Photo by Jakub Żerdzicki / Unsplash

Seigniorage Explained

What is Seigniorage?

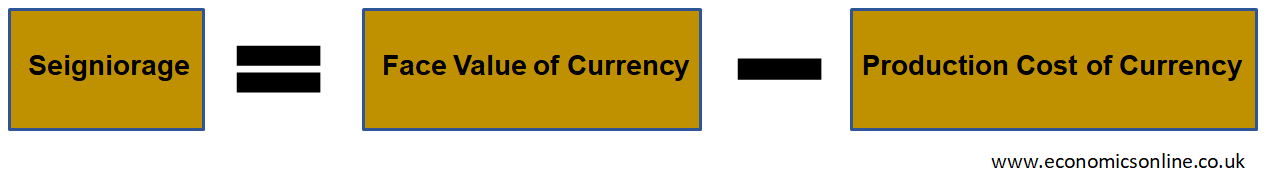

Seigniorage refers to the difference between the face value of the currency and its production cost. It is the profit generated by a government or central bank by printing and issuing currency. Seigniorage is a major source of revenue for governments and the central bank of every country.

Understanding Seigniorage

Suppose that a government produces a paper currency bill with a face value of $20. The cost of producing this paper currency bill is only $2, including paper, ink, and printing. The remaining $18 is the seigniorage revenue that the government earns from producing each paper currency bill and putting it into circulation. The government uses this central bank’s revenue to meet its expenses, issue funds for infrastructure projects, buy government securities such as government bonds and treasury bills (T-bills), etc.

The value of seigniorage is calculated by using the following formula.

Real World Example

The cost of producing a dollar bill is estimated to be around 5 to 10 cents per bill. The face value of each dollar bill is $1. The difference between the cost of production and the face value is seigniorage revenue on each dollar bill circulated in the market.

Origin

The term seigniorage originated from the traces of mediaeval times when seigneurs, or lords, had the right to collect coins and collect revenue from the difference between the face value and production costs of the coins. As time passed, this concept evolved, and now it is defined as the profit that a government or central bank generates by issuing currency.

History of Seigniorage

Seigniorage has a long history dating back to ancient civilizations. In ancient times, empires would mint their own coins to control their economies. They could collect seigniorage by controlling the production of currency, which was the difference between the face value of the coins and the value of the metal used to make coins. Over centuries, this concept has evolved, and now it is a profit that the central bank generates by producing paper currency bills.

Seigniorage and Gresham's Law

Gresham’s law is defined as saying that bad money generates good money. This means that when two forms of currency are in circulation, people tend to spend or hold the currency with a high intrinsic value and use the currency with a lower value for transactions. Then seigniorage comes into play because currency with a lower intrinsic value generates more seigniorage for issuing authority. Gresham’s law can influence the seigniorage revenue generated by central banks, governments and financial institutions.

Positive and Negative Seigniorage

Positive seigniorage refers to the revenue earned by a government when it mints and circulates currency at a cost lower than its face value (fiat money). However, negative seigniorage occurs when a government prints money at a higher cost than its face value.

Factors affecting Seigniorage

Main factors affecting seigniorage are explained below:

Production Costs

The cost of production and distributing currency affects seigniorage. Higher production costs can reduce the overall seigniorage generated.

Demand for Cash

The level of demand for physical currency impacts seigniorage. When people use different forms of payment or electronic transactions, this will reduce the demand for cash, thereby lowering the seigniorage.

Economic Activity

Seigniorage can be influenced by the overall level of economic activity. During periods of economic growth, there is increased demand for cash or currency, leading to an increase in the value of seigniorage.

Inflation Rates

Higher inflation rates can affect the value of seigniorage. The inflation rate affects the purchasing power of money over time, resulting in a reduction in seigniorage generated from issuing currency in the market.

