An image showing flying money as an analogy of capital flight.

Capital Flight

What is Capital Flight?

Capital flight refers to the rapid and large scale outflow of money and financial assets out of a country due to economic or political uncertainties.

In simple words, capital flight is the sudden and large outflow of money offshore due to economic uncertainty in a country. It occurs when wealthy people and firms lose confidence in the economic prospects of a country and decide to move their capital to safer and more stable destinations.

Capital flight means money is moving out of a country instead of being locally invested. It is a serious problem for many economies, as it can hamper economic growth, development, and the standard of living in those economies.

While the inflow of capital can boost economic growth and development, the outflow of capital, known as capital flight, can have serious negative effects on an economy. It will not be wrong if we say that capital flight is a global problem leading to poverty, unemployment, and wealth inequality in many countries.

Causes of Capital Flight

There are many causes of capital flight. Some of the main causes are explained below.

Economic Instability

One of the major causes of capital flight is economic instability. An economy may have a high rate of inflation, a volatile exchange rate, and unstable fiscal policies, leading to uncertainty for wealthy people, investors, and firms. This instability can trigger capital flight because economic uncertainty makes wealthy people and firms worried about the future of their wealth. These people and firms want to protect their wealth by moving it to more stable economies.

Political Uncertainty

The other major cause of capital flight is political instability. Political unrest, revolutions, changing governments, coups, and abrupt changes in government policies can undermine investor confidence and lead to capital flight. Governments may also be engaged in capital flight to keep foreign currency reserves safe from any domestic turmoil.

Currency Depreciation

Currency depreciation is another major cause of capital flight. When a country's currency experiences a significant decrease in the value of its currency, wealthy people become worried about the loss in value of their wealth and may decide to move their capital to countries with stronger currencies to safeguard their wealth. This so called 'hot money' may come back after the depreciation.

High Taxes

High taxes in a country can also lead to capital flight. Wealthy people can move their money out of a country in search of destinations with low or no taxes in order to reduce their tax liabilities.

Protection of Wealth

Some wealthy people and firms want to protect their money from being stolen in the event of civil unrest or even seized by the government. This feeling of lack of security can trigger capital flight, and money is parked in safer locations by the wealthy elite.

Consequences of Capital Flight

Capital flight is a serious problem for many countries, and it can have severe negative consequences in long-term. Some of the consequences of capital flight are explained below.

Economic Decline

When large sums of money leave a country instead of being invested locally, it can reduce investment in that country, leading to economic decline. Capital flight leaves a country deprived of much-needed investments in infrastructure, health, education, human capital, and technology. This leads to a slowdown in economic growth and development in that country.

Exchange Rate Depreciation

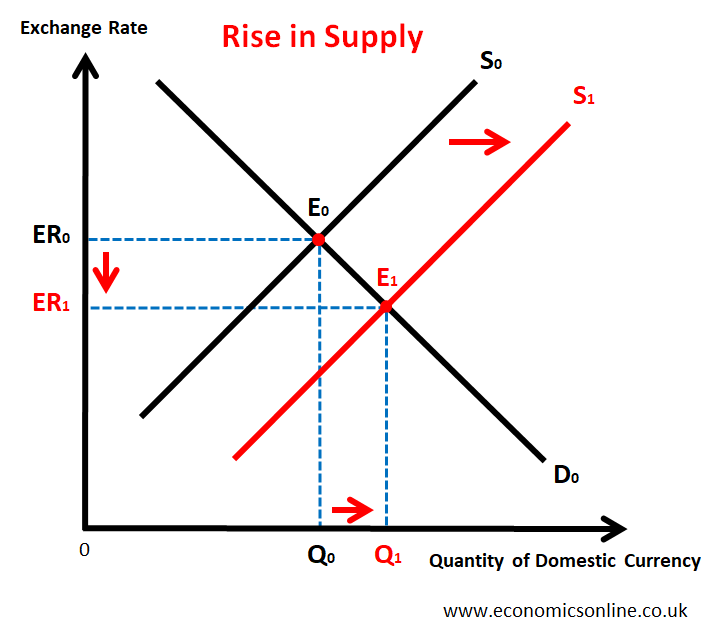

Large-scale capital flight can cause currency depreciation. This can be illustrated by the following diagram.

