An image of gold coins on a green surface.

Regressive Taxes

Taxes

Taxes are the contributions made by individuals and businesses and consumed by governments to regulate economic activities smoothly. Taxes are of many types and can be charged to individuals and corporations at the federal, state, regional, and local levels by the government. The amount of tax can vary from person to person, depending on their income. Depending on what percentage of tax rates are being charged to individuals in a country, there are three major types of tax systems: regressive tax, progressive tax, and proportional tax.

In this article, we shall discuss regressive taxes in detail.

What is a Regressive Tax?

A regressive tax is type of tax in which tax rate decreases when the taxpayer’s income increases. The regressive tax system charges a high percentage of tax rates from low earners instead of relatively high earners. The tax burden decreases for individuals as their income rises. Regressive taxes are the opposite of progressive taxes. Progressive taxes charge a high percentage of tax from high-income individuals.

Regressive Tax Examples

Sales taxes, sin taxes, payroll taxes, and excise taxes are some common types of regressive taxes.

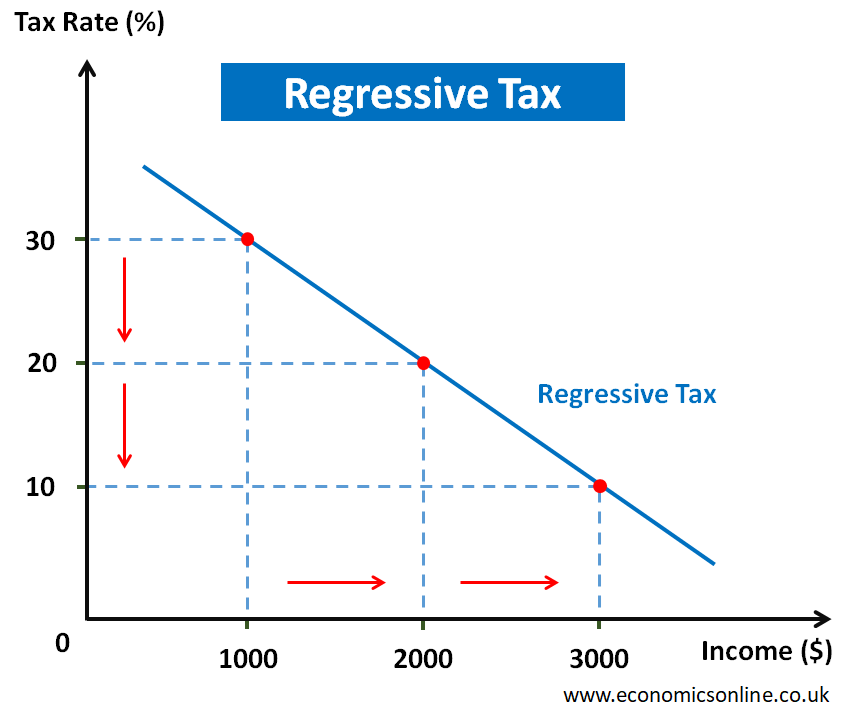

Graph of Regressive Tax

Let’s illustrate the concept of a regressive tax with the following graph:

In this graph, we have income on the horizontal axis (x-axis) and percentage tax rate on the vertical axis (y-axis). The regressive tax is shown by a downward sloping line. This graph shows that an increase in income can lead to paying a small percentage of tax rates as compared to low-income earners. For example, at the lowest income of $1000, there is a higher tax rate of 30%, while at a high taxable income of $3000, the rate is just 10%.

