit barriers

Let us explain these features one by one.

Number of Firms

The number of firms operating in a market is a major feature of its structure. The number of firms can vary from one to hundreds and thousands. If a market has too many firms (perfect competition) working in it, it is considered a good market structure in which firms are in healthy competition. Under competitive pressure, these firms allocate resources in an efficient way. But if there is only one firm (monopoly) or a few firms (oligopoly) dominating the market, then this market is considered different in terms of the way firms compete and make their decision about resource allocation.

Market Knowledge

Market knowledge is the information available to buyers and sellers. In some markets, there is perfect knowledge or perfect information, which means that all the information is freely and easily available for buyers and sellers. In other markets, there are secrets and the presence of asymmetric information.

Market Power

Market power refers to the ability of a firm to influence the price in the market. It is also an important determinant of the type and structure of the market. In some markets, firms have no market power and they cannot influence the price. These firms are called price takers. In some other markets, firms have the power to influence the market price and are called price makers or price setters.

Product Differentiation

Product differentiation is another feature which determines the type of market structure. In some markets, firms sell homogeneous products, which are perfect substitutes. In some other markets, products are differentiated.

Entry Barriers

Entry barriers are the hurdles faced by new firms when they try to enter the market. It is also an important feature of market structure. Some markets have low barriers to entry and new firms can freely and easily enter the market. Some other markets have high entry barriers, making it difficult for incumbent firms to enter the market.

Exit Barriers

Exit barriers are the hurdles faced by existing firms when they try to leave the market. When there are no barriers to exit, existing firms can easily and quickly leave the market.

Types of Market Structure

The following are some types of traditional market structures: In all of these types of markets, we assume that there are a large number of buyers.

Perfect Competition

Perfect competition is a market structure in which a large number of small firms compete with each other in the market. It is also called pure competition or atomistic competition. In a perfectly competitive market, new firms can easily enter or exit the market and sell homogeneous goods. An individual firm has no market power and cannot influence the market price. That is why; firms in this market structure are price takers. In this type of market structure, customers have access to all the information about the market. There is no asymmetry of information between buyers and sellers, and consumers are aware of the prices, seller locations, availability and quality of products. This type of market structure is rare to find in this world. However, this concept is useful when comparing other market structures.

In perfect markets, firms are assumed to sell at prices where marginal revenue becomes equal to marginal costs to generate normal profit.

Criticism

Critics thought this market was unrealistic, and then this market structure faced different criticisms, which are described as follows:

Lack of Economies of Scale

Critics argue that due to the small size of firms and there low market shares, firms do not enjoy economies of scale and hence cost cannot be further decreased. This can be a missed opportunity for cost reduction and efficiency improvement, which are possible through economies of scale.

No Incentive for Innovation

Critics argued that there is no incentive for innovation in this market. Normally, firms, in order to remain in competition and hold a large portion of market share, prefer to innovate to beat their competitors and remain at the same market share. But in this type of market structure, product prices are fixed; firms are price takers and they cannot increase or decrease the prices of products. This leads them to earn normal economic profits, which may not be enough to invest in innovation, leading to a lack of dynamic efficiency.

Monopolistic Competition

An imperfectly competitive market, which has both the qualities of a monopoly and a competitive market, is called monopolistic competition. There are many firms in this market and there are low entry/exit barriers. In monopolistic competition, seller firms compete and differentiate their products from each other to attract more consumers. In this market structure, product differentiation gives firms the power to increase the price slightly and become price makers.

There are many different aspects that are considerable when observing monopolistic competition, both short-term and long-term.

In the short term, monopolistic firms can charge their product prices on their own and enjoy abnormal or supernormal profits. The profit maximisation output and the price are determined by using marginal revenue (MR) and marginal cost (MC) curves (MR=MC). But marginal revenue becomes low and eventually diminishes when new firms enter the market due to low entry barriers. Due to this reason, in the long run, only normal profits are earned by firms in monopolistic competition.

Monopoly

Theoretically, a monopoly means a market structure in which there is a single firm with 100% market share. In real life, a monopoly is a market structure with more than 25% market share. In economic theory, we discuss a monopoly as the sole producer of a good or service. In this type of market structure, a single seller dominates the whole market and faces no competition due to very high entry barriers. These high entry barriers make it impossible for new firms to enter the market. In other words, in a monopoly market structure, firms are the sole owners of resources and have claims, copyrights, licences, and patents issued by the government with high initial set-up costs. Due to these factors, no one can easily enter the monopoly market structure. That is why the firm working in a monopoly structure is the single seller and has the power to manipulate prices according to their will to generate supernormal profits. Monopolist firms can further maximise their profits by using price discrimination, which converts consumer surplus into firm’s revenue. A natural monopoly is a firm that becomes a monopoly due to the cost structure of the industry.

