Understanding the laffer curve

Understanding the Laffer Curve

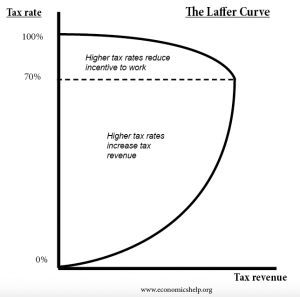

The Laffer Curve is an economic theory pioneered by economist Arthur Laffer suggesting that tax rates above a certain threshold reduce tax revenue since they incentivize people not to work. As such, it suggests that lowering tax rates motivates people to earn more money, resulting in greater tax revenue.

Rising to popularity in the 1980s, the Laffer Curve was a driving force behind economic policies during the Reagan administration in the U.S. and under Margaret Thatcher in the U.K. Over the subsequent decades, the ideas behind the theory have become so ingrained in economic discourse that while most are unfamiliar with the term Laffer Curve, they are versed in the concept.

The Laffer Curve at a Glance

- The premise of the Laffer Curve is that tax rates should fall somewhere in the middle range. At 0%, there is no revenue since none is collected; at 100%, there is no revenue since no one would work.

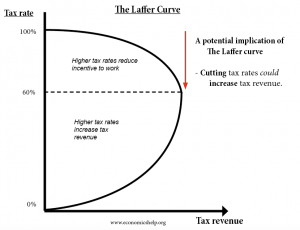

- It also supports cutting taxes, even temporarily, to boost productivity and encourage corporations to expand—thus causing economic growth and increasing tax revenue.

- The concept holds a lot of appeal as it supports lowering tax rates while presuming to increase tax revenue and reduce the deficit, all of which is popular among voters.

- However, some economists aren’t convinced that the Laffer Curve works as well in practice as it does in theory, debating where the ideal tax rate falls and how much lowering taxes actually incentivizes economic expansion.

The Economic Reality of the Laffer Curve

One of the foundational elements of the Laffer Curve theory is that higher tax rates result in fewer people working and less motivation for corporations to increase revenue. This isn’t necessarily true, especially for workers. There are two contradictory concepts that come into play here:

- Substitution Effect: If employers respond to higher taxes by lowering wages, employees will prioritize other activities over work.

- Income Effect: If employers respond to higher taxes by lowering wages, employees will work longer hours or work multiple jobs in order to survive.

Which wins out depends on a wide variety of economic factors. However, it can be generalized that when there are more social support services in place, the substitution effect is more likely to materialize, while in the countries where there are fewer support services, employees will be driven to work in order to survive. Considering higher tax rates are often used to create these safety nets, there is a correlation between higher tax rates and the substitution effect.

The Optimal Level of Taxation According to the Laffer Curve

Ultimately, the Laffer Curve doesn’t offer precise guidance on what the optimal tax rate is for generating revenue for the state while also motivating employees to work and corporations to expand. According to Don Fullerton in The New Palgrave Dictionary of Economics (2008) , on average, economists believe that the Laffer Curve begins to take effect when the tax rate reaches 70 percent.

This implies that rates of 70 percent or higher could be reduced and boost revenue. However, it also indicates that if the maximum income tax rate is much lower—as is the case in many countries—reducing the tax rate won’t boost the economy.

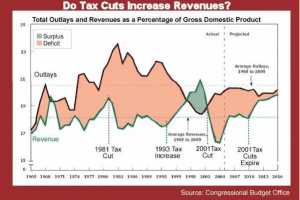

Do Tax Cuts Reduce the Deficit?

It’s hard to fully measure what impact a tax rate reduction on national deficits and the economy as a whole because there are so many factors at play. Here are just a few examples:

- If tax cuts occur during a recession, revenue will certainly fall; if they are implemented during a strong period of economic growth, revenue will rise.

- There is always a lag between the implementation of economic policies and their impact, making it difficult to determine the cause and effect of various changes.

- In a globalized economy, every country must compete to some degree with others when it comes to tax rates, given corporations can easily move to countries offering more appealing taxation policies.

With that said, numerous long-term studies indicate that tax cuts lead to higher national deficits while tax increases reduce them.

Final Thoughts

The foundational principles of the Laffer Curve are based on sound reasoning; it is undeniable that at a certain percentage, tax rates will leave employees unmotivated to work. The question that needs to be addressed is: at what percentage is the proper balance between tax revenue and employee incentivization achieved?