An image of a person holding an hourglass.

Time Lags in Economics

What is a Time Lag?

Time lag refers to the time elapsed between an action and its effects. In simple words, time lag is a delay between a cause and its effects or between a stimulus and its resulting response. It is a delay between when something occurs and when its effects are felt. When economic variables are changed, it takes some time to realise the effects of those changes, which is called time lag.

Understanding Time Lag

Let’s understand time lag with some examples:

Example 1

Suppose that a garment retailer is left with some unsold stock of garments at the end of the winter season. To get rid of that stock, the retailer has decided to reduce the price by 50% in the form of a sales promotion. On the day the price reduction is announced, the unsold stock will not be immediately sold. It may take a few number of days or weeks for customers to know about the price reduction and to make purchase decisions. If the stock is cleared in ten days, then this will be the time lag between the price reduction (action) and the clearance of the stock (effect).

Example 2

Suppose that the government has decided to use contractionary monetary policy in order to control inflation. When the central bank increases the interest rate and reduces the money supply, the changes in consumption, investments, and aggregate demand will not be immediate. It may take a few months to realise the effects of changes in monetary policy tools (action) on inflation (effect). This will be the time lag.

Example 3

Another example of time lag is when governments impose infrastructure projects such as roads, streets, bridges, dams, etc. There is a considerable time lag between the construction of these things and the proper functioning of roads, bridges, and streets for transport and dams for the production of electricity.

Example 4

There is also a time lag in the tech industry. When an engineer develops a technology, it takes time to spread it to consumers and guide them properly on how to use it. Consumers also take time to adopt new things.

Similarly, there are time lags in clinical research, including clinical trials, the development of new drugs, including drug discoveries and drug development, health research on breast cancer or lung cancer, biomedical research, clinical practice, and other scientific discoveries in the public health area.

Causes of Time Lag

Time lags can be seen in almost every economic phenomenon, and it is quite natural. The responses of various parties to economic variables need time, which causes a time lag. For example, consumers take time to react to a price change, which is a possible reason for the time lag. Similarly, firms may take time to change investments based on changes in interest rates.

Effects of Time Lag on Industries

The following are some major effects of time lag on different industries:

Production Delays

Time lag can affect production processes in manufacturing and retail industries. The production delay due to time lag can negatively affect the supply chains and inventory management systems in these industries.

Market Response

Nowadays, due to time lag, industries are struggling to respond quickly to changing market conditions, consumer demands, and new trends, which negatively affect their competitiveness.

Innovation Slowdown

Due to time lag, technological advancement and innovation processes slow down in tech-based industries. Time lag negatively affects their growth and adaptation to new trends in the market.

Financial Implications

Due to time lag, delays happen in the financial industry. These industries have to tackle their financial implications, such as increased costs or missed opportunities.

Competitive Disadvantage

Competitive disadvantages also happen due to time lags in many industries. These industries have low profitability and market share due to time lag because other countries are adapted to new trends and working more effectively as compared to them.

