An image illustrating the protection against the risk of falling from a rope.

Hedging Definition

Introduction

In the world of stock market, a market for buying and selling shares, hedging is an interesting and important topic. In the stock market, investors and traders are exposed to price fluctuation which may go in their favour or against them. These price movements increase the risk involved in trading and investment. Hedging is a strategy to reduce that risk. In this article, we will discuss the concept of hedging in detail.

What is Hedging?

Hedging refers to a risk management strategy that is used to protect an investment or a financial asset from a major loss due to adverse price movements. Investors and traders use hedging to limit their losses due to the risk of any adverse price movements of their financial assets. A hedge is a kind of trade in which investors and traders purchase an asset with the intention of reducing the potential loss of another asset.

The purpose of hedging is to reduce the risk of the potential loss of value of a financial asset due to unfavourable price fluctuations. However, if hedging is used, both the risk and the reward associated with a financial asset will reduce.

Understanding Hedging

Hedging is a financial strategy that is used to reduce the risk of loss in the value of financial assets. Think of hedging like insurance. People and firms buy insurance policies to protect something they consider valuable. For example, a person may buy life insurance, health insurance or car insurance to protect him from health risk or damage to the car. In the same way, in the stock market, individual investors use hedging to protect themselves from a major loss of a valuable financial investment.

During COVID-19, the stock exchanges started falling, and people were facing a fall in the value of their investment portfolios. Some wise investors used hedging to protect their investment portfolio by limiting the losses from getting bigger and bigger.

Investors hedge one trade or investment by making a trade in another related asset. For example, a person has bought shares of a company and is worried that the prices of those shares may fall if something bad happens to the company. He can protect his investment by using hedging. If something bad happens to the company and the value of shares falls significantly, the value of another asset will go up, and the person will be protected from a major loss.

In general, a hedge is the process of taking the opposite position in an asset or derivative-based security in the asset to be hedged.

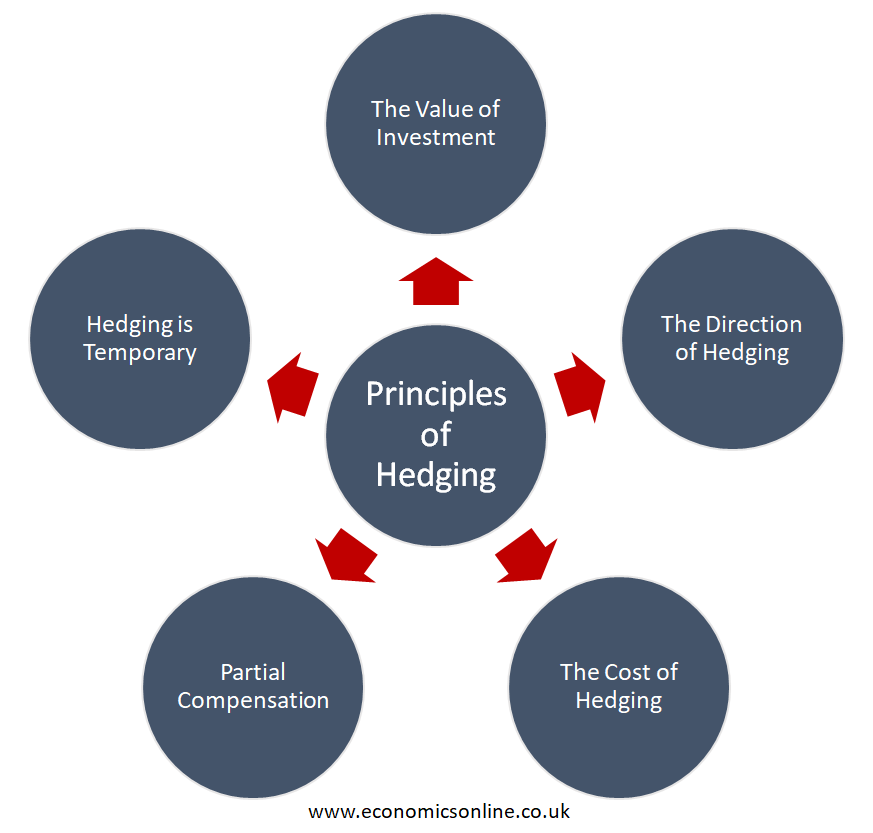

Principles of Hedging

The following are some basic principles of hedging:

