An image showing hand shake as an analogy of horizontal integration.

Horizontal Integration

Horizontal Integration Definition

Horizontal integration is a competitive strategy that involves the merger or takeover of two firms in the same industry at the same stage of production. The goal of horizontal integration is to increase market share, reduce competition, and achieve economies of scale.

This strategy is used to increase the size of a business, i.e., business growth.

Basic Terms

Before explaining horizontal integration in detail, let’s look at some basic terms related to this topic.

Business Growth

Business growth means an increase in the size of a business over a period of time. Business growth can be of two types: internal growth and external growth.

Internal Growth

Internal growth, or organic growth, means an increase in the size of a business within its existing operations without a merger or takeover.

External Growth

External growth or integration means an increase in the size of a business through a merger or takeover. External growth can take place through mergers or takeovers.

Merger

The joining of two firms to make them one is called a merger. Owners agree to join their firms together.

Takeover (Acquisition)

The purchase of the ownership of one business by another business is called a "takeover" or "acquisition."

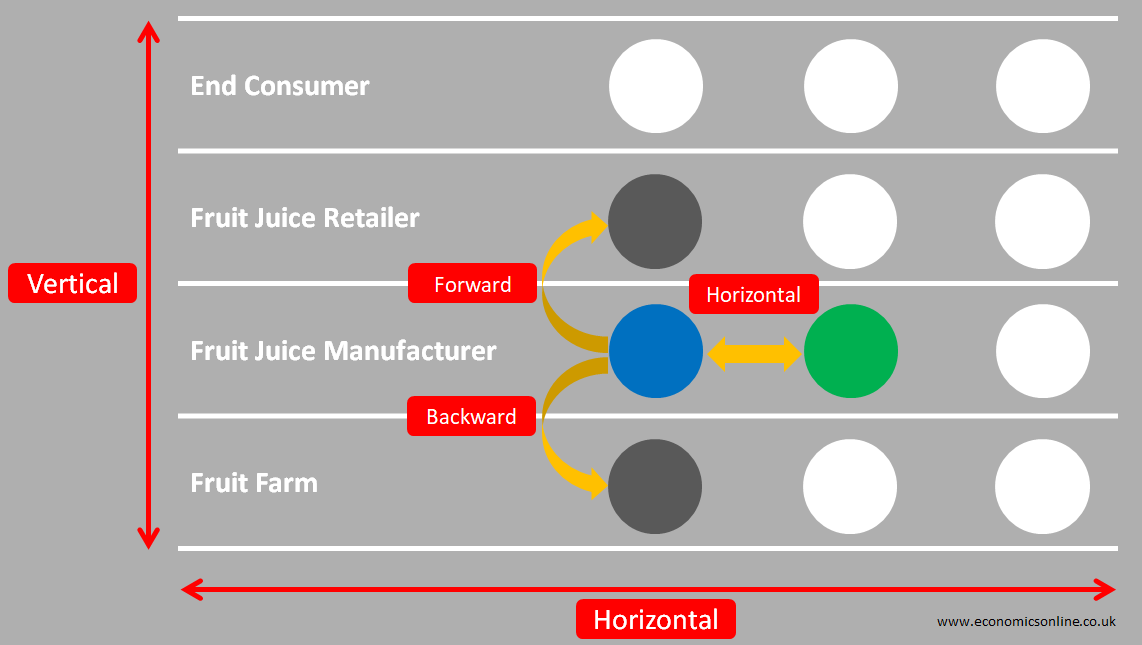

Horizontal Integration and Vertical Integration

Horizontal integration and vertical integration are two common business strategies used by firms to achieve growth and competitive advantage. Horizontal integration involves merging or acquiring another similar business in the same industry at the same stage of production. On the other hand, vertical integration involves merging with or acquiring another firm in the same industry but at a different stage of production.

While both strategies involve increase in the size of the company, they differ significantly in terms of the direction of growth and objectives.

The objective of horizontal integration is to increase market share and reduce competition, while the objective of vertical integration is to improve efficiency and control costs.

Advantages of Horizontal Integration

Horizontal integration can result in several advantages for a business, including:

Increased Market Share

One of the most significant advantages of horizontal integration is the ability to increase market share. By acquiring key rivals, a company can reduce competition and gain a larger share of the market. This can provide increased pricing power, allowing the company to charge higher prices and improve profitability.

Economies of Scale

Horizontal integration can also lead to economies of scale. By combining resources, the combined company can reduce duplication of efforts, increase efficiency, and improve overall productivity. This can result in cost savings and improved profitability.