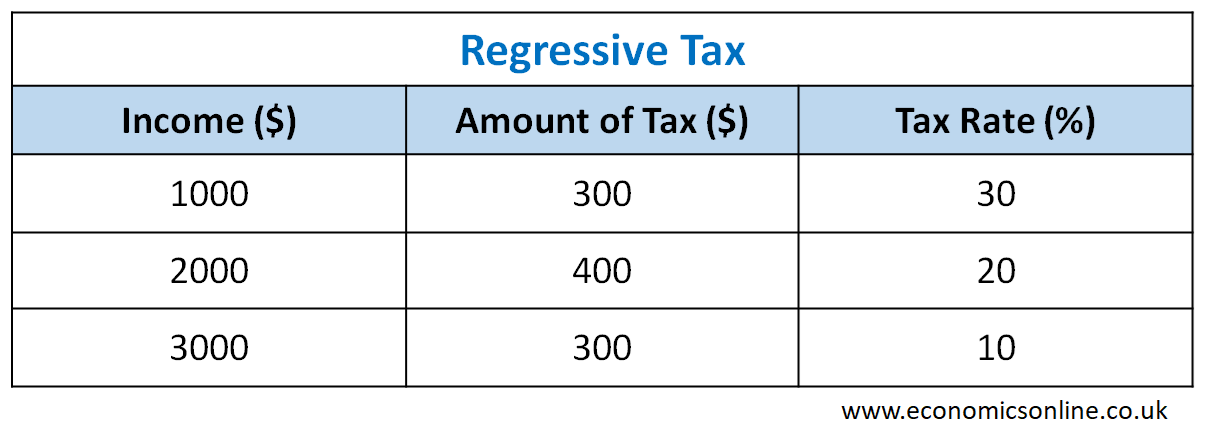

The following table also illustrates the same concept.

Types of Regressive Taxes

The following are some types of regressive taxes that taxpayers pay:

Sales Taxes

Sales taxes are implemented by governments uniformly on all types of consumers based on what they buy or consume. Consumers with lower incomes are most affected by sales tax, even though it might seem too low (7% sales tax).

For example, two individuals spend $300 on buying clothes and pay sales taxes of 7% each year as retail tax on their purchases. One individual earns $3000 per week, so this tax affects his earnings by 0.23%, while another individual earns $500 per week, so his income is affected by 1.4% sales tax on each purchase. Even though the tax rate is the same for each individual, sales tax affects each individual differently based on their earning levels, with low-income individuals affected most as compared to high-income taxpayers, making sales tax a regressive tax.

Excise Taxes

Excise taxes are also considered regressive and are charged on specific products. For example, luxury goods, petroleum products, tobacco, and alcohol are those goods on which excise tax is collected, and this tax is already included in the price of those products that consumers pay along with the product price.

Excise tax can also be regressive if it is charged on every individual, regardless of their income level.

For example, the excise tax on cheap beer is also a type of regressive tax, as low-income individuals demand more as compared to high-income ones.

Excise taxes can also be converted to progressive taxes. For example, if the tax on luxury goods is high as compared to the basic necessities like food, clothing, etc., then this tax rate affects high-income earners more because they prefer to buy luxury goods more as compared to others.

Tariffs

Tariffs are also a type of regressive tax because they are applied equally to all imported products, irrespective of the individual’s income who purchases them. Low-income people spend a large portion of their income on buying imported goods as compared to high-income individuals. The spending depends on consumer buying preferences. Tariffs can be progressive if they charge more for luxurious goods.

User Fees

User fees are also a type of regressive tax that is charged by governments on activities or services like toll fees for roads and bridges, the cost of identification cards and bridges, and admission to government-funded museums or state parks.

For example, if there is an admission fee to enter the Grand Canyon National Parks of $30 and two families enter the park with different income levels. The family with a high income pays less tax and is less affected by the percentage of tax on their income as compared to the other family with a lower income. The fee is the same for both, but it burdens the lower-income family, making it regressive for them.

Property Taxes

This type of tax is also considered regressive because if two people live in the same tax jurisdiction and have houses with the same values, then they have to pay a heavy amount of property taxes irrespective of their incomes. These taxes are not considered a rigid type of regressive tax as they only depend on the value of property, which may vary from person to person. It is also thought that lower-income earners live in less expensive houses and pay less property tax.

