Monetary policy

Monetary policy

Modern monetary policy has been shaped by the different schools of economic theory that emerged over the past 100 years. Monetary policy involves altering interest rates or the supply of money in the economy. Many economists consider that the manipulation of exchange rates is a form of monetary policy, given that exchange rates are affected by changes in interest rates.

The Monetary Policy Committee.

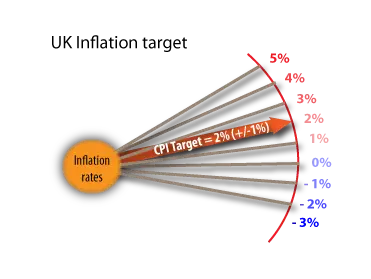

Monetary policy in the UK is the responsibility of the Bank of England’s Monetary Policy Committee (MPC). The MPC has nine members, four of whom are appointed by the Chancellor. The MPC has one goal, to hit its inflation target of 2%.

The inflation target is symmetrical, meaning that a rate of inflation below the target is considered as problematic as a rate of inflation above the target.

Changing official base interest rates is the most visible tool used by the MPC, whose team of economists meet each month to discuss current and future monetary policy options.

The Repo rate

Repo is short for repurchase agreement, and the repo rate is the rate at which the Bank of England buys back securities it has previously sold in the money markets. The money markets include banks, building societies and specialist securities dealers. Altering the repo rate affects short-term liquidity in the monetary system, which quickly has an effect on all other rates.

Other rates of interest in the economy, such as mortgage rates, will adjust in line with changes to the official rate.

Why the inflation target is not zero

According to the Bank of England, there are two reasons why the inflation target is set above zero:

Real interest rates can become negative

A positive rate allows real interest rates to become negative at times of weak demand. Real interest rates are nominal rates, less the inflation rate. Nominal interest rates can never be negative, as banks will always charge for lending. If inflation is 0%, nominal and real interest rates must be the same, hence, like nominal rates, real rates cannot be negative. It may be helpful for the Bank of England to make real interest rate negative at times of a deep recession, so having a positive inflation target allows this to happen.

Safety margin

Inflation cannot be measured with perfect precision, and it is safer to have a positive inflation target as this provides a margin of safety.

How does interest-rate policy work?

Interest rates are set so that the inflation target can be met in the future. In fact, it takes up to two years for a rate change to affect inflation, so the Bank of England must try to predict the state of the economy two years in advance!

Interest rates transmit their way to aggregate demand in the following ways:

- Changes in the official rate affect all markets rates, such as overdraft, mortgage, and credit card rates. Consumer demand is affected in a number of ways including affecting savings, which indirectly affect spending, and spending itself. For households or firms with existing debt, such as a mortgage, a change in rates affect repayments, and hence individuals have more (or less) cash after servicing their debts. Changes in rates affect the cash-flow firms and households.

- In the case of new debt to fund spending, borrowing is also encouraged, or discouraged, following interest rate changes. Interest rates also affect consumer and business confidence, and spending.

- Asset prices are also affected by interest rates. For example, a fall in rates will tend to make firms more profitable and they may pay higher dividends to shareholders, which can trigger an increase in spending. Similarly, a rate fall makes property more attractive, increasing the value of property and household wealth.

- Changes in the official rate also affect general expectations and confidence, which alters consumer and corporate behaviour. For example, a rise in rates indicates a tighter monetary stance and has a negative impact on consumer and corporate sentiment, leading to the postponement of discretionary spending.

- Finally, interest rates may affect the exchange rate, which can also influence export demand. For example, a rise in interest rates may raise the exchange rate, pushing up export prices and reducing overseas demand. Changes in the exchange rate also affect the price of imports, which also affect the inflation rate, through its effect on imported costs. For example, a fall in the exchange rate increases import prices and creates cost-push inflation. In this case, a rise in interest rates will push up the exchange rate and ease any cost-push inflationary pressures.

Summary of the transmission mechanism of monetary policy

Recent UK interest rates

In recent years, interest rates have been frequently adjusted to reflect changing macro-economic conditions.

1999 – 2000

Rates were relatively high at 6% to restrict demand.

2000 – 2003

Rates fell quickly to their lowest level for 25 years, helping to stimulate demand.

2003 – 2007

Rates were pushed up into a neutral zone at around 5%, but by 2007 they were edging up towards the restrictive zone.

2008 – 2016

In response to the deepening recession, base rates were slashed to levels unprecedented in modern times, and continued to be kept at 0.5%.

2016 (August) – 2017

Base rate was reduced to 0.25% in August 2016 as part of the monetary stimulus package in the wake of post-Brexit uncertainly.