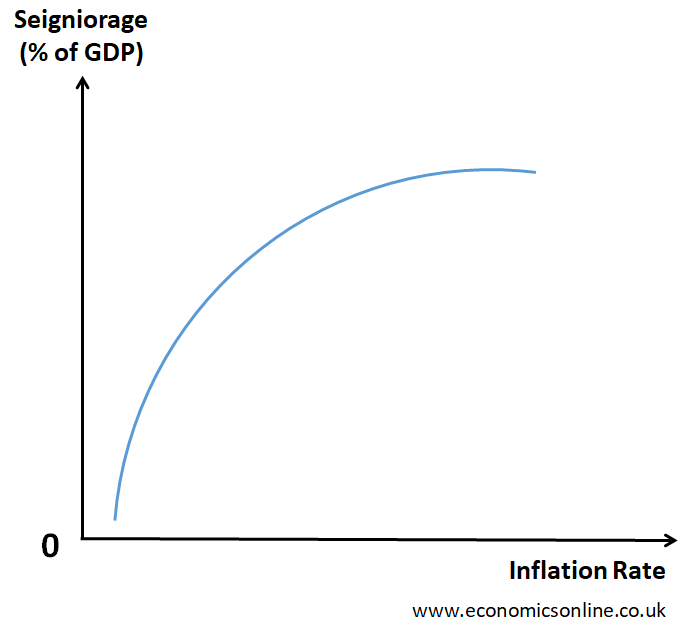

The relationship between the seigniorage and inflation can be observed through the seigniorage Laffer curve.

In the above graph, the inflation rate is taken on the horizontal axis (x-axis), and the seigniorage as a percentage of GDP is taken on the vertical axis (y-axis). The seigniorage Laffer curve shows the relationship between the seigniorage and inflation. It illustrates that there exists a specific inflation rate at which the seigniorage revenue will reach its maximum.

Government Policies

The government’s policies on currency issuance also affect the seigniorage. For example, if a government decides to increase or decrease the production of currency, it affects the seigniorage revenue generated.

Advantages of Seigniorage

The following are the advantages of seigniorage:

Revenue Generation

Government-generated revenue by issuing new currency to the market enhances seigniorage. With this revenue, the government funds its expenses and programmes.

Economic Stability

Economic stability is also enhanced by seigniorage. It provides a steady source of income for the government, which can help manage fiscal deficits and stabilise the economy.

Monetary Policy Flexibility

Monetary policy flexibility is an advantage of seigniorage. It provides the central bank with the ability to control the money supply and impose monetary policy measures. This will influence interest rates, inflation, and economic conditions.

Independence

Financial independence is a major advantage provided by seigniorage. Governments are not dependent on external sources for revenue. This enhances the country’s seigniorage and economic growth.

Disadvantages of Seigniorage

The following are the disadvantages of seigniorage:

Inflationary Pressure

The excessive printing of money to generate government revenue can lead to inflationary pressures by affecting the general price level. This reduces the purchasing power of currency, causing economic instability.

Counterfeiting Risk

As the seigniorage involved in the issuance of the physical currency in the market, there is a risk of counterfeiting. Counterfeiting decreases trust in the currency and negatively affects economic growth.

Cost of Currency Production

Production and distribution of new currency incur costs, like printing and security measures. These costs can eat into the seigniorage revenue generated.

Reduced Demand for Cash

As digital payment methods are introduced in the market, the demand for physical cash decreases. This will reduce the revenue generated by seigniorage.

Dependence on Currency Stability

Dependence on currency stability negatively affects the economic growth of a country. If the currency loses its face value, it will face a loss of trust due to its dependence on currency stability.

