Photo by Glenn Carstens-Peters / Unsplash

Atomistic Competition

Definition

A type of market structure in which many small firms compete independently with each other in a marketplace is called atomistic competition.

Every firm competing in the market is a price-taker and has no control over the market price of specific products or services.

In atomistic markets, the competition is so intense that it represents perfect competition.

Features of Atomistic Competition

In atomistic competition, the following features are present:

Many Small Firms

It is a feature of atomistic competition, which means that there are numerous small firms (atomistic competitors) operating and competing independently in the market. These sellers may be hundreds or thousands and sell the same product.

Many Buyers

There are a large number of buyers, generating a significant demand for the product and aiming to maximise their utility.

Perfect Knowledge

There is perfect knowledge. Buyers have perfect knowledge about sellers, products quality, features, price, availability, etc. Sellers also have perfect knowledge. There are no production secrets.

No Barriers to Entry

There are no entry barriers under the assumption of atomistic competition. That is why there are numerous firms in atomistic competition.

Price Taking

Every independent firm in the market lacks market power as they have no control over the market price. Firms are price-takers. An individual firm cannot influence the market price.

Intense Competition

Individual firms engage in fair competition with each other to attract customers. There is intense competition due to numerous firms competing for the same customers.

Homogenous Products

Firms sell homogeneous or identical products with no product differentiation. That is why the products in this type of competition are close substitutes.

Normal Profit

In atomistic competition, firms earn normal profits in the long run. This is the minimum amount of profit needed by firms to keep resources in operations and to stay in the market. Normal profit is a profit that covers all costs, including the opportunity costs of the resources used in the business.

Real-world Examples

Atomistic competition is very rare in real life. Real-world examples of atomistic competition include local agricultural markets where multiple small local farmers sell the same type of agricultural products like potatoes, wheat, vegetables, and fruits.

Another example of atomistic competition is the foreign exchange market (FOREX market), where the currency is a homogenous product and there are many buyers and sellers.

Benefits of Atomistic Competition

The following are some benefits of atomistic competition:

Increased Consumer Choice

As there are many small firms competing independently in the market, consumers have a greater variety and choice of sellers to buy products from according to their tastes.

Price Competition

Firms competing in the market offer lower price and better deals to engage customers and survive in the market.

Efficient Resource Allocation

To drive fair competition, small firms use resources efficiently to enhance productivity and reduce resource waste.

Market Responsiveness

As there are many firms competing in the market, atomistic competition allows firms to quickly adapt to market changes, like demand and supply changes or market conditions.

Competitive Markets

Competitive markets are the ones in which small firms compete with each other. Each firm has no control over market prices, and these firms struggle to differentiate their products or services from each other to attract more customers. This intense competition between firms encourages efficiency and innovation.

Idealising Conditions of Atomistic Competition

The following are the three idealising conditions of atomistic competition:

Many Small Firms

There are many small firms that compete and operate independently in the market. In atomistic competition, each small firm has a low market share.

Independence

These small firms are independent in their decision-making processes, such as production, pricing, operational strategies, etc.

Competition

These firms have intense competition with each other to attract customers and gain a competitive advantage due to atomistic competition.

Limitations of Atomistic Competition

The following are some limitations of the proposition of atomistic competition:

Lack of Economies of Scale

Many small firms struggle to attain cost efficiencies due to their limited size. The lack of economies of scale is a major limitation of atomistic competition.

Lack of Market Influence

In atomistic competition, firms are price-takers. They have no market power to influence the price. The lack of market influence is a major limitation of atomistic competition.

Vulnerability to External Factors

External factors, such as changes in consumer preferences and interference in the supply chain, may cause economic fluctuations for many small firms.

Equilibrium in Atomistic Competition

The equilibrium in atomistic competition can be achieved by various factors, which are explained below:

Supply and Demand Balance

The market is said to be in equilibrium when the supply of products or services is equal to the demand for the same products or services in the market.

Price Determination

The market is said to be in equilibrium when firms set prices at a level where the quantity supplied is equal to the quantity demanded.

Entry and Exit of Firms

In atomistic competition, the market is set to be in equilibrium when firms can freely enter or exit the market and maintain a balance between supplies of products or services to meet the demand for products or services.

Profit Maximisation

Firms struggle to maximise their profits by adjusting their production levels and price strategies to maintain market equilibrium.

Long-run Adjustments

Atomistic competition leads to adjustments in production levels, pricing strategies to attract customers, and market conditions. This will maintain a long-run equilibrium state in the market.

