The minimum and living wage

The minimum wage

A minimum wage sets the minimum hourly wage rate that is allowed in law. In the UK we can identify three types of minimum wage:

- The National Minimum Wage, which has been law in the UK since 1999, when the adult hourly rate was set at £3.60. The rate is currently (2019) set at £7.70, and aplies to workers from 21 to 24 years old. The rate tapers down to £6.15 for those 18 to 20 year olds, to £4.35 for those under 18.

- The National Living Wage, which is also a statutory requirement, and applies to employees 25 years or older. This is set at 55% of median earnings, and is currently £8.21 per hour.

- The Real Living Wage, which is based on an independent calculation of what people need to live, but is a voluntary wage rate, currently set at £9.00 in the UK and £10.55 in London, and applies to workers over 18. It is based on an analysis of the specific goods and services that employees and their families need to meet a minimum standard of living. The basket is regularly updated to ensure it is representative of typical expenditure. By 2019 over 5000 UK businesses had implemented this voluntary rate.

Summary

The aims of setting minimum wage levels

The long-term aim of a minimum wage is to remove the problem of poverty pay, which exists when the earnings from paid work fail to prevent individuals from living in poverty.

Low pay can result from a number of labour market failures, including:

- Lack of access to the labour market, as a result of barriers to entry including discrimination.

- Lack of bargaining power by individuals in uncompetitive labour markets, such as where there is one employer, a monopsonist. In this case the employer can adopt a ‘take it or leave it’ attitude.

- Lack of skills leading to very elastic demand for labour, so that a ‘higher’ wage would reduce demand, hence workers have to accept this wage, or remain unemployed.

- Inward migration from low-pay countries, where workers are prepared to accept extremely low wages, for often short periods of time, which this drives down the wages for indigenous employees.

By 2015, the adult rate had risen to £6.70p per hour and the rate for 18-20 year olds to £5.30p. In 2004, following a recommendation by the Low Pay Commission, a minimum wage of £3.00 per hour was introduced for under 18 year olds, and by 2015 this rate had risen to £3.87.

In 2016 a new ‘living wage‘ was set for those over 25, at £7.20 per hour, rising to £7.50 per hour in April 2017. Although this is the ‘legal’ level of the living wage, there are higher voluntary rates of £8.45 for the UK, and £9.75 for London.

The National Minimum Wage and Living Wage, 1998 – 2019

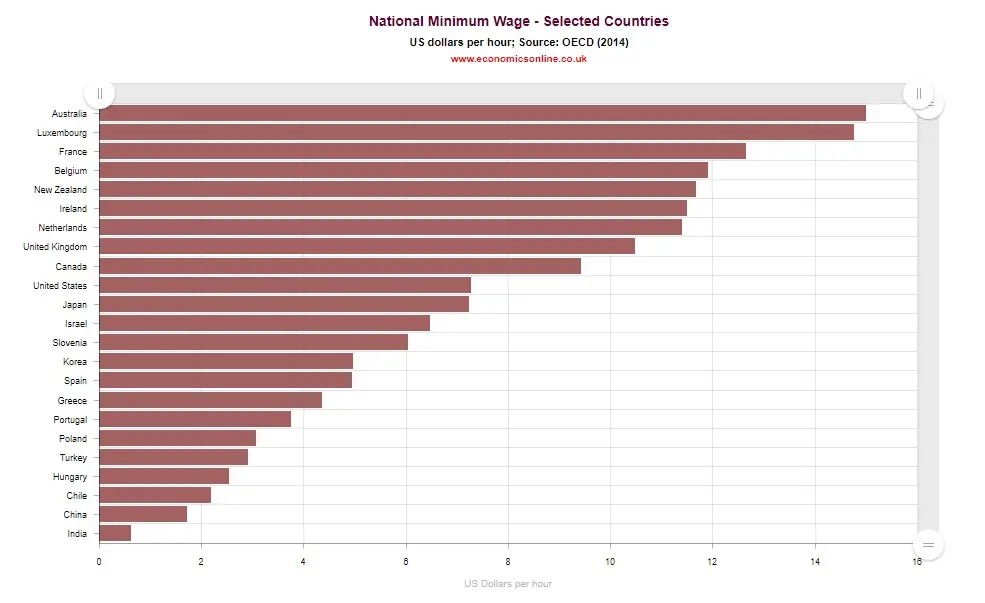

The National Minimum Wage for selected countries (2014)