The Value of Investment

In hedging, the value of the investment being protected should be greater than the value of the premium paid for hedging. For example, if an investment of $50000 is to be protected, it will be unwise to spend more than $50000 to protect this investment.

The Direction of Hedging

The direction of hedging should be opposite to the direction of the investment being protected. If the value of investment goes down, the value of hedge should go up, and vice versa. So the values of investment and hedge should be negatively correlated. In this way, if the value of investment falls, the increase in the value of hedge will offset the loss in the investment.

The Cost of Hedging

It should be kept in mind that hedging involves a cost. For example, when we buy insurance, we have to pay its premium, which is the cost of insurance. If the insurance premium is very high, we may not buy the insurance because it is too expensive and costly. Similarly, the investment which is to be protected must be worthy enough to justify the spending of money on its hedging.

Partial Compensation

It should also be kept in mind that hedging can partially compensate for the loss in the value of an investment. So, hedging a financial investment may not compensate for the full value of the financial loss. If, for example, a person wants full coverage for the loss, the cost of hedging may go high, even beyond the value of the loss, and it may not make sense to go for that option.

Hedging is Temporary

Another important point is that hedging is not permanent. Just like medical insurance or car insurance, which have to be renewed every year, hedging also has an expiration date of a few days, weeks or months. Once they expire, people have to buy new hedges to cover future losses.

Examples of Hedging

The following are some examples of hedging:

- Using derivative instruments to reduce the price risk associated with the underlying security or asset by using options or futures.

- Purchasing an insurance policy to overcome property risks.

- Opening a new position on foreign exchange to reduce the risk of losses from fluctuations in the existing currency, although the currency still has some upside potential.

De-Hedging

The closing of an existing hedge position is called de-hedging. This happens in various situations: if a hedge is no longer needed, if a hedge costs more than the the value of its protection, or if a person is willing to take additional risks associated with an unhedged position.

Hedging: An Imperfect Science

According to the investment and finance point of view, hedging is very complex and considered an imperfect science. A perfect hedge is one that eliminates all the risks from that position or investment portfolio. In this case, an investment will be 100% safe. But achieving this sort of hedging involves very high level of expertise and some luck factors as well. In real life, investments are risky and there is always a possibility of a potential future loss. Hedging can minimise the losses, but may not eliminate them all together.

Derivatives

Securities that show movements in accordance with their one or more underlying assets are called derivatives. They can be effective hedges against their underlying financial instruments as they show a relationship with one another that is clearly defined. Derivatives include put options, futures, forward contracts, and swaps, and the underlying securities can be stocks, commodities, bonds, indexes, different currencies, and interest rates. People can use a derivative to set a trading strategy in which the loss of one investment will be overcome or reduced by the potential gains in another comparable derivative.

Hedging with Derivatives

A type of financial contract whose price is dependent on the price of some underlying securities is called a derivative contract. Some common types of derivatives contracts are forwards, futures, and option contracts.

Hedge Ratio (Delta)

The delta that is used to express the effectiveness of a derivative hedge is called the hedge ratio. The amount by which the price of a derivative shows movement per $1 in the price of its underlying asset is known as the delta.