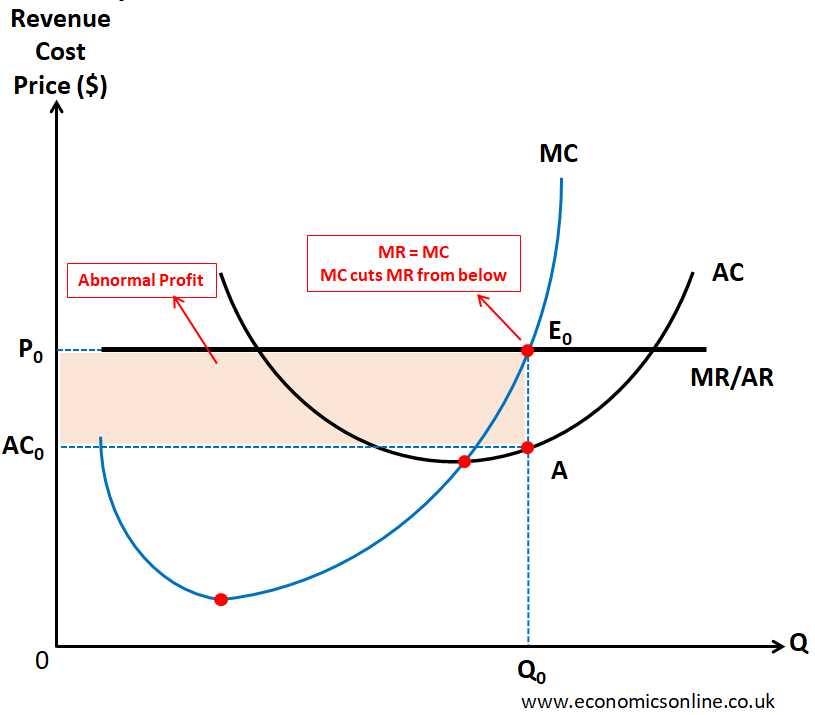

Short-Run Equilibrium

In the short run, firms can earn abnormal profits or subnormal profits (low profits) in atomistic competition. The case for abnormal profit is illustrated by the following graph.

In the above graph, we have taken the quantity (Q) on the horizontal axis (x-axis). Revenue, cost, and price are taken on the vertical axis (y-axis). The profit is maximum at the equilibrium point E0, where the marginal cost curve intersects the marginal revenue curve (MR=MC). The output Q0 is the profit-maximizing output, or equilibrium output. The abnormal profit is shown by the shaded area, which is the difference between total revenue and total cost. This short-run abnormal profit is taken away by new entrants by lowering the general market price level.

Long-Run Equilibrium

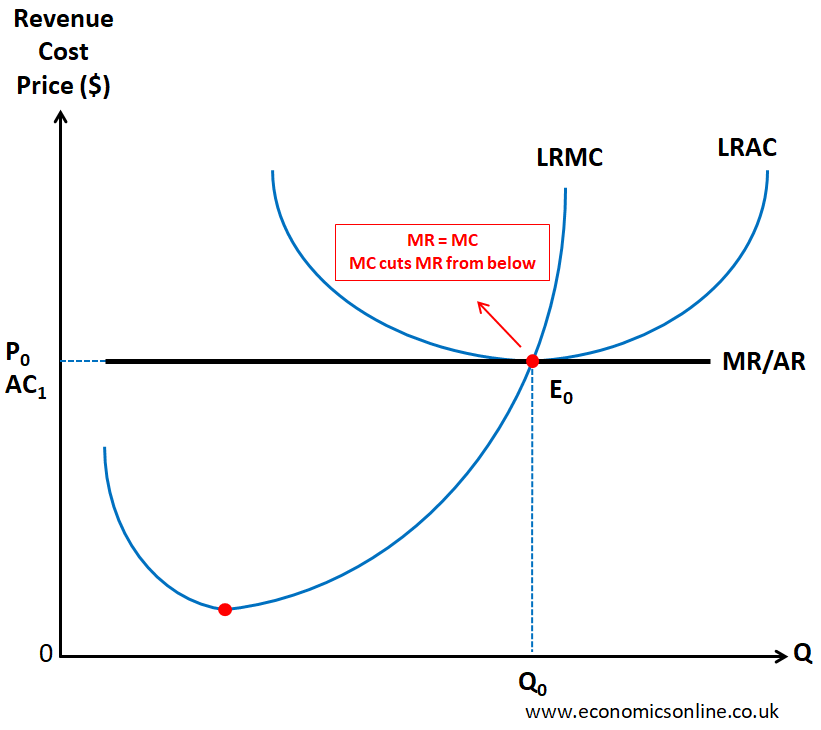

In the long run, firms can earn normal profits in atomistic competition. This is illustrated by the following graph.

In the above graph, at equilibrium point E0, price and LRAC are equal, which means that the firms earn a normal profit or zero profit in the long run.

Efficiency Analysis

In the long run, the conditions of productive and allocative efficiency are satisfied.

Productive efficiency exists in the long run because, at E0, the LRAC is minimum. Allocative efficiency exists because at E0, the price is equal to the marginal cost (P=MC).

This means that in atomistic competition, firms have productive and allocative efficiencies in the long run. This is not true for monopolistic competition, oligopoly or a monopolist which are economically inefficient. There is also an abnormal profit earned by firms in a monopoly or oligopoly equilibrium.

Criticisms of Atomistic Competition

Lack of Market Power

Critics claim that atomistic competition can limit the ability of firms to strive for market power and influence prices, which will reduce profits and provide less incentive for investment.

Ideal Conditions

Critics also argue that the conditions for atomistic competition are unrealistic and cannot be satisfied easily in real-life situations.

Externalities and Social Costs

Critics argue that atomistic competition ignores the impact of externalities and social costs associated with certain industries, like environmental impacts or worker exploitation.

Conclusion

In conclusion, atomistic competition is summarised as the presence of small firms operating and competing independently in the market. This definition is true according to many business books, along with the Penguin Dictionary of Economics, 3rd edition. The competition between these firms is at an intense level to attract more customers. However, critics argue that the assumptions of this model are unrealistic, making it a theoretical model to compare the behavior of markets in real-life scenarios.