Flat Taxes

In flat taxes, the same amount of tax is charged by the government on all individuals, irrespective of their incomes. There are no special deductions or credits for people under flat taxes. Each person is charged a set amount of tax, which is paid by every individual. Flat tax also affects low-income individuals more as compared to high-income individuals, even at the same amount, which means that low-income people pay a high percentage of tax on their income. That is why flat taxes are also considered regressive.

Sin Taxes

A type of regressive tax imposed and collected on products that are considered harmful for society are called sin taxes. For example, the tax on tobacco and alcohol is relatively high, making it unaffordable for people who consume these harmful products. According to the Internal Revenue System (IRS), sin taxes are considered more burdensome for low-income individuals as compared to high-income individuals because they earn less and pay a higher share of income as taxes.

Payroll Taxes

Payroll taxes are charged on wages and salaries as a flat tax up to a certain limit. They are also considered regressive taxes because every individual is bound to pay the same amount of tax no matter what they earn.

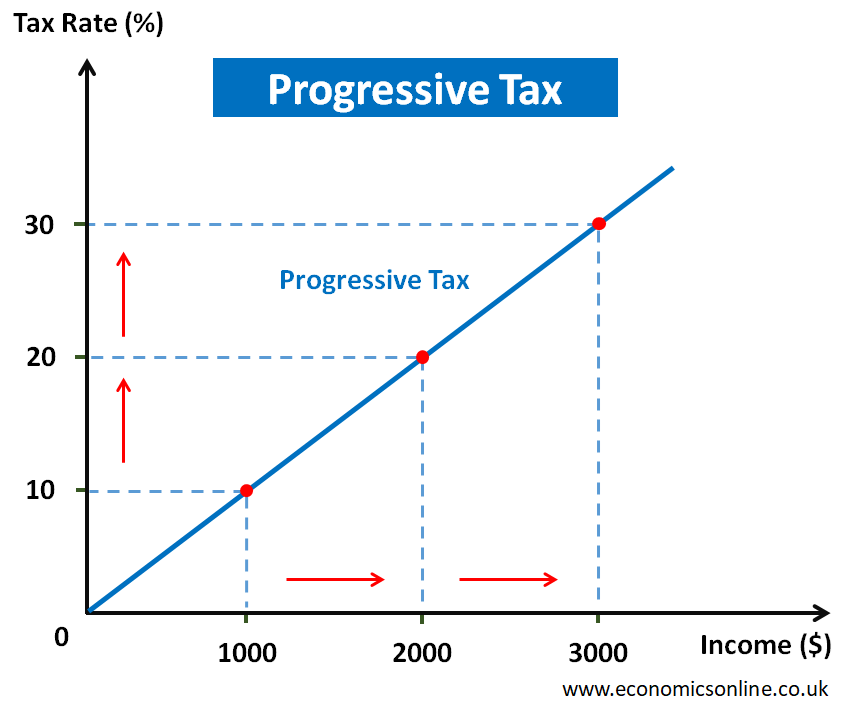

Progressive Taxes (Non-Regressive Taxes)

A type of tax in which tax rates increase as the income of taxpayer’s increases is called progressive taxes or non-regressive taxes. In this taxation system, people with higher incomes pay a higher percentage of tax as compared to low-income individuals. For example, income taxes and estate taxes are some common forms of progressive taxes.

The criticism of progressive taxation is that individuals must not be penalised for having high incomes and must be bound to pay for those benefits that low-income individuals utilise more. This taxation system is also a cause of capitalism and disincentives innovation because it does not promote success. It is also argued that individuals should not be charged high tax rates because they do not have the same income level as others.