When huge sums of money move out of a country, people and firms sell domestic currency in order to buy foreign currency. This increases the supply of domestic currency from S0 to S1 in the foreign exchange market, as shown in the graph above. As a result, the exchange rate of the domestic currency depreciates from ER0 to ER1.

This currency depreciation can fuel inflation by making imports more expensive, leading to decreased purchasing power for individuals and firms in the country.

Loss of Confidence

Capital flight means that investors do not have confidence in the country's future. When people and firms move their money abroad, it sends a negative signal to others, potentially triggering a further exodus of capital. This loss of confidence can undermine the country's reputation and make it more challenging to attract foreign investment in the future.

Examples of Capital Flight

Argentina (2001-202)

Argentina experienced a severe financial crisis in 2001–2002, characterised by high inflation and a collapsing banking system, leading to a huge capital flight. Argentina’s default on its debt triggered a large scale capital flight as investors rushed to move their wealth abroad in search of safe havens. This resulted in a sharp depreciation of the Argentine peso and a prolonged period of economic decline.

Zimbabwe (2000-2009)

Zimbabwe faced a long period of economic and political crisis, marked by hyperinflation. A huge capital flight occurred as people lost confidence in the country's economy. The outflow of capital caused a huge depreciation of the Zimbabwean dollar and deepened the economic crisis in Zimbabwe.

Greece (2010-2015)

Greece faced a severe debt crisis starting in 2010, leading to a massive capital flight. Due to economic instability and the risk of an exit from the Eurozone, many Greek citizens moved their money abroad. The outflow of funds contributed to the country's economic downturn.

Is Capital Flight Legal?

You might have read about the leaked Panama Papers. These papers accused global leaders and elites of being involved in illicit financial flows and having foreign assets beyond their means.

By its nature, capital flight is not illegal. Individuals and firms have the right to move their capital to other countries. But illegal capital flight menas that the money is transferred illegally (money laundering) or the source of money is corrupt.

Capital Flight and the Developing Countries

The problem of capital flight is very serious in many developing countries, including Pakistan, Kenya, Azerbaijan and some african countries like Nigeria, Angola and the Congo. Over half a trillion dollars of capital flows out of developing countries every year and much of this goes into western jurisdictions via complex offshore structures.

In many developing countries, money is leaking out because the owners of that money are not willing to disclose the source of their wealth because it may have been acquired illegally or because they want to avoid taxes.

Developing countries (especially in africa) normally face huge financing gaps. It means that the need for financing infrastructure, health, education, and public services is not met by the available resources. These countries get loans from International Monetary Fund (IMF) or other international financial institutions, and even those loans move out of the country partially because of the corrupt ruling elite who have access to those funds.

These huge capital outflows have deprived the developing countries of much-needed investments for their own people, leading to poor economic performance and a lower standard of living.

How to deal with Capital Flight?

Dealing with the issue of capital flight requires a comprehensive approach that addresses its underlying causes. Governments can take the following measures to control capital flight.

Economic and Political Stability

Governments can try to achieve economic and political stability in order to control capital flight. This can be done by using sound economic policies, maintaining the rule of law, strengthening the institutions, and achieving political stability.

Increasing Investor Confidence

Governments can increase confidence of domestic and foreign investors by protecting their wealth and by creating a conducive business environment through political stability and the srtict country’s laws.

Capital Controls

Governments can also impose temporary capital control regulations in order to limit the outflow of money. This may include limits on the outflow of money or currency conversions.

Conclusion

Capital flight is a phenomenon characterised by a sudden and huge outflow of money from a country. It has the potential to hinder economic growth and development in a country. Understanding the causes and consequences of capital flight is essential for policymakers to make policies to handle this issue.