An image of a factory emitting smoke.

Regulatory Capture

Introduction

Let’s start with the basics.

Business firms may often act against the public interest. For example, firms may charge higher prices, create entry barriers, and exploit customers and employees while running business operations. Governments make laws in a country to regulate these business firms in order to protect the public interest. These laws are enforced by regulatory agencies. These regulatory agencies may fall short of their expected performance due to regulatory capture.

What is Regulatory Capture?

Regulatory capture occurs when the regulatory agencies that are intended to control and regulate business firms end up being controlled by them.

In simple words, regulatory capture is an economic theory in which business firms or the industry capture their regulators and use their regulatory power for their own commercial benefit, which can be against the public interest. This situation of 'regulatory capture’ arises when these regulatory agencies give priority or favour to the interests of industry over the interests of the public. And the result is a loss of effectiveness and respect for those regulatory agencies.

Regulatory capture is a form of government failure and is called ‘the economic theory of regulation’, 'the theory of economic regulation, 'agency capture', or simply ‘capture theory'. The compromised regulatory agencies are called captured agencies.

The opposite of regulatory capture is ‘the public interest theory', which says that rules and regulations can make powerful firms, such as monopolies with high degrees of market power, behave in the interest of the public.

Examples of Regulatory Capture

The following are some examples of the sectors in which regulatory capture exits:

The Finance Sector

After the financial crisis of 2008, there was financial regulatory capture in the banking sector. Observers explain that the regulators became so comfortable with the banks they were regulating that the result was an incomplete supervision of rules and regulations.

The Pharmaceutical Industry

The pharmaceutical industry is also accused of benefiting regulatory agencies to gain favourable outcomes. These favourable outcomes include harmful drug approvals, and unjust pricing strategies.

The Energy Sector

The energy sector is another example which is believed to be influencing and benefiting regulatory agencies who were involved in making flexible environmental regulations, giving favours to certain companies, and promoting limited competition.

The Railroads Sector

Interstate Commerce Commission (ICC) is a regulatory body in the US for controlling the railroads under the Interstate Commerce Act of 1887 and is considered as a classic example of regulatory capture. ICC allowed the railroad industry to operate as a cartel and did nothing to enhance competition and control prices.

Historical Context

The concept of regulatory capture was presented in 1971 by the late economist George Stigler, who was a Nobel laureate at the University of Chicago. He was famous for his work on regulatory capture and said that business firms and different interest groups can, not only, influence the regulatory authorities, but they can also influence the government in shaping the laws and regulations in their favour. This results in regulatory capture, which is against the public interest.

Stigler also said the regulated industries take great interest and put more effort into influencing the regulators than the general public. For example, pollution standards are made by the government in the public interest, yet citizens are less motivated to collectively protect their health against the creation of pollution, while the industry that is creating the pollution tries to influence the regulators more than the general public.

Some other economists, such as Sam Peltzman and Daniel Carpenter, considered political factors and corruption as the main reasons for regulatory capture.

Types of Regulatory Capture

The following are some types of regulatory capture:

Capture through Undue Influence

This occurs when business firms impose pressure on regulatory agencies through lobbying or driving contributions.

Capture through Revolving Doors

This occurs when individuals or businesses move between industries and regulatory positions. This will result in a conflict of interest.

Cognitive Capture

This occurs when agencies prefer to adopt the mindset of industry. This will result in reducing their impartiality towards the industry they are regulating.

