An image of feet on a road with arrows showing three paths.

Prospect Theory

Definition

Prospect theory refers to a psychology theory that explains the behavior of individuals in making decisions based on perceived gains and losses. It is a theory in the field of behavioral economics that describes the decision-making of individuals when they are presented with options involving risk, probability, and uncertainty. This theory says that individuals value gains and losses differently and make decisions by comparing perceived gains and losses relative to a reference point.

History

The economists Daniel Kahneman and Amos Tversky first introduced a theory named “Prospect Theory” in 1970. They got the Nobel Prize for proposing this theory in 2002. Prospect theory came into existence through continuous experiments and observations conducted by Kahneman and Tversky, who concluded that individuals have different preferences in decision-making. These results differed from the expected utility theory, so they named this theory Prospect Theory. Nowadays, prospect theory is used in different fields, like human psychology, finance, and behavioral economics.

Understanding Prospect Theory

The prospect theory, also called loss-aversion theory, says that people give more value to a small, certain gain than a large, probable gain. For instance, we take the example of a person who will get $1000 for sure, but he also has the option of receiving $2000 along with the chance of a 50% loss. The prospect theory says that most people will prefer a certain gain of $1000 over a probable gain of $2000. They tend to avoid the risk and pain of loss related to $2000 and will prefer to get a certain $1000. This is called the certainty effect and says that small sure gains are valued more than large probable gains. This contributed to the risk aversion in case of sure gains and risk seeking in cases of sure losses.

Phases of Prospect Theory

Prospect theory consists of two main phases that help individuals in the decision-making process. These phases are explained below:

The Editing Phase

The process of creating alternative options and possibilities for deciding something is done in the editing phases. In this phase, individuals explore different potential outcomes, either in terms of gains or losses. They also find alternatives for the same situation.

The Evaluation Phase

The process of evaluating those outcomes and alternatives based on our preferences, values, and the outcomes associated with those options is done in the evaluation phase. The decisions are made in this phase.

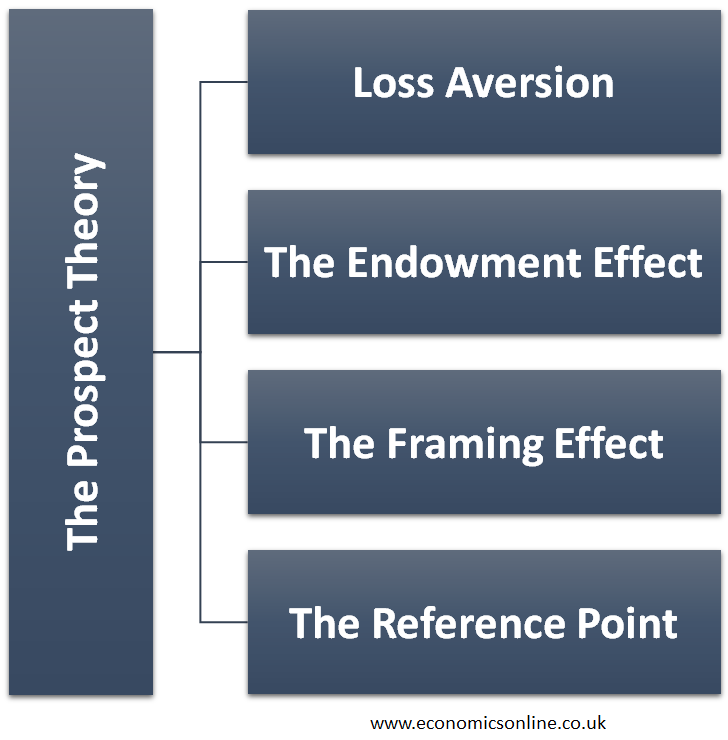

Characteristics of Prospect Theory

The prospect theory has some main characteristics, which are explained below:

Loss Aversion

Individuals prefer risk-aversion or loss-aversion in different situations. They value gains and losses differently. People feel the pain of losses more strongly than the excitement of gains. Loss aversion is a characteristic of prospect theory that changes people’s decision-making when facing potential losses.

The Endowment Effect

The propensity of people to value something they own more than something they don’t is known as the endowment effect. In this effect, people perceive that the value of the thing they own is more precious than the thing they don’t own. The ownership of something can change the perception of the individual about the value of that thing. For example, I had a ring for a long time, which I liked the most. Let’s say a person offers me a fair price to buy my ring from me. According to the endowment effect, this ring is more valuable to me than selling it for any amount of money. In this way, the endowment effect can change the behavior of individuals in their decision-making about something that is in their ownership.

The Framing Effect

An effect that tells how the framing of a decision can affect or influence the individual’s decision-making process, even when the probabilities or outcomes are the same, is known as the framing effect. The framing effect is known as the key concept in prospect theory.

For example, an ice cream product can have information on its packaging in two ways, 1% fat or 99% fat-free. Both contain the same information; however, people are more inclined towards 99% fat-free because of the framing effect.

