Monopoly

A pure monopoly is a single supplier in a market. For the purposes of regulation, monopoly power exists when a single firm controls 25% or more of a particular market.

Formation of monopolies

Monopolies can form for a variety of reasons, including the following:

- If a firm has exclusive ownership of a scarce resource, such as Microsoft owning the Windows operating system brand, it has monopoly power over this resource and is the only firm that can exploit it.

- Governments may grant a firm monopoly status, such as with the Post Office, which was given monopoly status by Oliver Cromwell in 1654. The Royal Mail Group finally lost its monopoly status in 2006, when the market was opened up to competition.

- Producers may have patents over designs, or copyright over ideas, characters, images, sounds or names, giving them exclusive rights to sell a good or service, such as a song writer having a monopoly over their own material.

- A monopoly could be created following the merger of two or more firms. Given that this will reduce competition, such mergers are subject to close regulation and may be prevented if the two firms gain a combined market share of 25% or more.

Key characteristics

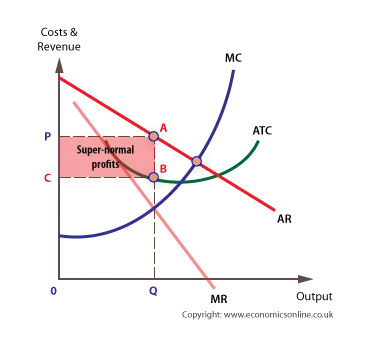

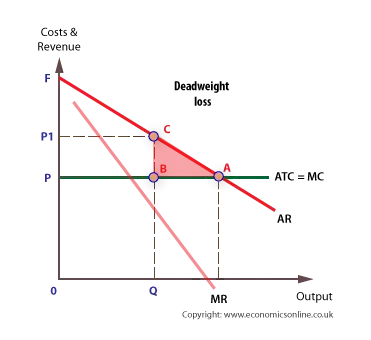

- Monopolies can maintain super-normal profits in the long run. As with all firms, profits are maximised when MC = MR. In general, the level of profit depends upon the degree of competition in the market, which for a pure monopoly is zero. At profit maximisation, MC = MR, and output is Q and price P. Given that price (AR) is above ATC at Q, supernormal profits are possible (area PABC).

With no close substitutes, the monopolist can derive super-normal profits, area PABC.

- A monopolist with no substitutes would be able to derive the greatest monopoly power.

See also: Natural monopolies

Evaluation of monopolies

The advantages of monopolies

Monopolies can be defended on the following grounds:

- They can benefit from economies of scale, and may be ‘natural’ monopolies, so it may be argued that it is best for them to remain monopolies to avoid the wasteful duplication of infrastructure that would happen if new firms were encouraged to build their own infrastructure.

- Domestic monopolies can become dominant in their own territory and then penetrate overseas markets, earning a country valuable export revenues. This is certainly the case with Microsoft.

- According to Austrian economist Joseph Schumpeter, inefficient firms, including monopolies, would eventually be replaced by more efficient and effective firms through a process called creative destruction.

- It has been consistently argued by some economists that monopoly power is required to generate dynamic efficiency, that is, technological progressiveness. This is because:

- High profit levels boost investment in R&D.

- Innovation is more likely with large enterprises and this innovation can lead to lower costs than in competitive markets.

- A firm needs a dominant position to bear the risks associated with innovation.

- Firms need to be able to protect their intellectual property by establishing barriers to entry; otherwise, there will be a free rider problem.

- Why spend large sums on R&D if ideas or designs are instantly copied by rivals who have not allocated funds to R&D?

- However, monopolies are protected from competition by barriers to entry and this will generate high levels of supernormal profits.

- If some of these profits are invested in new technology, costs are reduced via process innovation. This makes the monopolist’s supply curve to the right of the industry supply curve. The result is lower price and higher output in the long run.

The disadvantages of monopoly to the consumer

Monopolies can be criticised because of their potential negative effects on the consumer, including:

- Restricting output onto the market.

- Charging a higher price than in a more competitive market.

- Reducing consumer surplus and economic welfare.

- Restricting choice for consumers.

- Reducing consumer sovereignty.

Higher prices

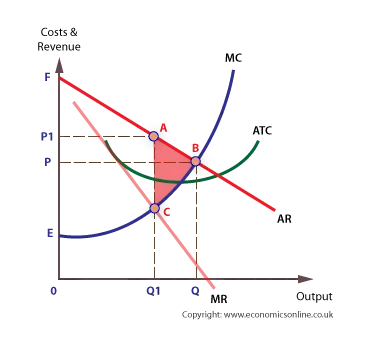

The traditional view of monopoly stresses the costs to society associated with higher prices. Because of the lack of competition, the monopolist can charge a higher price (P1) than in a more competitive market (at P).