The effect of a reduction in interest rates

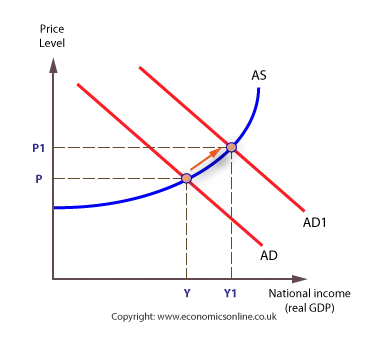

If we assume the economy has an output gap then a reduction in interest rates by the Bank of England will, ceteris paribus, increase aggregate demand.

A reduction in interest rates will stimulate aggregate demand. This creates a positive effect on economic growth, but at the potential cost of inflationary pressure.

The increase in aggregate demand occurs for seveal reasons, including:

- Falling savings

- More new borrowing

- Lower costs of servicing existing debts

- Rising confidence

- Greater export demand

- Rising asset values

- Rising business investment

Pushing rates too low is inflationary

Assuming the economy is at or very near to full employment, a reduction in interest rates by the Bank of England may over-stimulate aggregate demand beyond the capacity of the economy to respond in the short run.

In this case, the effect is mainly on the price level rather than output and jobs.

Therefore, interest rates can be used to help stabilise the macro-economy, and help create stable growth and stable prices. Policy induced shocks need to be avoided, so changes in interest rates tend to be small – usually 0.25% at a time. However, the depth of the recession in 2008, and its speed of onset, forced the Bank of England to reduce rates more quickly than in ‘normal’ economic conditions.

The advantages of interest rate policy

Powerful and direct

Evidence shows that interest rates have a direct and powerful effect on household spending, the evidence suggesting that UK consumers are interest rate elastic.

Independent

The Bank of England’s Monetary Policy Committee is independent of government and can make decisions free from political interference.

Easy to implement

Interest rates can be changed on a monthly basis, which contrasts with changes in discretionary fiscal policy, which cannot be made at such regular intervals.

Quick effect on confidence

While the full effects of interest changes may not be experienced for up to two years, there is often an immediate effect on confidence. The time lag affecting output is estimated to be around one year, and on the price level, around two years.

The disadvantages of interest rate policy

There are still time lags to see the full effects, and there are some other negative effects, including:

Investment can suffer

Investment spending is inversely related to interest rates, and higher rates increase the opportunity cost of investment. Long term, economic growth will suffer if high interest rates persist.

The housing market can suffer

The housing market is very sensitive to changes in interest rates, so individual changes tend to be small, partly so as not to have an excessive effect on housing.

The dual economy

There is also the problem of the dual economy. Should rates be set high to control the inflating service sector, or low rates for the depressed manufacturing and export sector? Unlike previous recessions, in the current recession all sectors of the economy have been suffering in a similar way, so rates have been set at historically low levels without any fear of inflation.

The liquidity trap

Reducing interest rates in a recession may be ineffective because of the so-called liquidity trap. This theory is associated with Keynes, and his analysis of the Great Depression. In a recession interest rates will fall towards zero, as in the UK during 2009, following the financial crisis. In this case, banks and other financial intermediaries prefer to hold cash rather than make loans. Therefore, while borrowing may be stimulated, liquidity is not released through the system – it is ‘trapped’ and unavailable. This acts to deepen a recession and weaken the real economy. In this case, authorities may have to by-pass the banks and pump money directly into the public’s hands. Allocating spending vouchers is one way this could be achieved. This is often referred to a ‘helicopter’ or ‘parachute’ money. More formally, the process is called quantitative easing.

Quantitative easing is a process whereby the Bank of England, under instructions from the Treasury, buys up existing bonds in order to add money directly into the financial system. The process of doing this is called open market operations, and it is regarded as a last resort when low interest rates fail to work.

When interest rates approach zero, but an economy remains in recession, further interest cuts are impossible. This situation faced central bankers in early 2009. Interest rate policy in these circumstances becomes impotent, as nominal interest rates cannot fall below zero. This, together with cash hoarding by individuals, corporations and commercial banks, resulted in liquidity being trapped in the banking system. In this situation quantitative easing may be necessary to boost liquidity and stimulate lending.

Quantitative easing involves the following steps:

- The Bank of England purchases existing corporate and government bonds held by banks and corporations with electronic money, rather than notes and coins.

- These funds are credited to the bank and become a reserve asset.

- This means that, via the credit multiplier, banks can lend out to corporate and individual customers.

- The hope is that lending starts to flow, which will lead to an increase in household and corporate spending, and aggregate demand. This, it is argued, will help pull an economy out of recession.

See: Bank of England’s forward guidance policy

See also : Monetary policy in Europe

See also: Monetary theory