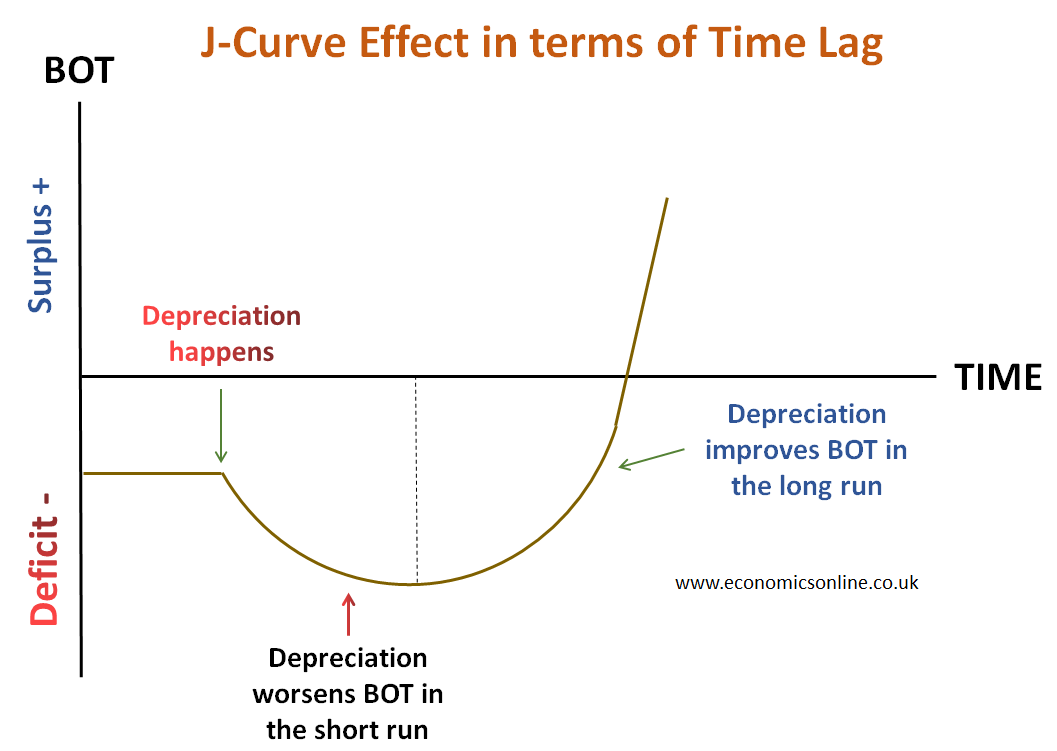

J-Curve Effect in terms of Time Lag

In terms of time lag, the J-curve can be defined as a process in which initially there is a decrease in the balance of trade in the short run following currency depreciation, but then slowly it shows improvement over time in the long run. There is a time lag between exchange rate depreciation and the long run improvement in the balance of trade. The time interval in the form of time lag allows the depreciation to show its long run effect on the balance of trade. This is illustrated by the following diagram.

In the above graph, we have time on the x-axis and the balance of trade on the y-axis. After depreciation, the balance of trade worsens in the short run but improves in the long run with a time lag.

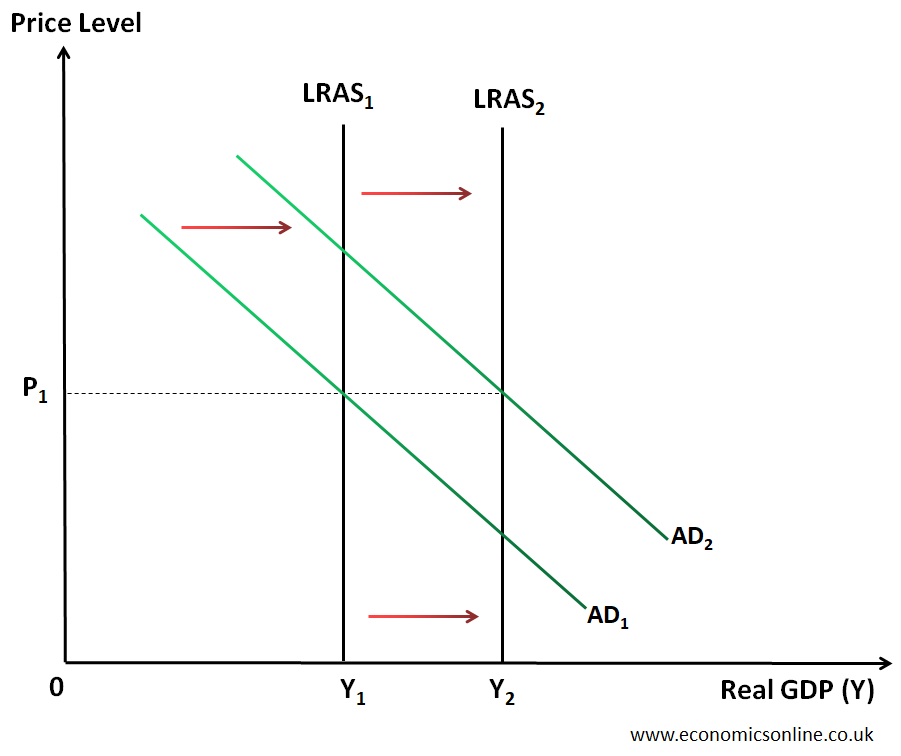

Effect of Investment and Time Lag

The investments have a significant impact on macroeconomic objectives. With an increase in investment, the aggregate demand curve shirts towards the right, as investment is a component of aggregate demand. This happens in the short run. However, in the long run, investment increases the productive capacity of the country, leading to a rightward shift in the aggregate supply curve. This shift in the aggregate supply curve involves a time lag after the increase in investment. This is illustrated by the following diagram.

