Asymmetric Information

Asymmetric information refers to a situation where one party in a transaction has access to greater knowledge or better information than the other party. This means that both the parties in a transaction have unequal knowledge. This can lead to a number of problems, including market failure, moral hazard and adverse selection. Understanding and addressing asymmetric information (information asymmetries) is important for businesses, policymakers, and individuals in order to promote fair and efficient economic transactions.

On the other hand, when all parties to a transaction have perfect information, this situation is called symmetric information by the economists.

The phenomenon of market failure due to asymmetric information is called information failure which means a situation when consumers (or producers) do not have full or complete information when making decisions leading to under or over-consumption (or provision) of products. It arises because consumers do not recognise how good or bad a particular product is for them. There may be a lack of information, inaccurate information or asymmetric information.

Asymmetric Information and Decision Makers

In real life, decision-makers don’t have perfect knowledge. So, resource allocation may not be as desired by society. Hence there are disadvantages of asymmetric information.

1. Asymmetric Information and the Consumers

Lack of information is probably the most apparent cause of market failure for consumers. Examples can be over-consumption of demerit goods and under-consumption of merit goods.

2. Asymmetric Information and the Producers

Producers lack information about the external effects of their production and their profit maximising behavior leads to over-allocation or under-allocation of resources.

3. Asymmetric Information and Workers

Workers lack information about job availability due to which there may be under-allocation of labour.

Examples of Asymmetric Information

1. Car Market

One common example of asymmetric information is the used car market. When a person buys a second-hand car, they often have limited information about the car's condition and history. The seller, on the other hand, may have more complete information about the car's condition and any previous problems or repairs. This information imbalance can lead to a situation where the buyer pays more for the car than it is worth, while the seller profits from the sale.

2. Insurance Market

Another example of asymmetric information is the insurance market. Insurance companies base their insurance contract premiums on the perceived risk of insuring a particular individual or group. However, individuals may not have complete information about their own risk level, and may be tempted to understate their risk in order to secure a lower premium. This can lead to a situation where the insurance company ends up insuring higher-risk individuals at lower premiums for insurance policies, which can result in financial losses for the company.

3. Under-consumption of the Merit Goods

The goods and services which are thought to be beneficial for the society and which will be under-provided if left to the private sector, are called the merit goods.

The merit goods are more beneficial for the individual consumer than the individual realises.

The merit goods are under-consumed because their benefit is under-estimated due to a lack of information (information Failure).

For example, an inoculation against a contagious disease is a merit good. Other people (the rest of the society) benefit from the inoculation, as they will not now catch the disease from the inoculated person. Other examples can be education and health care.

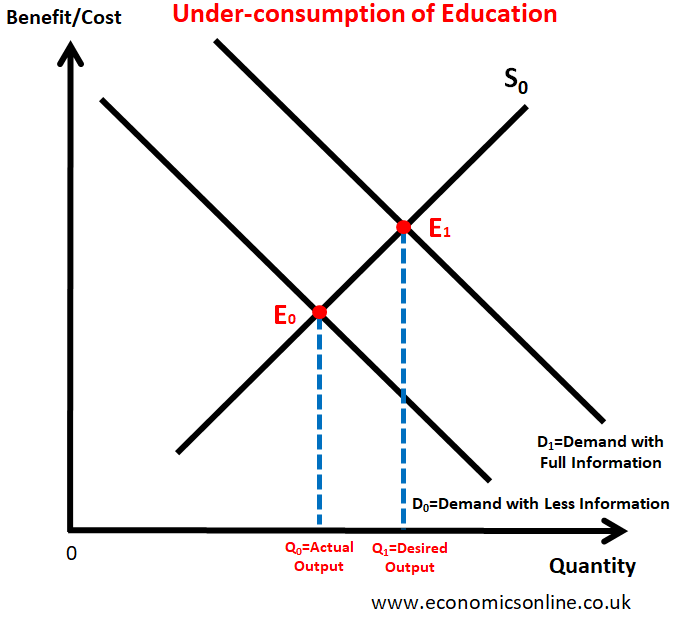

In this diagram, demand for education is lower at D0 due to lack of information which leads to under-consumption of education at Q0.