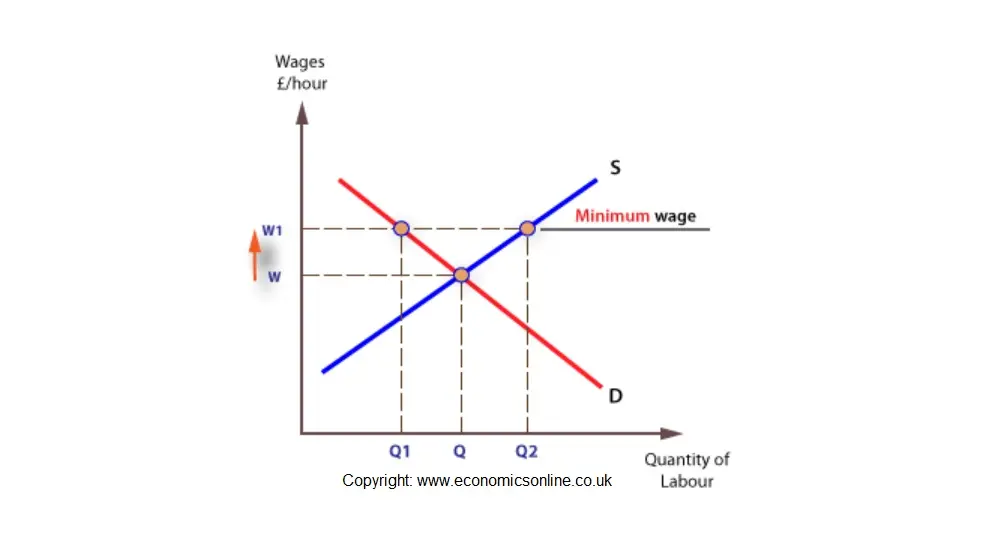

Effects of a National Minimum Wage

If the NMW is higher than market clearing wage for a particular job, then demand will contract and supply extend. The contraction of demand is the result of a combined income and substitution effect in response to the higher wage rate. In other words, at a higher wage rate the firm’s income, its profits, will, ceteris paribus, fall and the firm will reduce demand, hence the income effect. The substitution effect implies that at a high wage rate firms will look to substitute workers when they can, for other workers or with capital. One reason the minimum wage is fixed for all workers is to reduce the substitution effect, and make demand for labour more inelastic.

On the supply side the higher wage will encourage existing employees to supply more labour, or it will encourage workers out of voluntary unemployment. The effect can be demonstrated in the following diagram.

For example, a minimum wage of £5.00 would create a contraction in demand to Q1, but supply would extent to Q2 as more low skilled workers are encouraged to look for work, creating unemployment of Q1 – Q2.

Evaluation

The advantages of a national minimum wage:

- Greater equity will be achieved, and the distribution of income between the high paid and the low pay may be narrowed.

- Poverty may be reduced as the low paid gain more income and the unemployed may be encouraged to join the labour market. In this case the higher wage is an incentive for individuals to supply their labour.

- Less worker exploitation by labour market monopsonists, who are single employers is able to pay below the market equilibrium.

The disadvantages of a national minimum wage:

- A high minimum wage can cause price inflation as firms pass on the higher wages in higher prices.

- Falling employment, as demand contracts, and rising unemployment as supply extends.

- The competitiveness of UK goods abroad can suffer compared with low wage economies, such as China and India.

- Inward investment may be deterred, as foreign investors will look to avoid high wage economies.

- The labour market may become inflexible in response to changes in the rest of the economy.

- Workers and employers may be driven into the ‘unofficial’ labour market.

The full impact depends upon:

- The level of the minimum wage, and;

- The elasticity of demand for and supply of labour