Oligopoly

A market structure in which there are a small number of big firms that offer differentiated or identical products is called an oligopoly market. In this type of market structure, firms are interdependent and the actions of one firm will affect the other firms. The strategies used by firms depend on the actions of other firms. Due to this interdependence, firms can also indulge in collusive behaviour to maximise their joint profits. For example, firms can sign agreements to share the market by limiting the production of goods. This will lead to enormous profits. In this type of agreement, they can perform like monopolies, and the formal collusion between them is termed a cartel.

In this market structure, barriers to entry and exit are high due to the availability of advanced technology, strategies designed by existing firms, and patents to discourage new entrants.

Duopoly is a type of oligopoly with two dominant sellers in the market.

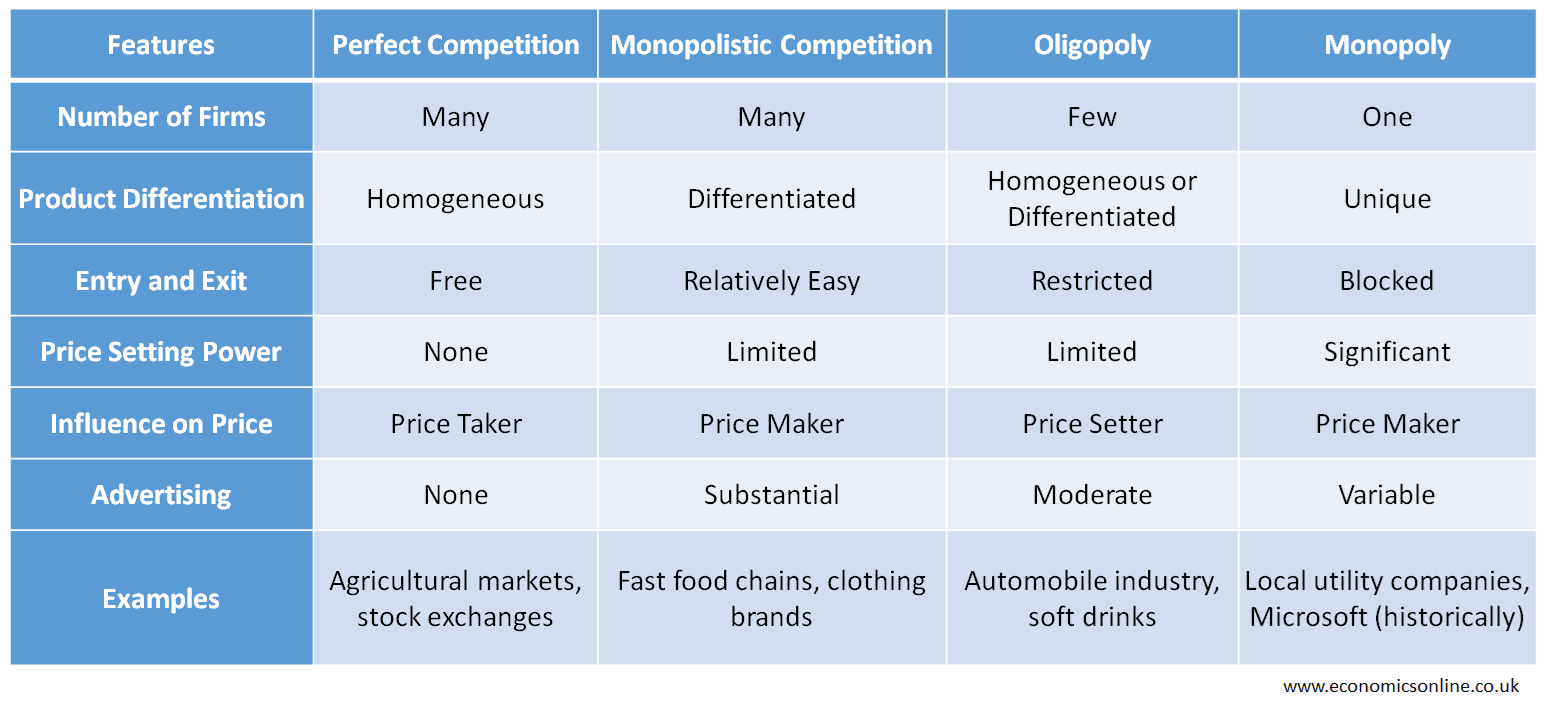

The following table contains the main points of comparison for different types of markets.

Contestable Markets

A market structure that has the freedom to enter or exit the market and has a low sunk cost is called a contestable market. According to the theory of contestability, the existing number of firms doesn’t matter in order for firms to behave in a competitive way. The threat of competition is just like the actual competition. This theory says that even monopolies can behave in a competitive way if the market is contestable and there is a high threat of potential competition.

Conclusion

In conclusion, a market structure mainly consists of a perfect market and an imperfect market. An imperfectly competitive market is further divided into monopolistic competition, oligopoly, and monopoly. We can identify a market by knowing the number and size of its sellers, the level of information, and the barriers to entry or exit in the market. This will help us determine the behaviour of firms operating in that market.