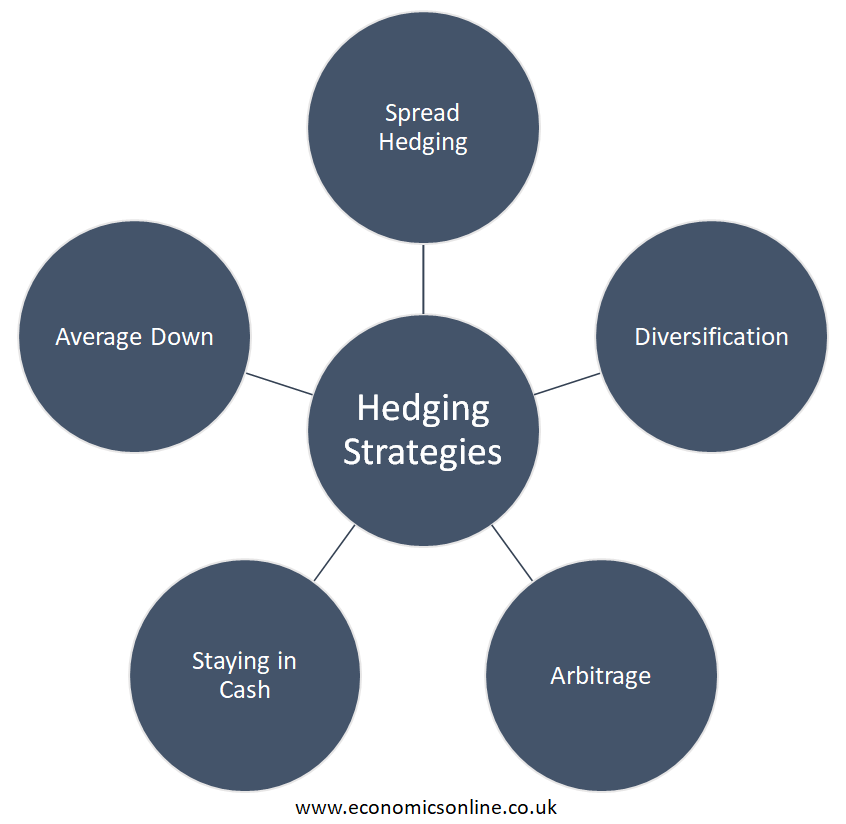

Hedging Strategies

Investors use a specific hedging strategy in which the price of hedging instruments, securities, or underlying assets depends upon the reduction of risk in their underlying security. In other words, the greater the downside risk, the higher will be the price or cost of a hedge. But the value of downside risk tends to increase with higher volatility levels. An option contract that will expire after a long period of time, also related to a highly volatile security, will be more expensive as a source of hedging. The following are some common hedging strategies that people use:

Spread Hedging

Moderate price declines are very common and are highly unpredictable in investment markets. Investors, in order to reduce moderate decline rather than severe decline, use a bear put spread a common hedging strategy. In spread hedging, investors already buy a put option with a high strike price. Then, they sell that put at a low strike price but with the same expiration date.

Diversification

A common proverb in finance is “don’t put all your eggs in one basket,” which means that investors must not put all their investments in one asset. Long-term investors should use a hedging strategy of diversification in which they are able to diversify their long term investment portfolio instead of limiting it to only one direction. Simply speaking, an investment portfolio should be diverse and investors should invest in multiple assets instead of investing in one, so that if an investment goes down, a profit can be gained from another investment which is going up.

Arbitrage

The arbitrage strategy involves buying a product and selling it immediately in another market at a high price. This process, although it makes less money, has steady profits. The arbitrage strategy is most commonly used in the stock market.

Staying in Cash

In this strategy, the investor keeps a portion of his money as cash, which is used to hedge against potential losses in his investments.

Average Down

The hedging strategy involves buying extra units of products even though the strike price or cost of those products is falling. Those who prefer to invest in stocks use this hedging strategy to hedge their investments. For example, if the price of a previous stock declines, they buy more stocks at a lower price. Then, if prices rise to the point between both purchases, the gain in the second buy reduces the loss in the first buy.