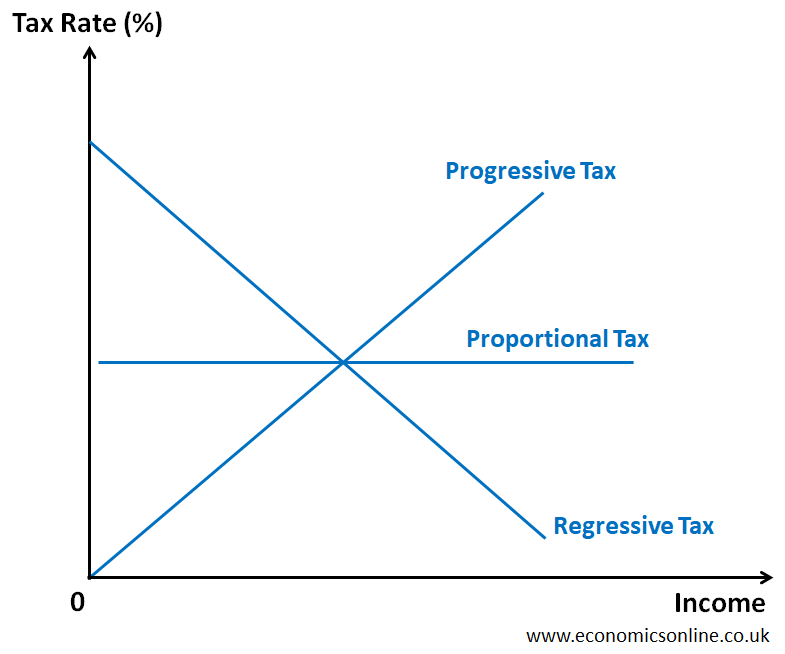

The above graph illustrates the progressive tax. The upward sloping graph illustrates that low-income individuals pay tax at a low rate, while an increase in income will lead to paying a high percentage of tax rates to high-income individuals.

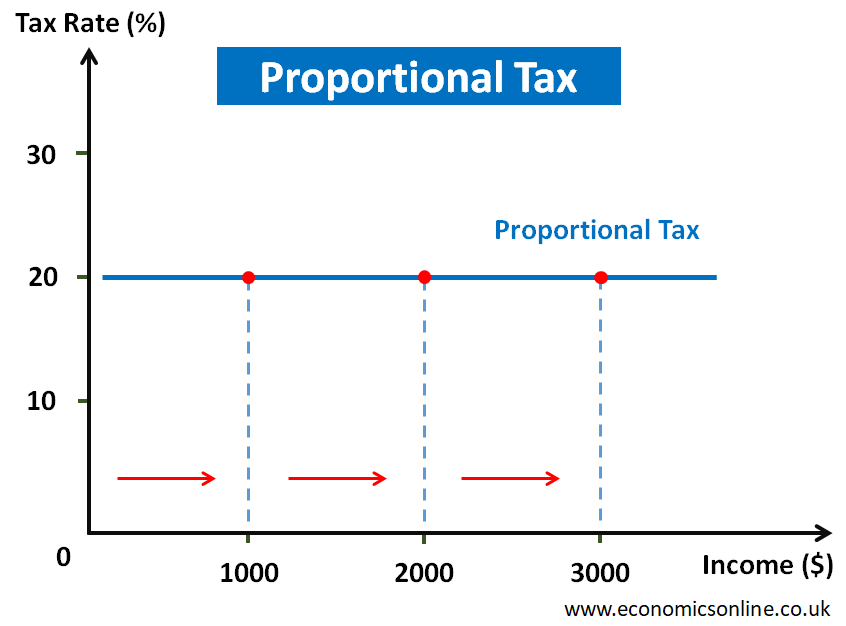

Proportional Taxes

A taxation system in which everyone is bound to pay the same percentage of income as tax regardless of their earnings is called proportional tax. Individuals with high incomes are bound to pay a high percentage of income taxes in terms of dollars. In the case of proportional tax, everyone pays the same percentage of income as tax. Critics argued that this is a lose-lose situation because higher taxes are not charged by either high- or low-income taxpayers, which consume more public services.

