Market Equilibrium

Equilibrium

Consumers and producers react differently to price changes. Higher prices tend to reduce demand while encouraging supply, and lower prices increase demand while discouraging supply.

Economic theory suggests that, in a free market there will be a single price which brings demand and supply into balance, called equilibrium price. Both parties require the scarce resource that the other has and hence there is a considerable incentive to engage in an exchange.

Price discovery

In its simplest form, the constant interaction of buyers and sellers enables a price to emerge over time. It is often difficult to appreciate this process because the retail prices of most manufactured goods are set by the seller. The buyer either accepts the price. or does not make the purchase. While an individual consumer in a shopping mall might haggle over the price, this is unlikely to work, and they will believe they have no influence over price. However, if all potential buyers haggled, and none accepted the set price, then the seller would be quick to reduce price. In this way, collectively, buyers have influence over market price. Eventually a price is found which enables an exchange to take place. A rational seller would take this a step further, and gather as much market information as possible in an attempt to set a price which achieves a given number of sales at the outset. For markets to work, an effective flow of information between buyer and seller is essential.

Market clearing

Equilibrium price is also called market clearing price because at this price the exact quantity that producers take to market will be bought by consumers, and there will be nothing ‘left over’. This is efficient because there is neither an excess of supply and wasted output, nor a shortage – the market clears efficiently. This is a central feature of the price mechanism, and one of its significant benefits.

Example

The weekly demand and supply schedule for a brand of soft drink at various prices (between 0p and 80p) is shown below.

| PRICE (p) | QUANTITY SUPPLIED | QUANTITY DEMANDED |

| 80 | 2000 | 0 |

| 70 | 1800 | 200 |

| 60 | 1600 | 400 |

| 50 | 1400 | 600 |

| 40 | 1200 | 800 |

| 30 | 1000 | 1000 |

| 20 | 800 | 1200 |

| 10 | 600 | 1400 |

| 0 | 400 | 1600 |

Equilibrium

As can be seen, this market will be in equilibrium at a price of 30p per soft drink. At this price the demand for drinks by students equals the supply, and the market will clear. 1000 drinks will be offered for sale at 30p and 1000 will be bought – there will be no excess demand or supply at 30p.

How is equilibrium established?

At a price higher than equilibrium, demand will be less than 1000, but supply will be more than 1000 and there will be an excess of supply in the short run.

Graphically, we say that demand contracts inwards along the curve and supply extends outwards along the curve. Both of these changes are called movements along the demand or supply curve in response to a price change.

Demand contracts because at the higher price, the income effect and substitution effect combine to discourage demand, and demand extends at lower prices because the income and substitution effect combine to encourage demand.

In terms of supply, higher prices encourage supply, given the supplier’s expectation of higher revenue and profits, and hence higher prices reduce the opportunity cost of supplying more. Lower prices discourage supply because of the increased opportunity cost of supplying more. The opportunity cost of supply relates to the possible alternative of the factors of production. In the case of a college canteen which supplies cola, other drinks or other products become more or less attractive to supply whenever the price of cola changes. Changes in demand and supply in response to changes in price are referred to as the signalling and incentive effects of price changes.

If the market is working effectively, with information passing quickly between buyer and seller (in this case, between students and a college canteen), the market will quickly readjust, and the excess demand and supply will be eliminated.

In the case of excess supply, sellers will be left holding excess stocks, and price will adjust downwards and supply will be reduced. In the case of excess demand, sellers will quickly run down their stocks, which will trigger a rise in price and increased supply. The more efficiently the market works, the quicker it will readjust to create a stable equilibrium price.

Changes in equilibrium

Graphically, changes in the underlying factors that affect demand and supply will cause shifts in the position of the demand or supply curve at every price.

Whenever this happens, the original equilibrium price will no longer equate demand with supply, and price will adjust to bring about a return to equilibrium.

Changes in equilibrium

For example, if there is a particularly hot summer, students may prefer to drink more soft drinks at all prices, as indicated in the new demand schedule, QD1 .

| PRICE (p) | QUANTITY SUPPLIED | QUANTITY DEMANDED | NEW Q DEMANDED |

| 80 | 2000 | 0 | 400 |

| 70 | 1800 | 200 | 600 |

| 60 | 1600 | 400 | 800 |

| 50 | 1400 | 600 | 1000 |

| 40 | 1200 | 800 | 1200 |

| 30 | 1000 | 1000 | 1400 |

| 20 | 800 | 1200 | 1600 |

| 10 | 600 | 1400 | 1800 |

| 0 | 400 | 1600 | 2000 |

At the higher level of demand, keeping the price at 30p would lead to an excess of demand over supply, with demand at 1400 and supply at 1000, with an excess of 400. This will act as an incentive for the seller to raise price, to 40p. Equilibrium will now be re-established at the higher price.

There are four basic causes of a price change:

An increase in demand shifts the demand curve to the right, and raises price and output.

Demand shifts to the right

Demand shifts to the left

A decrease in demand shifts the demand curve to the left and reduces price and output.

Supply shifts to the right

An increase in supply shifts the supply curve to the right, which reduces price and increases output.

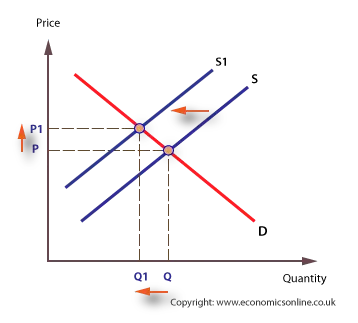

Supply shifts to the left

A decrease in supply shifts the supply curve to the left, which raises price but reduces output.

The entry and exit of firms

In a competitive market, firms may enter or leave with little difficulty. Firms may be attracted into a market for a number of reasons, but particularly because of the expectation of profit. This causes the market supply curve to shift to the right. Rising prices may provide a sufficient incentive and provide a signal to potential entrants to enter the market.

There is a chain reaction, starting with an increase in demand, from D to D1. This raises price to P1, which provides the incentive for existing firms to supply more, from Q to Q1. The higher price also provides the incentive for new firms to enter, and as they do the supply curve shifts from S to S1.

A market where prices are rising provides the best opportunity for the entrepreneur. Conversely, lower prices encourage firms to leave the market.