Inflation

Price stability

Price stability exists when average prices are constant over time, or when they are rising at a very low and predictable rate. Price inflation occurs when average prices are rising above this low and predictable rate, and price deflation occurs when average prices are falling. In both cases, the effects are potentially extremely harmful to a country’s economic performance and to the welfare of its citizens. For this reason, price stability is commonly regarded as the single most important macro-economic objective.

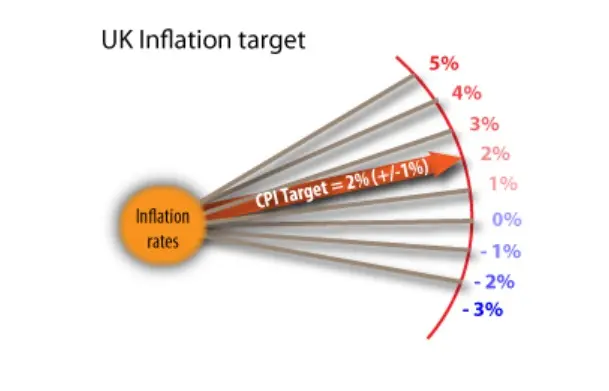

For the UK, price stability means ensuring that the price level increases gradually, by an average of no more than 2% per year. The official target is 2%, though there is a safety margin of +/- 1%. The Bank of England is forced to intervene if inflation falls outside of these limits.

The costs of inflation

Price inflation is regarded as a serious economic problem because it causes a number of significant costs to an economy, including the following:

It erodes the value of money and assets

A rise in the price level means, ceteris paribus, that money can buy fewer goods. If assets are stored in a monetary form, inflation means that asset values fall. This explains why, during inflationary periods, individuals often choose to put their wealth into physical assets, like property, rather than keep it in a monetary form in a bank account.

It redistributes income between groups

Inflation can create a random redistribution of income given that inflation does not have an equal impact on individuals and groups. For example, individuals who can protect their earnings or their assets from inflation will increase their income relative to those who cannot. Similarly, borrowers do better at times of rising prices because the real value of their repayments are reduced over time. Lenders need to charge a higher interest rate to compensate for the falling value of the repayments to them, and for the loss of liquidity suffered as the value of repayments fall.

It has a negative effective on the balance of payments.

The balance of payments may deteriorate because domestic inflation stimulates import spending, given that imports appear relatively cheaper, and dampens export sales, as exports appear more expensive abroad.

It causes uncertainty and falling investment.

Firms respond unfavourably to inflation for several reasons. Firstly, inflation dampens consumer confidence and spending and reduces aggregate demand. Secondly, inflation increases costs and reduces competitiveness, which can lead to falling demand. Finally, firms may anticipate that interest rates will have to rise to deal with inflation, and this undermines business confidence. Falling confidence is likely to force firms to postpone capital investment.

It creates shoe leather and menu costs.

Shoe leather costs can be incurred during times of inflation when households and firms make an additional effort to seek out the best deals. These costs are also called search costs, reflecting the increased time spent attempting to find the lowest available prices. The Internet has made information freely and quickly available, and considerably reduced the problem of search costs. Menu costs are costs associated with having to regularly re-price products to bring them in line with general inflation.

It can create unemployment

Inflation can lead to a loss of jobs through its effect on costs. As costs rise firms may substitute labour with other factors, such as new technology.

Inflation distorts the price mechanism

When average prices rise, the price mechanism cannot effectively fulfil its role as a resource allocating mechanism. Markets work best when prices rise and fall, providing information about relative values, but if average prices rise continuously, with increases outweighing decreases, resource allocation is distorted. The distortionary effect is called inflation noise which can occur when consumers and producers misperceive relative prices and costs. The effect is most significant when the rate of inflation is excessive. When inflation rates approach zero, inflation noise is minimised.

It creates money illusion

Money illusion, also called inflation illusion, is a phenomenon that may arise when rising prices lead people to make irrational decisions. For example, if wages rise, workers may decide to work longer hours, but if inflation erodes the value of the wage rise they have been fooled into working longer.

The causes of inflation

Demand pull inflation

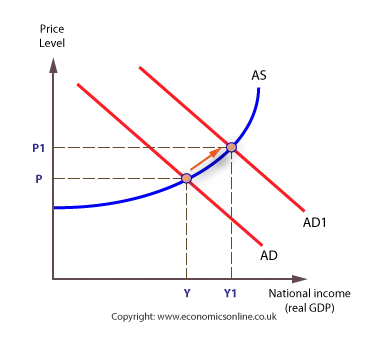

Demand pull inflation usually occurs when there is an increase in aggregate monetary demand caused by an increase in one or more of the components of aggregate demand (AD), but where aggregate supply (AS) is slow to adjust.

The commonest causes are demand shocks, such as:

- Earnings rising above factor productivity.

- Cheaper credit, following a reduction in interest rates.

- Excessive public sector borrowing.

- A housing boom creating equity withdrawal and a positive wealth effect.

- Changes in the savings ratio.

The savings ratio

The savings ratio indicates the percentage of disposable GDP (national income) saved, rather than spent. Sudden changes in the savings ratio are an indicator of future changes in spending and AD, and can be a prelude to inflation or deflation.

A rise in the savings ratio indicates a decline in consumer confidence, whereas a fall in the savings ratio indicates a rise in confidence and spending, which can trigger an increase in the price level.

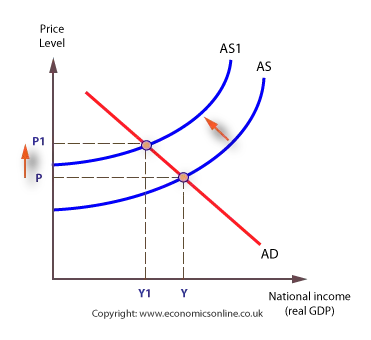

Cost-push inflation

Cost-push inflation occurs when an economy experiences a negative cost shock. Diagrammatically, the aggregate supply curve shifts upward and to the left, causing the price level to rise, and aggregate demand to contract.

The commonest causes are:

- Oil price shocks, caused by wars or decisions by OPEC to restrict output.

- Increases in farm prices following a series of poor harvests.

- Rapidly rising wage costs.

- A fall in the exchange rate, which increases the price of all imports.

- Imported cost push inflation

Exchange rates and cost push inflation

A fall in the exchange rate will mean that more Sterling is required to purchase a given quantity of imports; in other words, the price of imports will rise. After a time-lag, this is likely to feed into retail prices. For example, a motor vehicle imported from Germany for €50,000 would cost £25,000 at an exchange rate of £1 – €2. If Sterling falls in value, to £1 = €1.90, then the Sterling price would rise to £26,316.

Given that approximately 35% of the CPI basket of consumer goods and services are imports, the effect of a fall in the exchange rate is to raise the CPI. In addition, imported raw materials are also more expensive so costs of production will rise for those firms that source their inputs from abroad. Therefore, while a low exchange rate may be beneficial for exports, it has as a potentially inflationary effect on costs and prices.