Hedging with Put Options

A common way of hedging is through put options. Put options provide the holder with the right to sell the underlying security on or before the date it expires at a pre-set price instead of obligations to sell that security.

For example, a person buys 100 shares of some stock at a price of $10 per share. He cleverly hedged his investment by buying a put option with a strike price of $8 that would expire in one year. By owning this option, he has the right to sell his 100 shares of stock at the specific price of $8 at any time in the next year until the time of maturity. He paid a $100 premium as a cost to purchase an option contract at $1 per share. If the stock is trading at $12, this means that he is unable to recognise or identify the future gains of the stock. In this case, he will not exercise the option and be at the same $100. But if the stock is trading at $0, he will face a loss of $300 by exercising the option at $8, instead of big loss of $1100.

Commercial Hedgers

The companies or producers of some products that are willing to use derivative markets in order to hedge their market exposure in both situations—either the produced goods or inputs to produce these products—are called commercial hedgers.

For example, those companies that produce cereal from corn, such as Kellogg’s, buy corn futures to hedge against the rise of corn prices. A corn farmer also willingly sells corn futures rather than hedge against the downfall in market prices before harvest.

Scope of Hedging

The hedging can be used in various areas. For example, hedging is used for commodities, which include things like gas, oil, milk, sugar, meat products, and others. It is also used in securities, such as stocks and bonds. Investors can buy stock without having anything physical, making it an easily tradable property. Currencies can also be hedged.

Risks of Hedging

There are also some risks associated with hedging, as it is a process of downsizing risk in underlying financial investments. First, hedging is an imperfect process, second, it does not guarantee future success, and third, it also reduces the benefit arising from an upward movement in the value of an investment. It also does not promise to reduce all the risks associated with underlying securities. Investors should understand the benefits and drawbacks of hedging before using this process as a trading strategy in their investment decisions.

Advantages of Hedging

The following are some advantages of hedging:

Minimising Overall Risk

An advantage of hedging is that investors can minimise overall risk for an investment portfolio by spreading risk or implementing other precautionary measures for both short-term and long-term risk reduction.

Predictability

Many hedging strategies, like using derivatives, involve two parties in a contract at fixed prices or exchange rates on future dates, regardless of market fluctuations. This advantage makes you able to predict the future and plan accordingly.

Reducing Foreign Exchange Risk

Another advantage of hedging is that it reduces the foreign exchange risk associated with those companies that are working internationally and encounter losses due to fluctuations in the exchange rates, which also affect the trade of goods and services. They can sign forward contracts with an agreed-upon fixed exchange rate for a certain period of time.

Continue Trading and Investing

Due to uncertainty and recession, when markets are facing difficulties, this can cause a great loss of investors’ money and make it difficult to continue trading and investing. With the help of hedging investments, investors are able to continue their trade and investments and continue to find opportunities in adverse market conditions.

Disadvantages of Hedging

The following are some advantages of hedging:

Complexity

Hedging is a complex process as it involves financial derivatives. Regardless of your confidence and your knowledge about what you are doing, the complexity associated with it becomes more problematic.

Cost

Each hedging process charges a certain amount of cost or fee, either in the form of cash or a separate risk. For example, if you invest too much time and money in hedging your investment, the actual cost of this process becomes much greater than the original cost you incur without doing this.

Less Returns

Any hedging strategy that reduces your risk also reduces your returns. In favourable market conditions, extensively hedging investments leads to lower overall returns on your investments. So there is a risk-reward tradeoff involved in hedging.

Conclusion

In conclusion, hedging is a precautionary measure used by investors to protect themselves from sudden and unpredictable changes in financial markets due to the risk of adverse price movements. With the help of hedging, investors and traders are able to reduce the overall risk associated with their underlying investments. A hedge is just like buying an insurance policy as a precautionary measure on an investment or portfolio. The most common and effective hedgers are those who use derivatives, like futures, forwards, and put options contracts.