The Reference Point

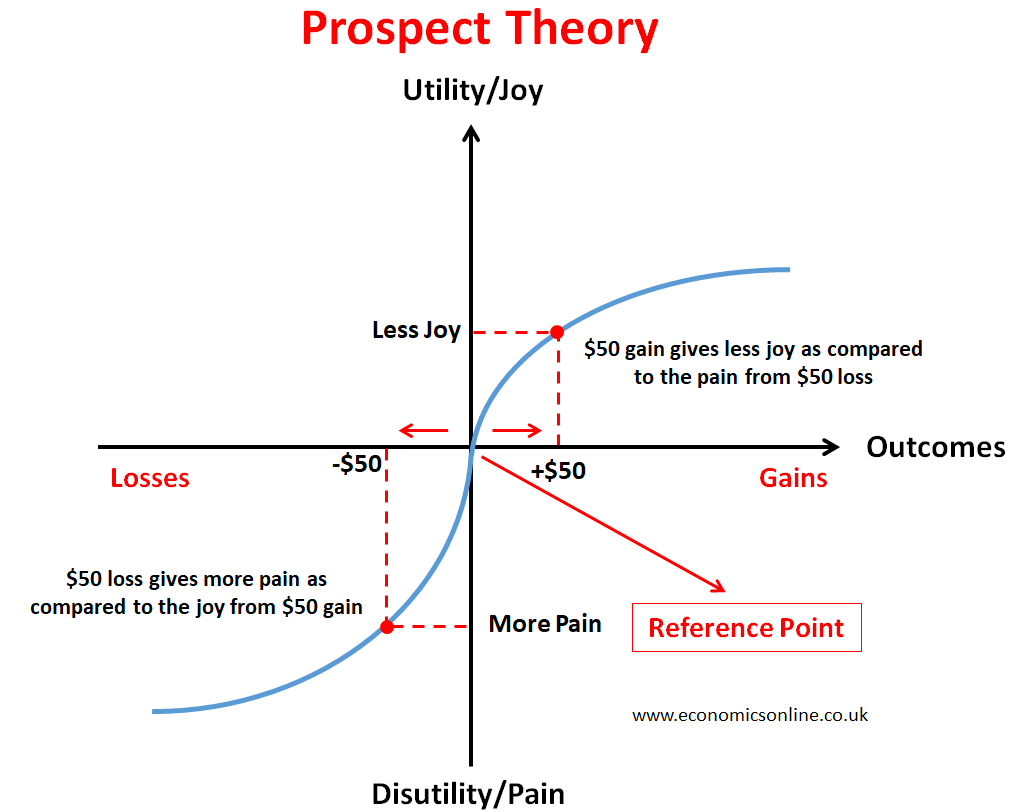

A reference point is a mental starting point. People evaluate outcomes or alternatives corresponding to a reference point. If our outcome is better than the reference point, it is a gain. If the outcome is worse than the reference point, it is a loss. Prospect theory explains how our brain processes gains and losses in a decision-making situation. People hate losses more than they love gains, and the joy of gains is not the same as the pain of losses. Let’s consider the following graph:.

In the above graph, there are two curves representing gains and losses. Both curves are in the opposite direction. The upper curve is the gains curve plotted in the first quadrant, showing an upward gaining trend. The downward curve is the loss curve plotted in the third quadrant, showing a downward losing trend. Origin is a reference point. The graphs illustrates that $50 gain gives less joy as compared to the pain of a $50 loss. In other words, a $50 loss gives more pain as compared to the joy of a $50 gain. This is because people treat perceived gains and losses differently. The pain from a loss is much higher than the joy of an equivalent gain. This is illustrated by the slopes of the curves in the above graph.

The graph also illustrates diminishing sensitivity towards gains and losses. The worth of gains or losses diminishes as their values increase. People become less sensitive when the potential gains or losses become larger. The pleasure of gains or the pain of losses diminishes as the value of gains or losses increases.

Advantages of Prospect Theory

The following are some potential advantages of the prospect theory, which are explained as follows:

Descriptive Accuracy

The prospect theory provides descriptive accuracy about how individuals make decisions under uncertainty (gains or losses). It also considers the cognitive biases or emotional factors that influence our decision-making in different situations.

Loss Aversion

Prospect theory uses the process of loss aversion to explain individuals’ behavior when facing potential losses. There is always uncertainty about gains or losses in the market. So, people become more loss-averse in their decision-making.

Reference Point

A reference point is always necessary for a better understanding of people’s preferences about different outcomes or alternatives. It explains how people evaluate outcomes corresponding to a specific frame of reference.

Practical Applications of Prospect Theory

The practical application of the prospect theory in different fields of study is also an advantage of the prospect theory. The prospect theory is applied in fields such as finance, behavioral economics, human psychology, software engineering, international relations, and political science.

Limitations of Prospect Theory

Prospect theory has some limitations, which are explained as follows:

Simplified Assumptions

Prospect theory only makes simplified assumptions about how people make decisions, like the value function and the weighting function. Prospect theory does not capture the complex nature of human psychology under different economic settings of uncertainty.

Limited Generalisability

Prospect theory was developed based on different experiments performed in limited laboratory settings by psychologists. It does not cover or apply to the decision-making of all individuals, irrespective of their cast, cultures, contexts, and regions. Limited generalisability is a major limitation of the prospect theory.

Lack of Dynamic Elements

Prospect theory only focuses on the decision-making of individuals at a specific point in time. It lacks dynamic elements like changes in individuals’ preferences or learning with the passage of time which can lead to inconsistent preferences.

Prospect Theory and Relocating

Prospect theory of decision making and relocating are related to each other. We know that prospect theory tells us about people’s behavior in decision-making under gains and losses. But relocating shows that people prefer potential gains like better job opportunities, a high return on minimum investments, and an enhanced lifestyle instead of selecting potential losses like moving to another country for better job opportunities, leaving behind their loved ones, difficulties in adjusting to different social circles, or starting a business from scratch, etc.

Conclusion

In conclusion, prospect theory is a behavioral theory in economic analysis through which we can understand an individual’s behavior in making decisions under certain conditions. Prospect theory is used in economics as an alternative model to expected utility theory. Prospect theory is an alternative theory of choice that is widely used in different fields in the real world as an analysis of decisions made by individuals.