The area of economic welfare under perfect competition is E, F, B. The loss of consumer surplus if the market is taken over by a monopoly is P P1 A B. The new area of producer surplus, at the higher price P1, is E, P1, A, C. Thus, the overall (net) loss of economic welfare is area A B C.

The area of deadweight loss for a monopolist can also be shown in a more simple form, comparing perfect competition with monopoly.

Alternative diagram

The following diagram assumes that average cost is constant, and equal to marginal cost (ATC = MC).Under perfect competition, equilibrium price and output is at P and Q. If the market is controlled by a single firm, equilibrium for the firm is where MC = MR, at P1 and Q1. Under perfect competition, the area representing economic welfare is P, F and A, but under monopoly the area of welfare is P, F, C, B. Therefore, the deadweight loss is the area B, C, A.

The wider and external costs of monopolies

Monopolies can also lead to:

- A less competitive economy in the global market-place.

- A less efficient economy.

- Less productively efficient

- Less allocatively efficient

- The economy is also likely to suffer from ‘X’ inefficiency, which is the loss of management efficiency associated with markets where competition is limited or absent.

- Less employment in the economy, as higher prices lead to lower output and les need to employ labour.

Creative destruction

Creative destruction is a concept associated with Joseph Schumpeter who argued that the dynamics of business cycle under capitalism might destroy some large inefficient firms by smaller new entrants. New entrants would be able to exploit new technology, and gain a competitive advantage over older, larger firms that continued to use older technologies. New entrepreneurs are often willing to take risks and employ new technologies in order to enter markets. In a sense they have less to lose than established firms. Eventually, across the economy, new technologies replace older and obsolete ones.

Schumpeter’s analysis can be argued to be a ‘defence’ of monopoly, at least in terms of the whether they need to be regulated. If Schumpeter is accurate, then even natural monopolies may be subject to competition and innovation from new entrants.

Remedies

Monopoly power can be controlled, or reduced, in several ways, including price controls and prohibiting mergers.

It is widely believed that the costs to society arising from the existence of monopolies and monopoly power are greater than the benefits and that monopolies should be regulated.

Options available to regulators include:

- Regulators can set price controls and formulae, often called price capping. This means forcing the monopolist to charge a price, often below profit maximising price. For example, in the UK the RPI – ‘X’ formula has been widely used to regulate the prices of the privatised utilities. In the formula, the RPI (Retail Price Index) represents the current inflation rate and ‘X’ is a figure which is set at the expected efficiency gain, which the regulator believes would have existed in a competitive market. However, there is a dilemma with price controls because price-capping results in lower prices, but lower prices also deter entry into the market. The formula for water is RPI + K + U, where K is the price limit, and U is any unused ‘credit’ from previous years. For example, if K is 3% in 2010, but a water company only ‘uses’ 2%, it can add on the unused 1% to K in 2011. Regulators may remove price caps if they judge that competition in the market has increased sufficiently, as in the case of OFCOM who removed BT‘s price cap in 2006.

- An alternative to price-cap regulation is rate-of-return regulation. Rate of return regulation, which was developed in the USA, is a method of regulating the average price of private or privatised public utilities, such as water, electricity and gas supply. The system, which employs accounting rules for the calculation of operating costs, allows firms to cover these costs, and earn a ‘fair’ rate of return on capital invested. The ‘fair’ rate is based on typical rates of return which might be expected in a competitive market.

- Regulators can prevent mergers or acquisitions, or set conditions for successful mergers.

- Breaking-up the monopoly, such as forcing Microsoft to split into two separate businesses – one for the operating system and one for software sales. In 2004, the UK telecom’s regulator Ofcom recommended that BT is split into two businesses: retail and wholesale.

- A less popular option would be to bring the monopoly under public control, in other words to nationalise it.

- Regulators can also force firms to unbundle their products and open-up their infrastructure. Bundling means selling a number of products together in a single bundle. For example, Microsoft sells PowerPoint, Access, Excel and Word as one product rather than separate ones. Unbundling makes it easier for firms to enter the market, as in the case of UK telecoms, when BT was forced to apply local loop unbundling, which enabled new broadband operators to enter the market.

- Regulators can use yardstick competition, such as setting punctuality targets for train operators based on the highly efficient Bullet trains of Japan.

- It is also possible to split up a service into regional sections to compare the performance of one region against another. In the UK, this is applied to both water supply and rail services.

Go to: natural monoplies