An image showing a house made of coins and currency note.

Loanable Funds Theory with Graphs

What is the Loanable Funds Theory?

Definition

The loanable funds theory is a fundamental concept in economics that explains how the supply and demand for loanable funds affect interest rates in an economy.

Origin

The loanable funds theory was formulated in the 1930s by British economist Dennis Robertson and Swedish economist Bertil Ohlin. However, Ohlin credited the origin of the theory to Knut Wicksell, a Swedish economist, and the Stockholm school, which included economists like Erik Lindahl and Gunnar Myrdal.

Interest Rate and its Types

Loanable funds theory is used to determine the interest rate in the money market of a country.

Interest Rate

The cost of borrowing money, expressed as a percentage of the amount of the loan, is called the interest rate. In other words, the interest rate is the amount paid by the borrower to the lender for the use of the borrowed money, expressed as a percentage of the principal amount.

Types of Interest Rates

Nominal Interest Rate

The interest rate measured at current year prices, which includes inflation, is called the nominal interest rate.

Real Interest Rate

The interest rate measured at base year prices and adjusted for inflation is called the "real interest rate."

Real Interest Rate = Nominal Interest Rate - Rate of Inflation

Theories of Interest Rate Determination

There are two theories regarding the working of the money market and the determination of the interest rate.

- Loanable Funds Theory

- Liquidity Preference Theory

In this article, we will explain the loanable funds theory.

Assumptions of the Loanable Funds Theory

Perfect competition

The loanable funds theory assumes that there is perfect competition in the financial markets. This means that there are many buyers and sellers in the market, and no single entity has the power to influence the market price.

Rationality

The theory assumes that borrowers and lenders are rational and make decisions based on their self-interest.

No Risk

The loanable funds theory assumes that there is no risk associated with lending or borrowing money.

Homogeneity

The theory assumes that all loanable funds are identical. In reality, however, different loans and investments have different characteristics and risks.

No Transaction Cost

The theory assumes that there is no transaction cost associated with borrowing or lending money. In reality, however, there are always transaction costs, such as fees and commissions.

Understanding the Loanable Funds Theory

The loanable funds model explains the determination of interest rates through the relationship between supply and demand for loanable funds in an economy. In this model, the supply of funds comes from savings, while the demand for funds comes from investment opportunities.

In essence, the loanable funds theory explains how lenders and borrowers interact to determine the equilibrium interest rate, which is the rate at which the quantity of funds supplied equals the quantity of funds demanded.

According to Loanable Funds Theory, the interest rate in an economy is determined by

- Demand for Loanable Funds

- Supply of Loanable Funds

Loanable Funds

The funds available with banks for lending and borrowing are called "loanable funds."

1. Demand for Loanable Funds

The willingness and ability of borrowers to get loans is called the demand for loanable funds.

Households, firms, and the government demand loanable funds.

- Households demand loanable funds for expensive purchases, e.g., houses, cars, etc. This demand for loanable funds is interest-elastic.

- Firms demand loanable funds for investment. This demand for loanable funds is also interest-elastic.

- The government demands loanable funds to finance its budget deficit. This demand for loanable funds is interest-inelastic.

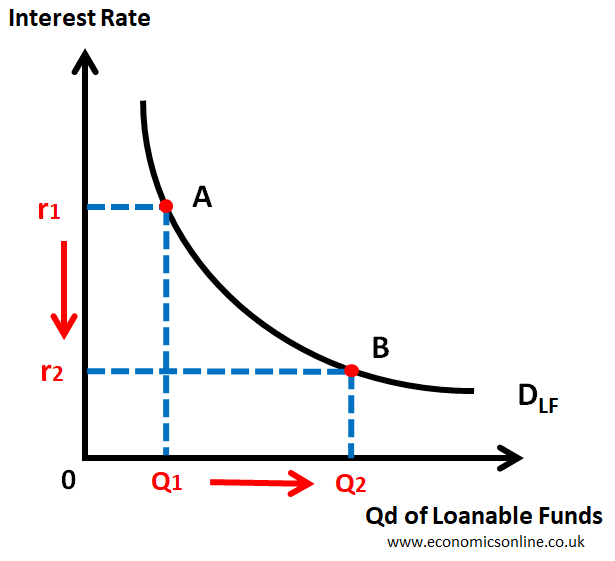

There is a negative or inverse relationship between the quantity demanded of loanable funds and the interest rate as shown in the following graph of the demand curve.

Factors Affecting the Demand for Loanable Funds

The demand for loanable funds is affected by various factors, including the level of economic growth, the state of consumer confidence, and the availability of alternative sources of financing, such as equity markets.

2. Supply of Loanable Funds

The willingness and ability of banks (lenders) to give loans is called the supply of loanable funds.

Banks supply loanable funds from the amounts deposited by households and firms.

- As savers, the households save money in banks.

- Firms keep their excessive profits and capital in banks.