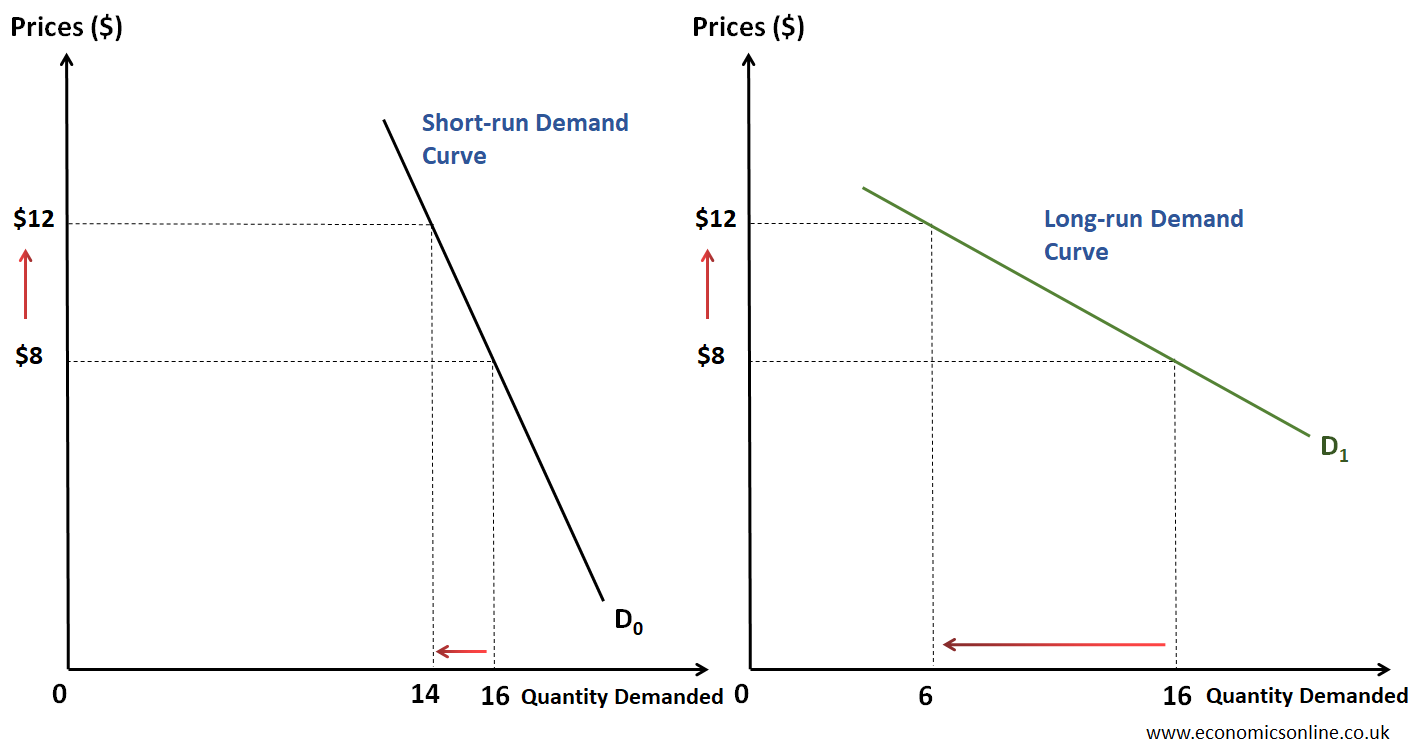

Price Elasticity of Demand and Time Lag

The price elasticity of demand and time lag are connected to each other. The result of consumer demand for changing prices may not occur immediately due to time lag but slowly affect consumer buying behavior. When prices are increasing, consumers do not suddenly stop buying products or services but gradually decrease their buying or shift towards other alternatives with the passage of time, showing time lag behavior. This is illustrated by the following diagram.

In the above graphs, we have quantity demanded on the x-axis and price in dollars on the y-axis. These graphs show the short-run and long-run behavior of demand in response to price changes. In the short run, when the price is increasing, the quantity demanded is decreased by a small percentage, showing a price inelastic demand curve. But in the long run, due to time lag, as price increases, there is a large percentage decrease in the quantity demanded, showing a profound effect, as illustrated by a price elastic demand curve in the diagram.

Disadvantages of Time Lag

The following are some disadvantages of time lag:

Delayed Decision-Making

Time lag can cause a delay in the decision-making process in industries, resulting in missed opportunities and negatively affecting their efficiency to adapt to new market trends.

Reduced Efficiency

Due to time lag, there is reduced efficiency faced by industries, resulting in inefficiencies in their operations. These industries also face delays in the resource allocation process due to time lag.

Customer Dissatisfaction

Due to time lag, industries face customer dissatisfaction because they are unable to complete their tasks on time. They are unable to meet the customers’ demands or expectations.

How to Overcome Time Lags

It must be noted that the time lag is a natural phenomenon and cannot be made zero. However, a long time lag can be reduced by using the following methods:

Improved Communication

Decision-makers can enhance the speed of communication in order to reduce the time lag. Decisions need information that can be quickly provided in order to reduce the response time of the parties involved. This is possible through the use of better and improved communication.

Streamlined Processes

Streamlining business processes and improving workflows can help overcome time lag, by reducing the time wasted between activities. This will improve efficiency as well.

Use of Technology

Effective use of technology and timely data analysis can help overcome the time lag. This will increase the speed of the decision-making process and, hence, reduce the time lag.

Conclusion

In conclusion, time lag is the period of time elapsed between an economic action and its effects. The dictionary meaning of time lag is the delay in the occurrence of something. Time lag is a natural phenomenon and can reduce the innovation and competitiveness of businesses, which is very important for them to sustain themselves in the market. The time lag can be reduced by taking appropriate measures, but it cannot be made zero. Some ways to reduce time lag are improved communication and utilising technology to efficiently perform in the market.