4. Over-consumption of the Demerit Goods

The goods and services which are thought to be harmful for the society and which will be over-provided if left to the private sector, are called the demerit goods.

The demerit goods are more harmful for the individual consumer than the individual realises. The demerit goods are over-consumed because their harmful effect is under-estimated due to lack of information.

The over-consumption of junk food is an example. Junk food has low nutritional value, is readily available, cheap and quick to consume. Obesity can be partly attributed to the over-consumption of fast foods and high-sugar drinks, especially in low-income households.

Smoking is another example of a demerit good which is popular among young people and hence is over-consumed. Smoking is often not allowed in public places, such as offices and restaurants. Governments seek to reduce cigarette consumption by imposing heavy indirect taxes, advertising restrictions and health warnings and images on cigarette packets.

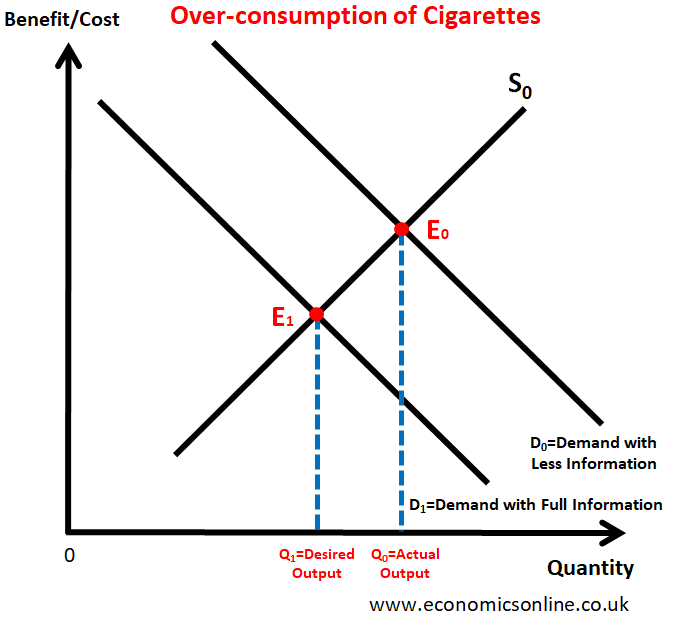

In this diagram, demand for cigarettes is higher at D0 due to lack of information which leads to over-consumption of cigarettes at Q0.

Addressing the Problem of Asymmetric Information

There are several ways to address asymmetric information in markets.

1. Using Intermediaries

One approach is to use intermediaries or third parties to provide information to both parties in a transaction. For example, a used car dealer may perform a thorough inspection of a car before offering it for sale, and a car buyer may rely on the dealer's expertise and reputation to make an informed purchasing decision. Similarly, insurance companies may use actuaries to assess the risk level of potential policyholders and set premiums accordingly.

2. Using Disclosure Requirements

Another strategy for addressing asymmetric information is to use disclosure requirements, which require one party to reveal certain information to the other party. For example, the Securities and Exchange Commission (SEC) requires publicly traded companies to disclose certain financial and operational information to investors, in order to promote fair and efficient capital markets. Similarly, mortgage lenders are required to disclose certain information to borrowers, including the terms and conditions of the mortgage, in order to protect consumers.

3. Other Strategies

There is a huge quantity of information available to consumers on the internet to help them make informed decisions about what to buy. Better labelling of consumer products, such as food, drink and non-prescription medicines, can help consumers when deciding what to buy. Health warnings on tobacco products may make consumers stop or limit their consumption.

More information should enable consumers to make rational decisions that will maximise their welfare. Where this happens, the market works efficiently; if not, there will be an inefficient allocation of resources.