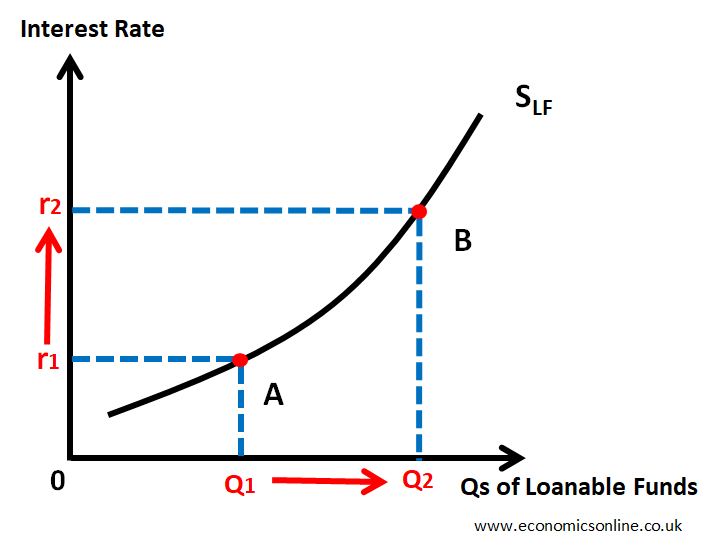

There is a positive, or direct, relationship between the quantity supplied of loanable funds and interest rate as shown in the following graph of the supply curve.

Factors Affecting the Supply of Loanable Funds

The supply of loanable funds is primarily influenced by two key factors: the willingness of households to save and the level of government borrowing. When households are more willing to save, the supply of loanable funds increases, and interest rates decrease. Conversely, when the government borrows more money, the supply of loanable funds decreases, and interest rates increase.

Equilibrium Interest Rate

It is an interest rate for which

Demand for Loanable Funds = Supply of Loanable Funds.

In other words, the interaction between the supply and demand for loanable funds determines the equilibrium interest rate, which is the rate at which the quantity of loanable funds supplied equals the quantity of loanable funds demanded.

When there is a surplus of loanable funds, interest rates decrease, making it cheaper for businesses and individuals to borrow money. Conversely, when there is a shortage of loanable funds, interest rates increase, making it more expensive to borrow.

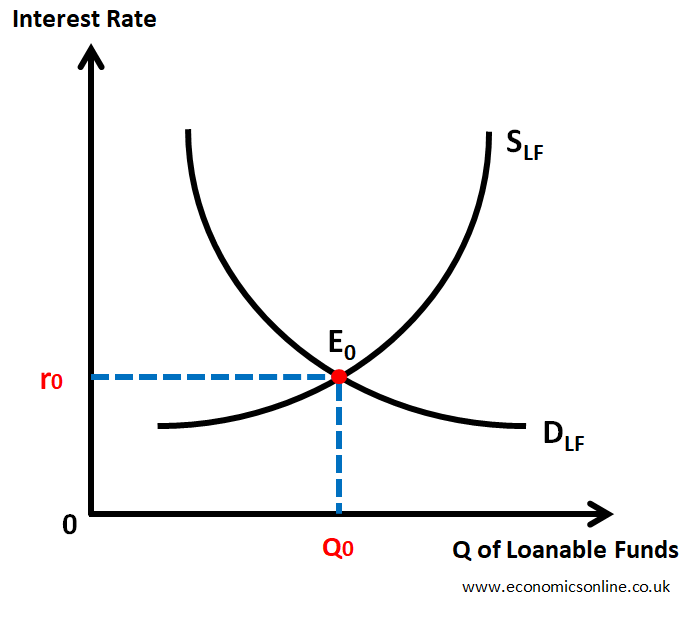

The equilibirum interest rate (r0) is shown by the following correctly labeled graph of the loanable funds market showing the interaction between the demand and supply curves.

The quantity of loanable funds is taken on the horizontal axis, and the interest rate is taken on the vertical axis. The supply and demand curves intersect at the equilibrium point E0. Q0 is the equilibirum quantity of loanable funds and r0 is the equilibirum interest rate.

Changes in Equilibrium Interest Rate

Changes in equilibrium interest rate can be due to

- The rightward or leftward shift in the demand for loanable funds

- The rightward or leftward shift in the supply of loanable funds

- The simultaneous shifts in the demand for loanable funds and the supply of loanable funds

Application of the Loanable Funds Theory

The loanable funds theory has numerous real-world applications, including the role of central banks in setting interest rates. Central banks, such as the Federal Reserve in the United States, adjust interest rates to influence the supply and demand for loanable funds in the economy, in order to maintain stable economic growth and low inflation.

The theory also has implications for government borrowing and spending. When governments borrow more money, they increase the demand for loanable funds, which can lead to higher interest rates and reduced private investment.

Limitations of the Loanable Funds Theory

Liquidity Preference

The theory does not take into account the fact that investors may prefer to hold liquid assets, such as cash or short-term securities, instead of investing in long-term projects.

Imperfect information

The theory assumes that borrowers and lenders have perfect information about the market and each other. In reality, however, there is always some degree of information asymmetry, which can affect the lending and borrowing decisions.

Behavioral Factors

The theory does not take into account the role of behavioral factors, such as emotions, social norms, and cognitive biases, which can influence the lending and borrowing decisions.

Government Intervention

The theory assumes that there is no government intervention in the financial markets. In reality, however, governments often regulate and influence the financial markets through policies such as taxes, subsidies, and interest rate controls.

International Capital Flows

The theory focuses on the domestic market for loanable funds and does not take into account the role of international capital inflows, which can affect the interest rates and allocation of credit in an economy.

Money Supply

This theory ignores the total money supply in the economy and considers only the supply of loanable funds.

Conclusion

In conclusion, the loanable funds theory is a crucial concept in economics that explains how the supply and demand for funds affect interest rates and the allocation of credit in an economy. By understanding the key components of this theory, we can better understand how economic agents interact and how monetary policy and the working of the central bank can influence the overall health of an economy.