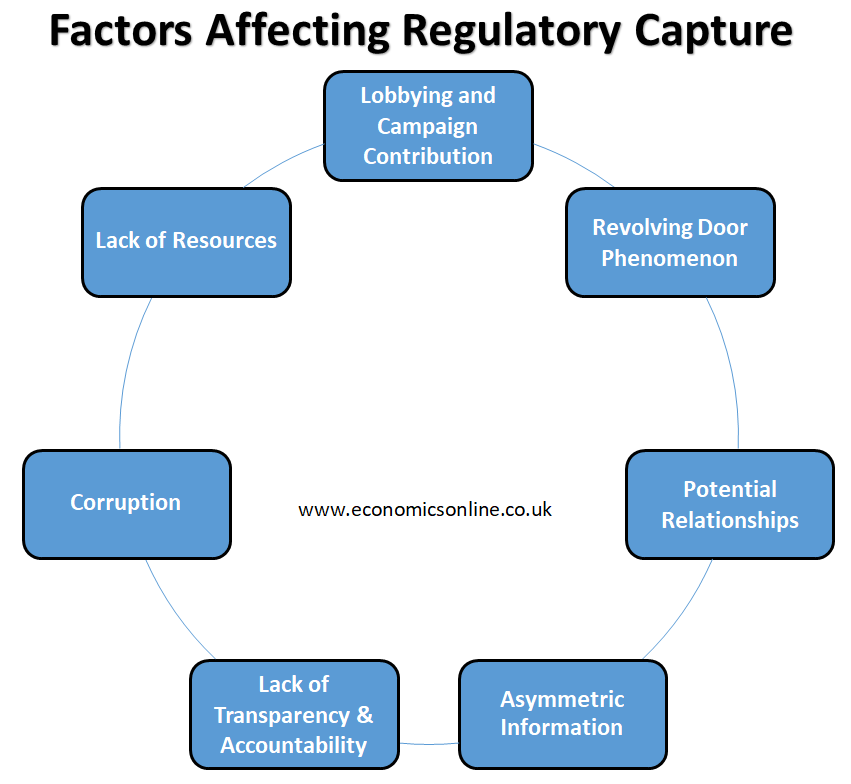

Factors Affecting Regulatory Capture

The following are some factors affecting regulatory capture:

Lobbying and Campaign Contributions

Those industries that have surplus resources can influence regulatory agencies through lobbying. These industries also invest financially in political campaigns in order to influence politicians so that they can use their political influence in the future to make laws in the commercial and business interests of the industries.

Revolving Door Phenomenon

In most cases, the regulators come from the industry due to the need to have technical, specialised, and complex knowledge that is required to regulate the industry. Moreover, after the completion of their service as regulators, they may also go back to the industry to work. This is known as the revolving door phenomenon, in which regulators move between regulatory positions and industry. Industries may promise the regulators future job positions against the favourable regulations, which leads to regulatory capture. Thus, the revolving door phenomenon creates a greater conflict of interest and affects regulatory decisions.

Potential Relationships

Those agencies that regulate industries develop potential relationships with them. This procedure leads to biased behaviour towards industry interests.

Asymmetric Information

There may be the presence of asymmetric information between regulators and industry. Regulatory agencies may rely on the information coming from the industry, such as pricing, investment, and costs. This lack of information will make the regulatory agencies biased in favour of the industry, leading to regulatory capture.

Lack of Transparency and Accountability

Regulatory agencies are also affected by a lack of transparency and accountability between industry and regulatory positions, which creates an environment of regulatory capture.

Corruption

Firms may bribe the regulatory agencies, leading to decisions in their favour and hence creating an incentive for regulatory capture.

Lack of Resources

In some countries, the regulatory agencies may not have so many resources. This lack of resources means that they will be less influential on the firms in the industry, leading to regulatory capture.

Development of Regulatory Capture

The following factors cause the development of regulatory capture:

Industry Influence

There is always an industry influence over the regulators or regulatory positions. Some examples of industry influence may be lobbying or campaigning financial contributions, revolving doors between industry and regulators, etc.

Legal and Regulatory Framework

The legal and regulatory framework can also influence the development of regulatory capture. It suggests that week-long regulations, loopholes, and insufficient enforcement will lead to a regulatory capture situation.

Political Dynamics

Political factors also influence the development of regulatory capture by promoting agendas that are favorable to them, influencing other interest groups, and controlling revolving door movement between industry and regulatory positions.

Drawbacks of Regulatory Capture

Undermines Public Interest

A major drawback of the regulatory capture is that it undermines the public interest, which is the primary purpose of regulatory agencies. They are bound to protect the public interest, but regulatory agencies become inclined towards the commercial interests of the industry.

Lack of Competition and Innovation

Regulatory capture can lead to less competition and hence, a reduced innovation in an industry. When regulators fall prey of the regulatory capture, they create entry barriers for new entrants, which results in reduced competition and innovation.

Erosion of Trust and Legitimacy

Another drawback of regulatory capture is that it diminishes the trust of the general public in regulatory agencies. This reduces the effectiveness and credibility of regulations as well as the regulatory authorities.

Conclusion

In conclusion, regulatory capture happens when regulatory agencies that are intended to control industries end up being controlled by them. These captured regulatory agencies, prioritise their personal interests over the public interest. This agency capture leads to reduced effectiveness and honour for those regulatory industries.