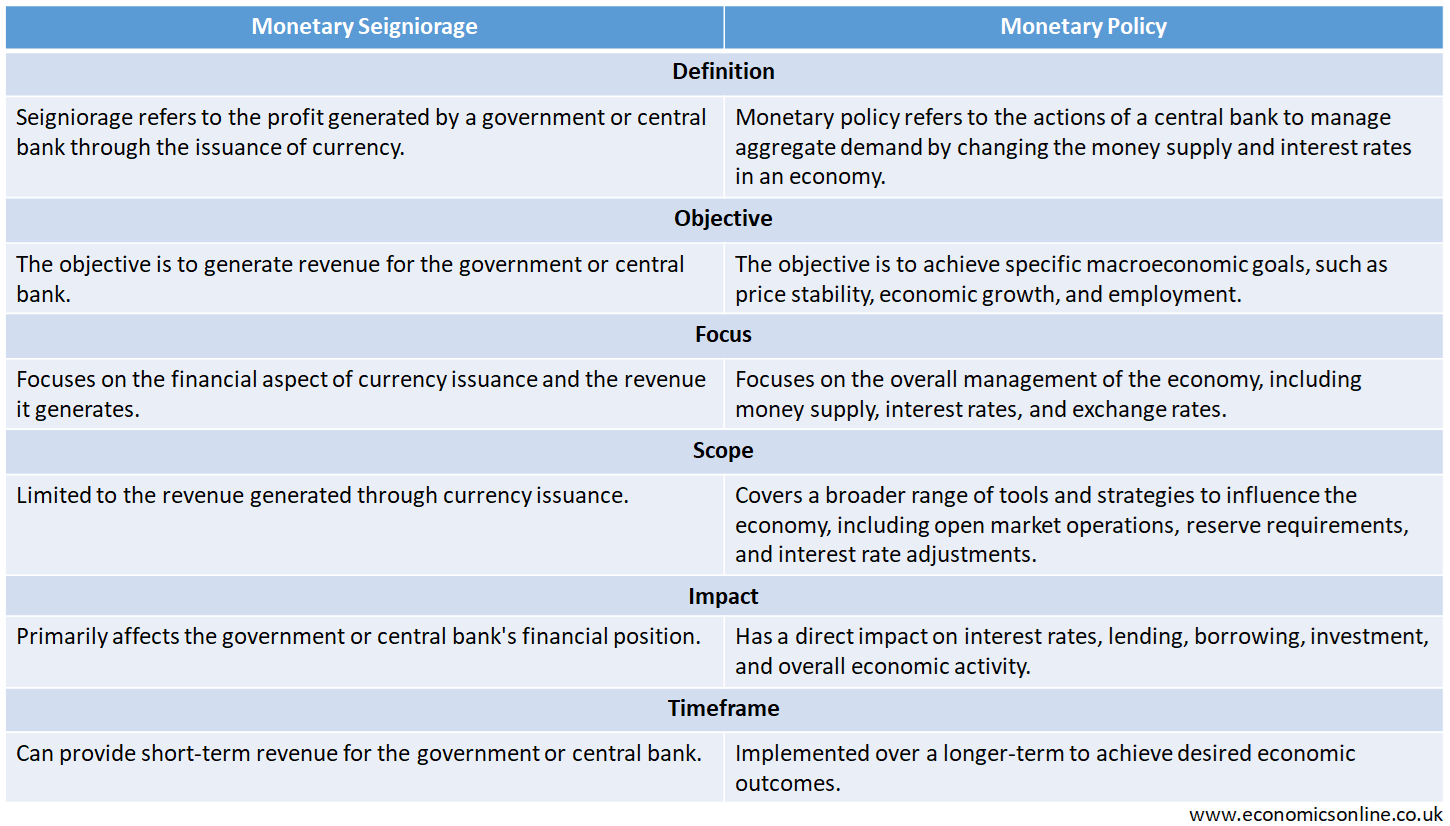

Monetary Seigniorage vs. Monetary Policy

The following table compares the main features of seigniorage and monetary policy.

Seigniorage and Central Banks

Seigniorage is closely associated with the role of the central bank (Fed, the Bank of England and the European Central Bank). Central banks, including the federal reserve, are responsible for the issuance and management of a country’s currency, including revenue generated by seigniorage. Central banks use seigniorage to support their operations by generating revenue to fulfil their mandate.

Seigniorage as a Tax

Seigniorage is a form of tax when the government issues new currency; it enhances the value of the currency. This value is known as seigniorage, which is generally a tax on the holders of the currency. Seigniorage is based on the value of currency held by individuals and businesses as money is a medium of exchange. In this way, seigniorage is considered a basic form of inflation tax (a term coined by Milton Friedman).

The Role of European Central Bank

The European Central Bank, is abbreviated ECB, plays a central role in the Eurozone. The ECB’s role is to maintain price stability and promote smooth financial operations. The ECB’s also sets monetary policies, including interest rates, inflation rate targets and controls the issuance of euro currency.

Types of Coins the U.S. Mint Produces

The U.S. mint produces a variety of coins like pennies, nickels, dimes, quarters, and dollar coins. The coinage is done to produce variety of coins. These coins are circulated in the international market to generate revenue for the governments and central bank of the U.S.

Seigniorage and the Liquidity Trap

During a liquidity trap, interest rates are very low and huge amount of seigniorage can be generated without causing inflation.

Conclusion

In conclusion, seigniorage is the difference between the face value of a currency and its production costs. Seigniorage provides revenue for governments through money creation, supports monetary policies, and stimulates economic stability. It also negatively affects the economy due to inflation, counterfeiting risks, etc. It provides overall information on the issuing and printing of new money and its circulation in the market through commercial banks.