The above graph illustrates the proportional tax. The horizontal straight line graph illustrates that the same tax rate of 20% is imposed on all the individuals irrespective of their incomes.

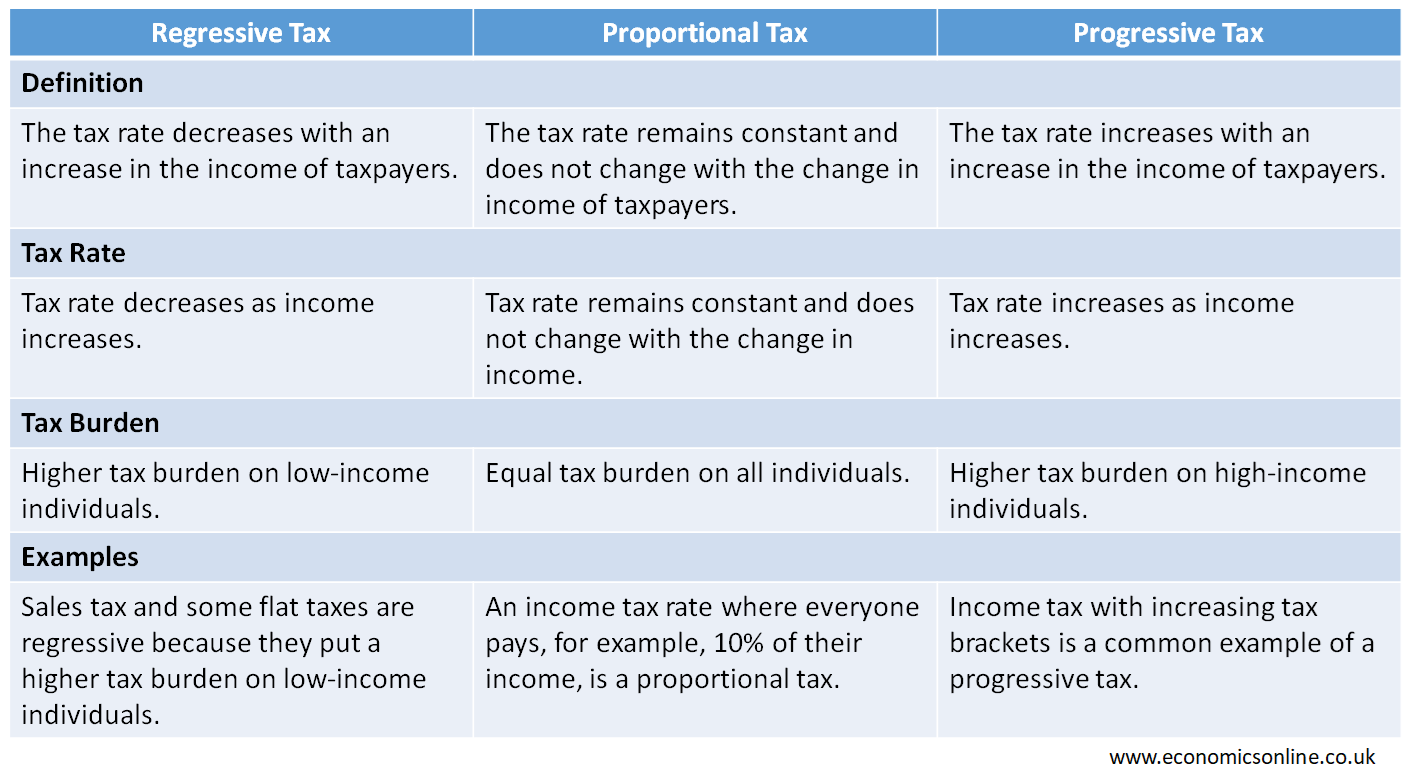

Comparing Regressive Tax, Proportional Tax, and Progressive Tax

Features

The following table contains the main points of comparison for regressive tax, proportional tax, and progressive tax.

