An image of the Capitol Building in Washington, DC.

Washington Consensus Definition

Introduction

The Washington Consensus refers to a set of liberalised free market economic policies, supported by renowned economists and international organisations including the IMF, the European Union, the United States, and the World Bank. The Washington consensus supports a free trade, changing exchange rates, free market, and macroeconomic stability.

Historical Background

Economist John Williamson from PIIE (Peterson Institute for International Economics), was the one who introduced the term “Washington Consensus” in 1989. He was explaining the policies that gained support from Latin American policymakers. These policies were made due to macroeconomic difficulties and the debt crises of the early to mid-1980s. Experts from the Washington International Institute were behind these policies. The International Monetary Fund (IMF) and the World Bank, including the US Treasury, were the ones who helped recover from debt crises.

Implications of the Washington Consensus

The Washington consensus was very important for regulating policies towards economic development in countries such as Latin America, Southeast Asia, and many more. The following are some implications of the Washington consensus:

- The Washington consensus supports free trade with the help of NAFTA and the WTO, which reduce tariff barriers.

- The IMF’s rescuses are going to be inclined towards free market refinement as a condition of collecting or receiving money.

- It also had beliefs in trade openness that suggested other countries should specialise in specific goods or services to have comparative advantages, which means that developing economies should only stick to producing only primary products or services.

Principles of the Washington Consensus

John Williamson in 1989 was the one who originally stated ten principles that consist of ten sets of policy recommendations for the Washington Consensus:

National Budget Deficit

In the 1980s, large budget deficits were those that contributed to the high and variable inflation rates in Latin America, and then economists and policymakers suggested fiscal discipline. By raising tax revenues and cutting government domestic spending, government borrowing needs were automatically reduced and economic stability was enhanced.

Reducing Subsidies

Some forms of public spending or subsidies to state-owned firms or for food and fuel consumption have led to economic instability, which favours urban developed nations instead of rural ones. A strategy of reducing subsidies from politically connected economic sectors can impose costs on one, but it frees up spending in support of basic social welfare services, infrastructure, and education.

Improving the Tax System

Improving the tax system was involved in widening the tax base and removing exceptions. This strategy removes politically connected taxpayers and organisations from tax payments. It is important to broaden and simplify tax rates, which in turn increase efficiency, improve tax collections, and decrease tax evasion.

Market-Determined Interest Rates

The government’s control over interest rates can punish savers and discourage investment while shifting towards financial development and investment in this industry. The credit rationing will favour political insiders and increase corruption in government sectors. That is why there is a need for market-determined interest rates that help promote savings and ensure that it is the banks or financial markets who control the allocation of credits, not the government.

Competitive Single Exchange Rate

There were overvalued exchange rates that were used in the past, which discouraged exports and caused foreign exchange rationing. A competitive market-driven exchange rate is the one that can change exchange rates to promote exchange-led economic growth and can be beneficial in reducing issues of balance of payments.

Decreasing Trade Restrictions

Trade restrictions or trade barriers should be reduced. Tariffs, quotas and other arbitrary trade restrictions should be reduced to promote free international trade. This means that the domestic firms have to adjust and improve in order to compete with foreign players.

Reducing Barriers to Foreign Direct Investment

It was suggested that the barriers to foreign direct investment (FDI) should be reduced to promote economic growth. Reducing and restricting inward foreign investment can give domestic firms a monopoly and reduce the level of competition. Foreign investments can be a source of capital gain, job creation, and skills development in countries, which leaves domestic firms in great competition.

Privatising State-Owned Firms

State-owned firms are the ones that survive only on government subsidies and are inefficient, causing an increase in the government’s fiscal deficits. Privatization seemed to reduce the rate of employment, but it can increase the profitability and efficiency of firms and will contribute to national productivity and growth.

Removing Policies that Restrict Competition

Reducing hurdles and regulations that hinder new firms from entering the market can stimulate economic efficiency, competition, and growth.

Secure and Affordable Property Rights

A suitable legal system should be used to implement legislative measures in order to protect property rights. For example, the rights of people performing informal jobs that are not officially reported to the system and owning land without official documentation, can cause increased investment and individual liberty. Private assets that allow their owners to access credits will help expand the economy and the government’s tax base.