Diversification

Horizontal integration can also provide diversification of product offerings, product lines and markets. By expanding into new areas, a company can reduce its dependence on a single product or market, reducing its overall risk.

Access to New Markets

Another advantage of horizontal integration is access to new markets and distribution channels. Acquiring a competitor can provide access to new customers and markets, allowing the company to expand its customer base and increase revenue.

Increased Power over Suppliers

One of the benefits of horizontal integration is increased power over suppliers. When a company acquires or merges with another company in the same industry, it can gain bargaining power over suppliers. This is because the combined company has a larger market share, which gives it more leverage to negotiate better prices, terms, and conditions with suppliers. With increased bargaining power, the integrated company can demand lower prices and better quality from its suppliers.

Synergy

Synergy refers to the concept of the combined effect of two or more entities being greater than the sum of their individual effects. It means that the whole is greater than the sum of parts or two plus two is greater than four.

It is assumed that when two firms are integrated into one bigger firm, it will be more successful and profitable than two separate firms. When two or more companies engage in horizontal integration, they can often achieve synergies. The main source of synergy in horizontal integration strategy is the ability to combine the resources and capabilities of two or more companies to create a more efficient and effective operation. For example, if two companies merge, they can combine their manufacturing facilities, distribution networks, and marketing efforts to reduce costs and increase sales.

Disadvantages of Horizontal Integration

Antitrust Concerns

One of the main concerns with horizontal integration is that it can raise antitrust concerns and monopoly investigations. By reducing competition and increasing market power, a company may be able to raise prices and reduce consumer choice, which can harm consumers.

Integration Challenges

Merging with a competitor can be complex and challenging. The two companies may have different cultures, systems, and processes, which can make integration difficult. This can result in delays and increased costs.

Increased costs

The costs of acquiring and integrating a competitor can be significant. This can include legal and advisory fees, as well as costs associated with integrating systems, processes, and people. These costs may not be offset by the expected benefits, making the merger a poor investment.

Rationalisation

Horizontal integration is often followed by rationalisation which means reducing the size of the combined business to make it lean and fit. This can put the jobs of some workers at risk and can also create bad publicity.

Impact of Horizontal Integration on Stakeholders

When horizontal mergers become successful, they put consumers at a disadvantage. Consumers may have less choice due to reduced competition and may have to pay higher prices.

Workers may lose job security as a result of rationalisation. Suppliers may have to offer lower prices to the bigger integrated business. Shareholder impact depends on whether profit rises or not. An increase in profit may make the shareholders happy.

Examples of Horizontal Integration

There are many examples of companies that have successfully implemented horizontal integration. For example:

1. Disney's Acquisition of 21st Century Fox

In 2019, Disney completed its acquisition of 21st Century Fox, a major media company. This acquisition allowed Disney to expand its media empire and gain access to Fox's film and television content.

2. Facebook's Acquisition of Instagram

In 2012, Facebook acquired Instagram, a popular photo-sharing app. This acquisition allowed Facebook to expand its social media platform and reach new audiences.

3. Microsoft's Acquisition of LinkedIn

In 2016, Microsoft acquired LinkedIn, a professional networking site. This acquisition allowed Microsoft to expand its services to professionals and businesses.

4. Fiat and Chrysler

In 2014, Fiat and Chrysler merged to form Fiat Chrysler Automobiles, a major automotive company. This merger allowed the companies to combine their resources and gain cost savings through operational efficiencies.

5. Exxon and Mobil

The merger between Exxon and Mobil in 1999 is an example of horizontal integration. The two companies merged in a deal valued at $81 billion, creating the third-largest company in the world at the time. The newly merged company was named ExxonMobil.

6. Disney and Pixar

In 2006, Disney acquired Pixar, a major animation studio. This acquisition allowed Disney to expand its offerings into animated films and gain access to Pixar's technology and creative talent.

7. Volkswagen and Porsche

Volkswagen's acquisition of Porsche in 2009 is an example of successful horizontal integration in the automotive industry. The merger allowed Volkswagen to increase its market share in the premium sports car segment, gain access to Porsche's technology and engineering expertise, and diversify its product portfolio.

Conclusion

Horizontal integration is a common strategy used by companies to expand their operations and increase their market share. While there are many advantages to horizontal integration, including increased market share, economies of scale, and diversification, there are also potential disadvantages, such as antitrust concerns, integration challenges, and increased costs. Companies must carefully evaluate the costs and benefits of horizontal integration before pursuing this strategy.