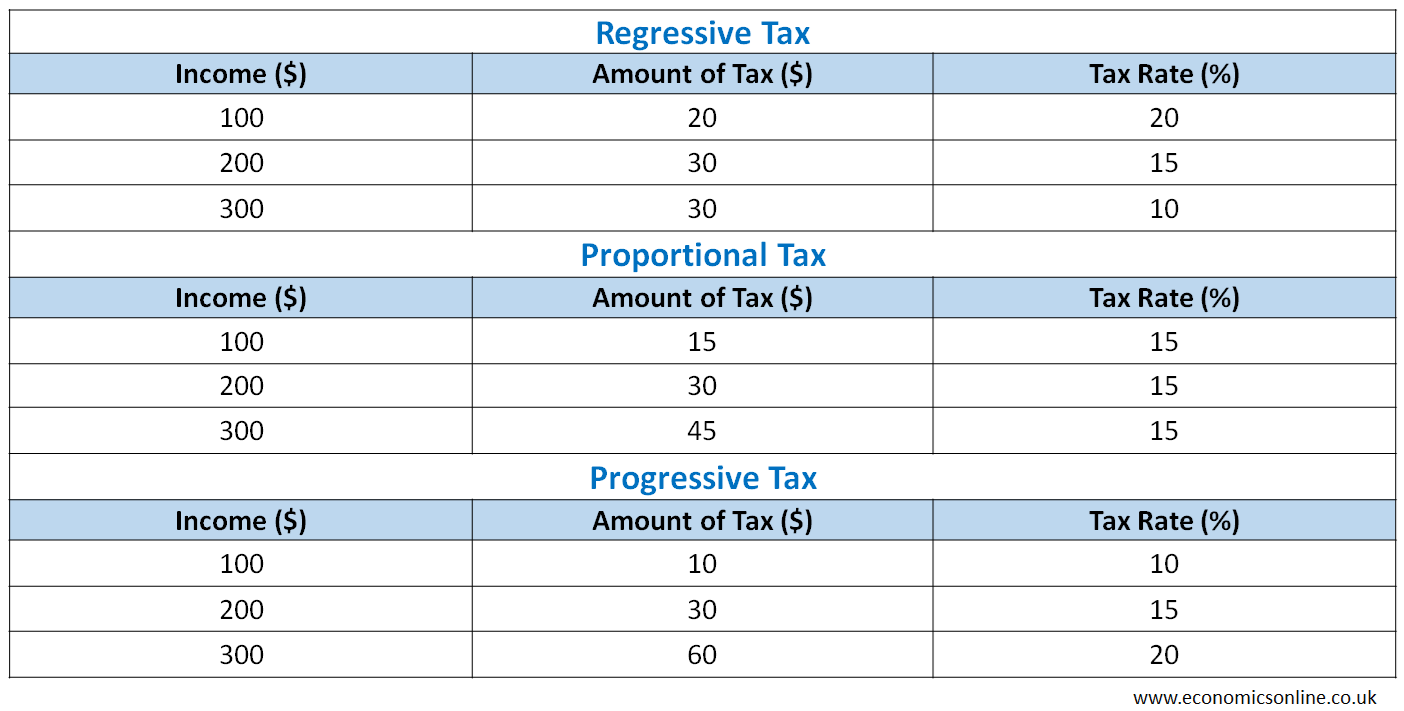

Numerical Examples

The following table contains the numerical examples for comparing regressive tax, proportional tax, and progressive tax.

Graph

The following graph compares regressive tax, proportional tax, and progressive tax.

Conclusion

In conclusion, regressive taxes are those in which a high percentage of the burden is placed on low-income individuals as compared to high-income individuals. Due to this, a large portion of their income is consumed in paying taxes. Regressive tax systems are the opposite of progressive tax systems, in which the richer pay more tax while the poor pay less tax. Regressive taxes are sales taxes, excise taxes on specific goods, tariffs, etc.