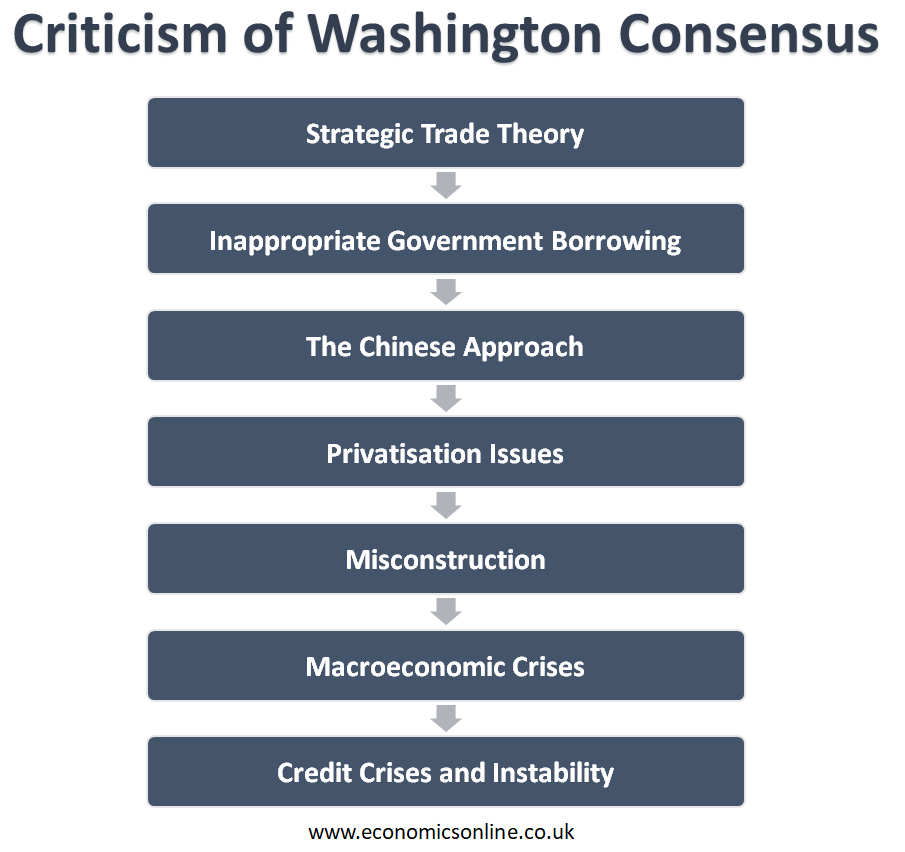

Criticism of the Washington Consensus

The following points explain criticism of the Washington consensus:

Strategic Trade Theory

Critics argued that trade liberalization is not always in the best interest of developing countries. When these countries adopt strict free trade and comparative advantage, it can leave these developing economies to produce low-income growth and unstable-priced products. When countries promote new industries, there might be a need for tariffs on cheap imports and government subsidies. For example, the support from the government of Brazil and the development of Embraer, helped Brazil become successful in airline manufacturing.

Inappropriate Government Borrowing

It is also argued that implementing irrelevant fiscal policies can cause unnecessary difficulties in the economy if governments cut their spending at an inappropriate time. For example, during the Great Recession, the implementation of irrelevant policies caused low growth rates and a failure to decrease debt-to-GDP ratios. Welfare programmes can also be affected if governments are bound to cut their spending, which ultimately increases poverty. Other economists also suggest that it is wise to reduce structural borrowing to manageable levels in the long run.

The Chinese Approach

The Chinese approach was also criticised in recent years because it was an interesting development that Chinese firms invested a huge amount in developing economies in multiple countries, such as Africa and Latin America. It is also criticised that China invested or lent $110 billion to developing economies as compared to what the World Bank stated in an FT report. An interesting fact about this approach is that it is also involved in investing in infrastructure and private sector investment, which will lead to future economic developments.

Privatisation Issues

An increase in economic efficiency and an improvement in product quality or service can occur due to privatisation. That is why, for some public sector industries, privatisation means companies may ignore their main social objectives. For example, under the pressure of the World Bank in the 1990s, a country named Bolivia shifted its water industry towards privatisation. But when this happened, the water supplies for poor members of society were cut off.

Misconstruction

The point of criticism is the redirection or misconstruction of public spending towards public sector initiatives such as infrastructure investments, primary education, and primary healthcare facilities that are being ignored. Then the Washington consensus came to the fore and provided more market-oriented policies that used less government investment.

Macroeconomic Crises

The macroeconomic crises of Southeast Asia in the 1990s and the Latin American crises of the 1980s were the main factors in making the policies for free markets ineffective in those countries where they were imposed.

Credit Crises and Instability

There is also criticism of credit crises and the instability of free markets. Due to the credit crisis in 2007, it had the potential to create financial instability and high unemployment in free markets. Financial deregulation was the main cause of financial instability.

Justification of the Washington Consensus

The following are some justifications for the Washington consensus:

- All the principles of the Washington consensus have an equal level of economic validity. Strategies like widening the tax base, investing in the education system, stable government borrowing, and flexible exchange rates can help improve economic welfare in developing countries. Privatisation and increased competition can be beneficial in some conditions. Many economists support the idea that free trade has potential advantages.

- It is very easy to criticise when things are not going well. In the 1990s, when the economies of Southeast Asia were in great difficulties, any policy implementation would go wrong or become unpopular. When there is a time of difficulty, any good thing can change into something worse.

- It is also supported that the EU problems are only associated with managing a single currency. A strategy to return to competitive exchange rates helped overcome crises more easily.

- It is also important to note that any economic policy has fair justifications but is not acceptable worldwide, like in the case of free trade, as it is beneficial for developed countries or provides advantages to only developed countries rather than developing countries. But when developed countries like the US and EU cut agriculture tariffs, it indirectly benefits developing countries at the same time.

Conclusion

In conclusion, the Washington Consensus is composed of market-based policies suggested by John Williamson to improve Latin American countries. Despite failures for free markets, the original ten principles of the Washington consensus are still valid. But there is a need for greater discrimination and less blanket implementation. For example, the privatisation of the state-owned car industry is best, but it is not good for the water industry to be privatised. The Washington consensus is not the best set of strategies in all situations and the economic reforms should be implemented with caution.